Security Matters SPAC Presentation Deck

Transaction Overview

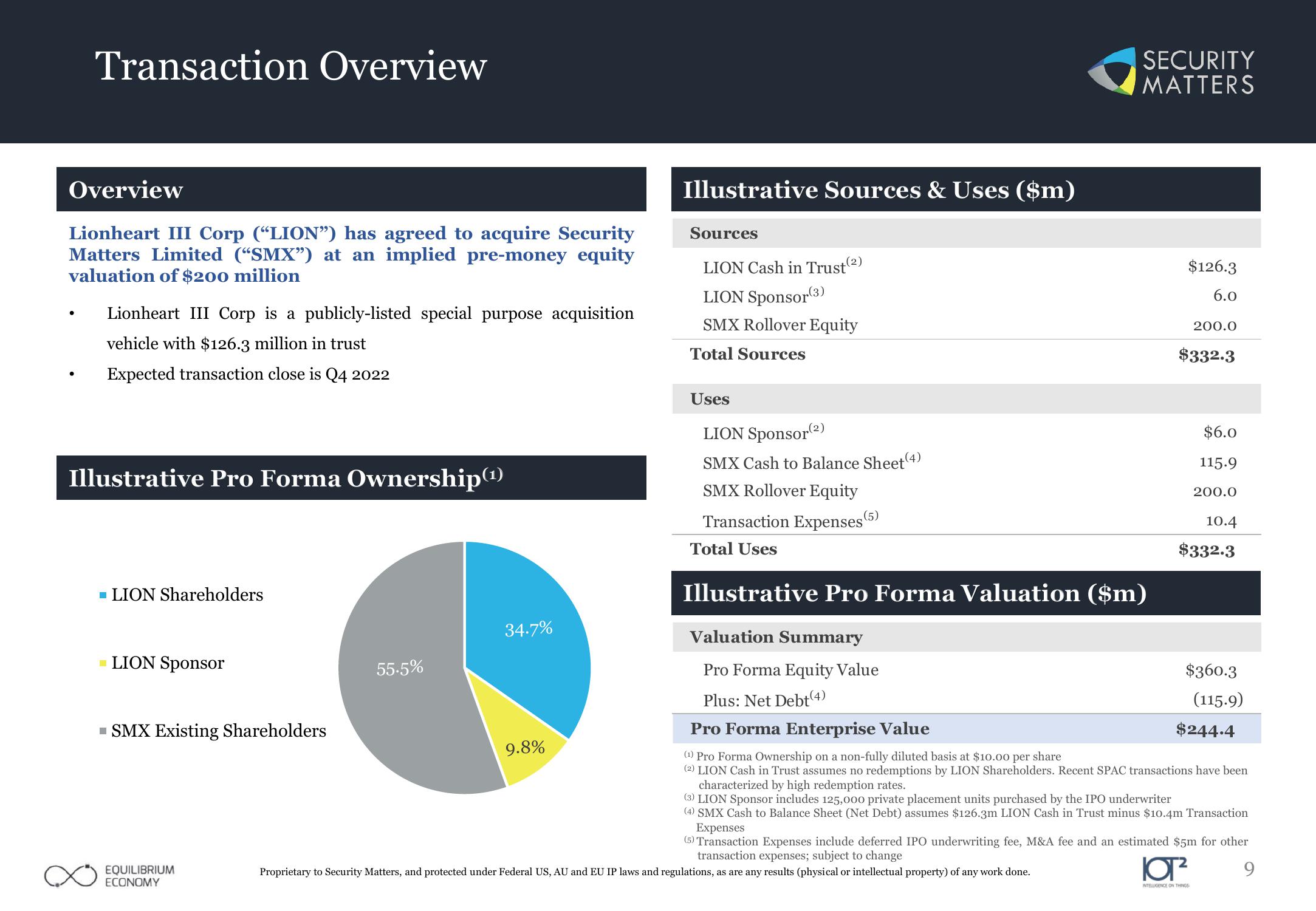

Overview

Lionheart III Corp ("LION") has agreed to acquire Security

Matters Limited ("SMX") at an implied pre-money equity

valuation of $200 million

Lionheart III Corp is a publicly-listed special purpose acquisition

vehicle with $126.3 million in trust

Expected transaction close is Q4 2022

Illustrative Pro Forma Ownership (¹)

■ LION Shareholders

- LION Sponsor

■ SMX Existing Shareholders

EQUILIBRIUM

ECONOMY

55.5%

34.7%

9.8%

Illustrative Sources & Uses ($m)

Sources

LION Cash in Trust (²)

LION Sponsor (3)

SMX Rollover Equity

Total Sources

Uses

LION Sponsor(2)

SMX Cash to Balance Sheet(4)

SMX Rollover Equity

Transaction Expenses (5)

Total Uses

Illustrative Pro Forma Valuation ($m)

Valuation Summary

Pro Forma Equity Value

Plus: Net Debt (4)

SECURITY

MATTERS

Proprietary to Security Matters, and protected under Federal US, AU and EU IP laws and regulations, as are any results (physical or intellectual property) of any work done.

$126.3

6.0

200.0

$332.3

$6.0

115.9

200.0

10.4

$332.3

$360.3

ar²

INTELLIGENCE ON THINGS

Pro Forma Enterprise Value

(¹) Pro Forma Ownership on a non-fully diluted basis at $10.00 per share

(2) LION Cash in Trust assumes no redemptions by LION Shareholders. Recent SPAC transactions have been

characterized by high redemption rates.

(3) LION Sponsor includes 125,000 private placement units purchased by the IPO underwriter

(4) SMX Cash to Balance Sheet (Net Debt) assumes $126.3m LION Cash in Trust minus $10.4m Transaction

Expenses

(5) Transaction Expenses include deferred IPO underwriting fee, M&A fee and an estimated $5m for other

transaction expenses; subject to change

9

(115.9)

$244.4View entire presentation