Fast Radius SPAC Presentation Deck

06 Attractive growth path

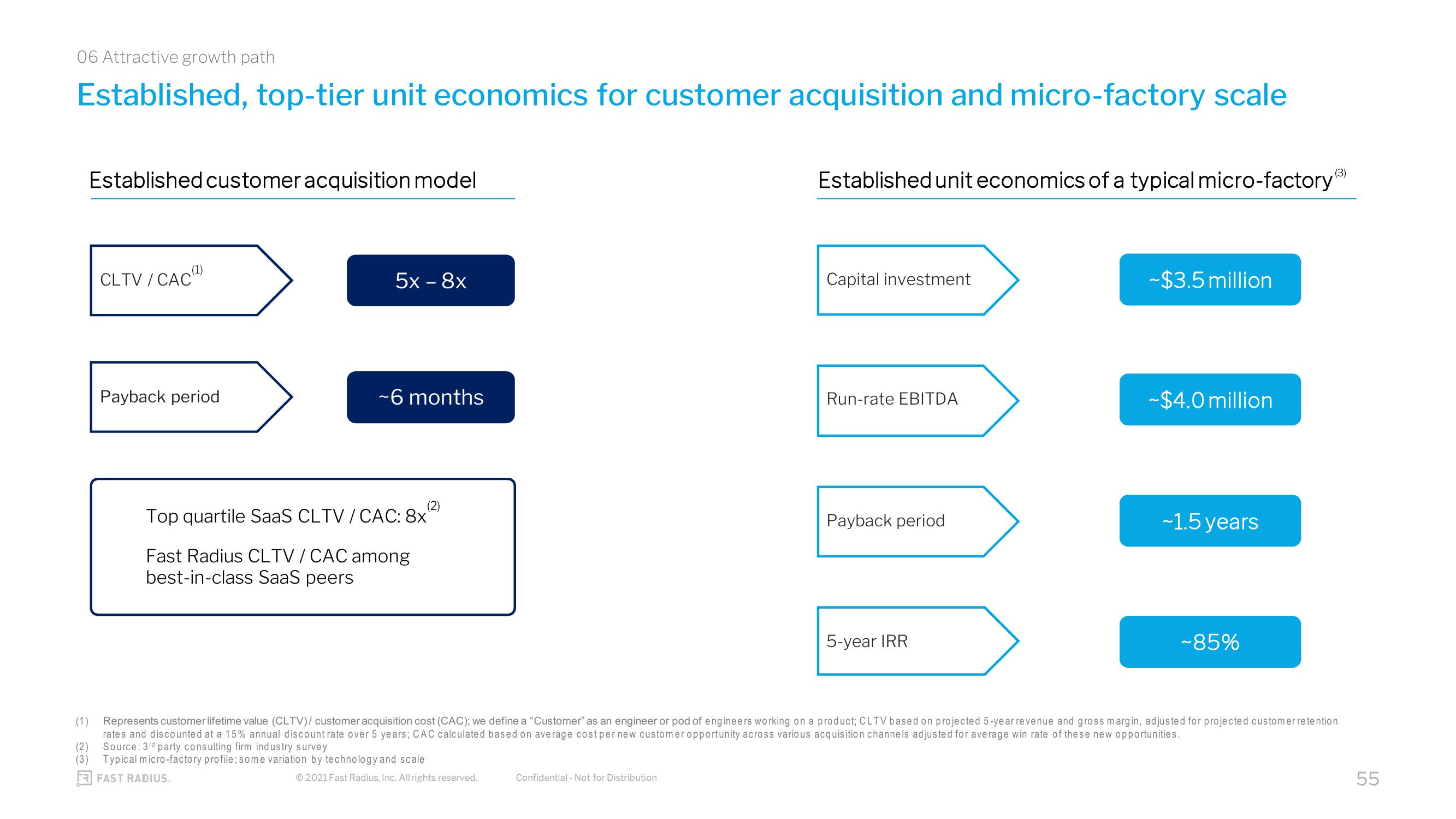

Established, top-tier unit economics for customer acquisition and micro-factory scale

Established customer acquisition model

CLTV/CAC(¹)

Payback period

5x − 8x

~6 months

(2)

Top quartile SaaS CLTV/CAC: 8x'

Fast Radius CLTV/ CAC among

best-in-class SaaS peers

© 2021 Fast Radius, Inc. All rights reserved.

Established unit economics of a typical micro-factory (3)

Confidential - Not for Distribution

Capital investment

Run-rate EBITDA

Payback period

5-year IRR

-$3.5 million

-$4.0 million

~1.5 years

(1) Represents customer lifetime value (CLTV)/ customer acquisition cost (CAC); we define a "Customer" as an engineer or pod of engineers working on a product; CLTV based on projected 5-year revenue and gross margin, adjusted for projected customer retention

rates and discounted at a 15% annual discount rate over 5 years; CAC calculated based on average cost per new customer opportunity across various acquisition channels adjusted for average win rate of these new opportunities.

Source: 3rd party consulting firm industry survey

(2)

(3) Typical micro-factory profile; some variation by technology and scale

FR FAST RADIUS.

-85%

55View entire presentation