Credit Suisse Investment Banking Pitch Book

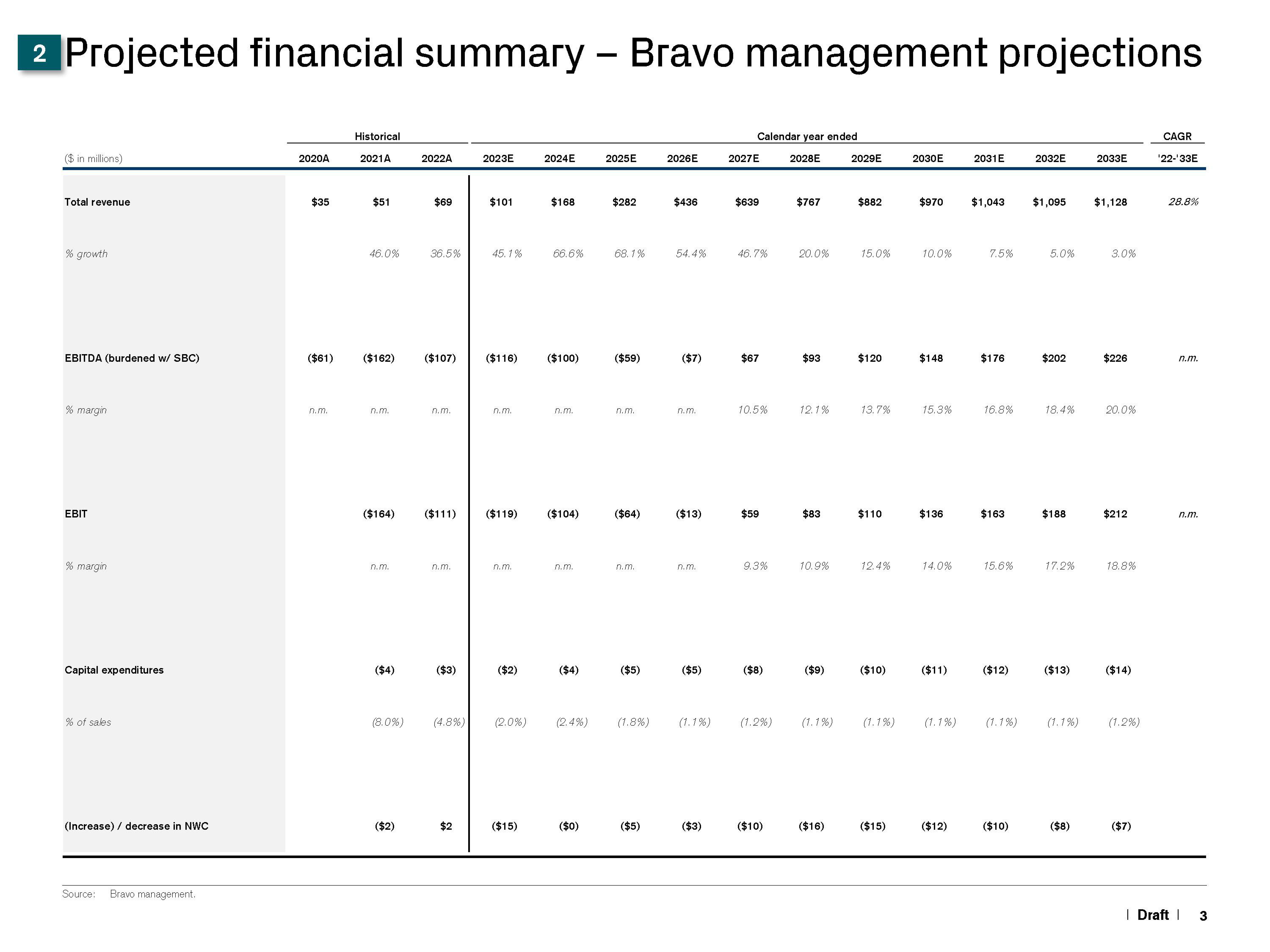

2 Projected financial summary - Bravo management projections

Calendar year ended

2028E

($ in millions)

Total revenue

% growth

EBITDA (burdened w/ SBC)

% margin

EBIT

% margin

Capital expenditures

% of sales

(Increase) / decrease in NWC

Source:

Bravo management.

2020A

$35

($61)

n.m.

Historical

2021A

$51

46.0%

($162)

n.m.

($164)

n.m.

($4)

2022A

($2)

$69

36.5%

($107)

n.m.

($111)

n.m.

($3)

(8.0%) (4.8%)

$2

2023E

$101

45.1%

n.m.

($119)

($116) ($100)

n.m.

($2)

(2.0%)

2024E

($15)

$168

66.6%

n.m.

($104)

n.m.

($4)

2025E

($0)

$282

68.1%

($59)

n.m.

($64)

n.m.

($5)

2026E

($5)

$436

54.4%

($7)

n.m.

($13)

n.m.

(2.4%) (1.8%) (1.1%)

($5)

($3)

2027E

$639

46.7%

$67

10.5%

$59

9.3%

($8)

(1.2%)

($10)

$767

20.0%

$93

12.1%

$83

10.9%

($9)

(1.1%)

($16)

2029E

$882

15.0%

$120

13.7%

$110

12.4%

($10)

(1.1%)

($15)

2030E

$970

10.0%

$148

15.3%

$136

14.0%

($11)

(1.1%)

($12)

2031E

$1,043

7.5%

$176

16.8%

$163

15.6%

($12)

2032E

($10)

$1,095

5.0%

$202

18.4%

$188

17.2%

($13)

2033E

($8)

$1,128

3.0%

$226

20.0%

$212

18.8%

(1.1%) (1.1%) (1.2%)

($14)

($7)

CAGR

'22-'33E

28.8%

n.m.

n.m.

| Draft |

3View entire presentation