LCI Industries Investor Presentation Deck

APPENDIX

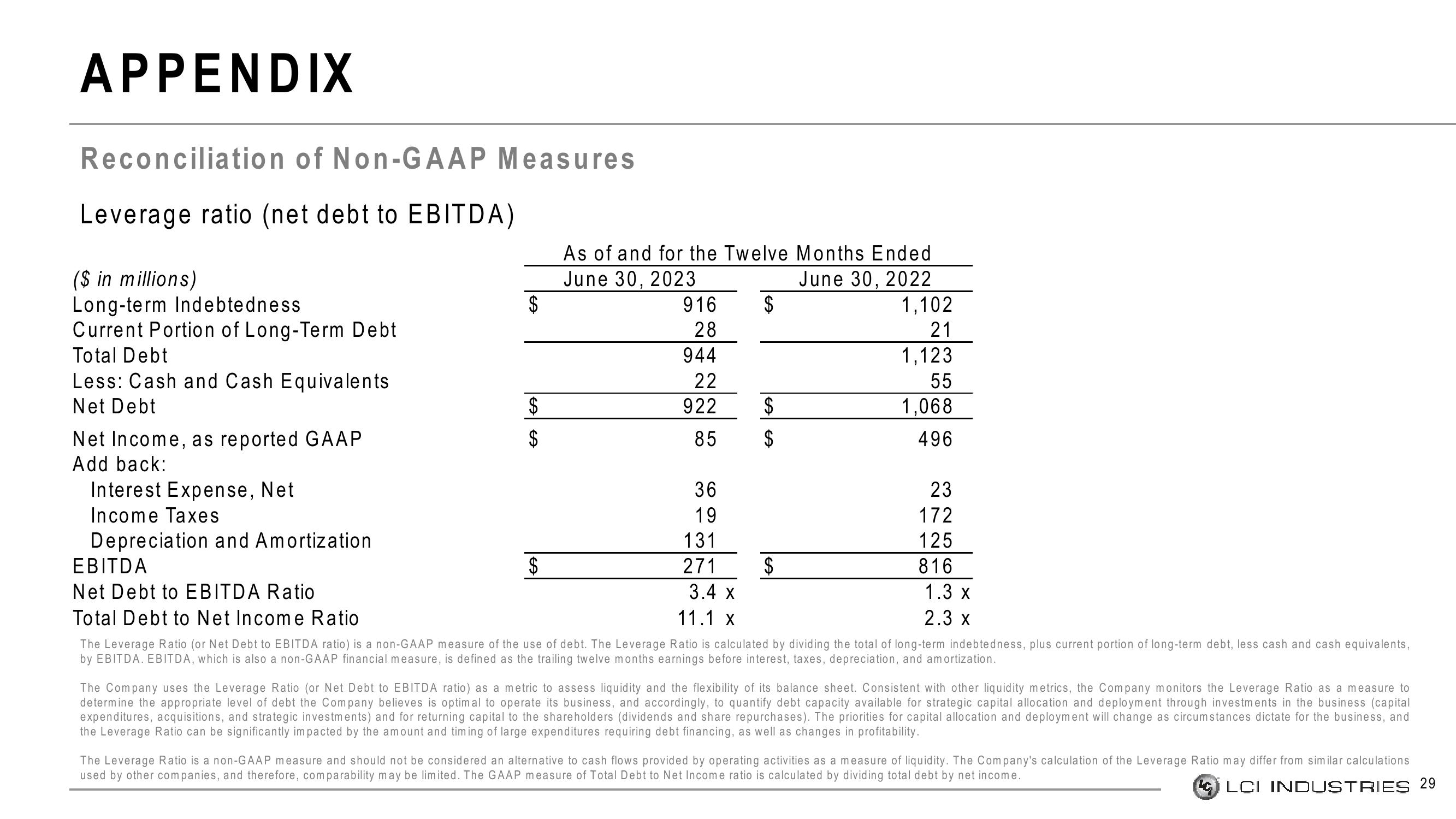

Reconciliation of Non-GAAP Measures

Leverage ratio (net debt to EBITDA)

($ in millions)

Long-term Indebtedness

Current Portion of Long-Term Debt

Total Debt

Less: Cash and Cash Equivalents

Net Debt

Net Income, as reported GAAP

Add back:

Interest Expense, Net

Income Taxes

Depreciation and Amortization

EBITDA

Net Debt to EBITDA Ratio

Total Debt to Net Income Ratio

$

$

SA

$

the Twelve Months Ended

June 30, 2022

As of and

June 30, 2023

916

28

944

22

922

85

36

19

131

271

3.4 x

11.1 x

$

$

$

GA

$

1,102

21

1,123

55

1,068

496

23

172

125

816

1.3 x

2.3 x

The Leverage Ratio (or Net Debt to EBITDA ratio) is a non-GAAP measure of the use of debt. The Leverage Ratio is calculated by dividing the total of long-term indebtedness, plus current portion of long-term debt, less cash and cash equivalents,

by EBITDA. EBITDA, which is also a non-GAAP financial measure, is defined as the trailing twelve months earnings before interest, taxes, depreciation, and amortization.

The Company uses the Leverage Ratio (or Net Debt to EBITDA ratio) as a metric to assess liquidity and the flexibility of its balance sheet. Consistent with other liquidity metrics, the Company monitors the Leverage Ratio as a measure to

etermine the appropriate level debt the Company believes is optimal to operate its business, and accordingly, to quantify debt capacity available for strategic capital allocation and deployment through investments in the business (capital

expenditures, acquisitions, and strategic investments) and for returning capital to the shareholders (dividends and share repurchases). The priorities for capital allocation and deployment will change as circumstances dictate for the business, and

the Leverage Ratio can be significantly impacted by the amount and timing of large expenditures requiring debt financing, as well as changes in profitability.

The Leverage Ratio is a non-GAAP measure and should not be considered an alternative to cash flows provided by operating activities as a measure of liquidity. The Company's calculation of the Leverage Ratio may differ from similar calculations

used by other companies, and therefore, comparability may be limited. The GAAP measure of Total Debt to Net Income ratio is calculated by dividing total debt by net income.

LCI INDUSTRIES 29View entire presentation