Affirm Investor Presentation Deck

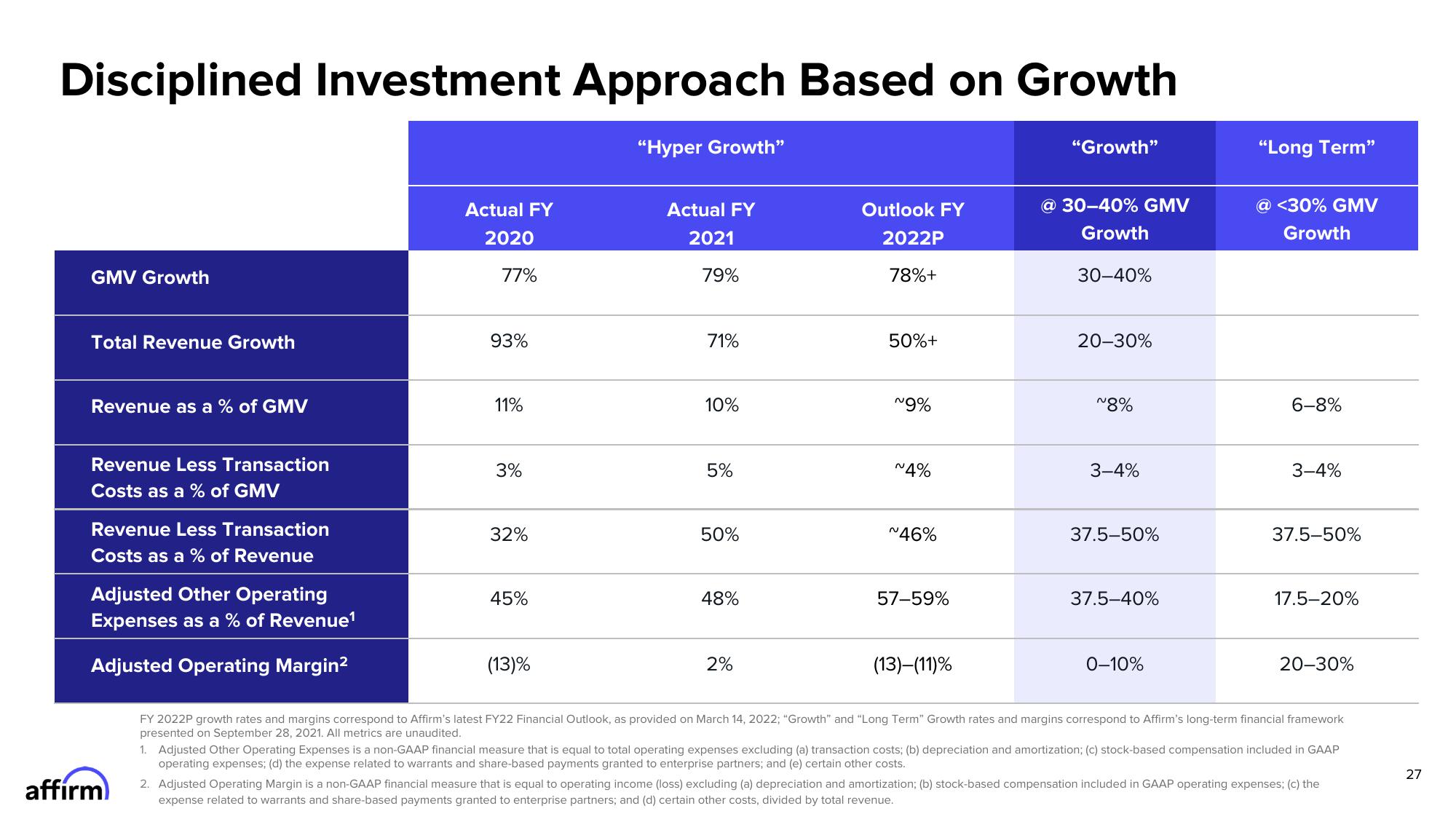

Disciplined Investment Approach Based on Growth

GMV Growth

Total Revenue Growth

Revenue as a % of GMV

Revenue Less Transaction

Costs as a % of GMV

Revenue Less Transaction

Costs as a % of Revenue

Adjusted Other Operating

Expenses as a % of Revenue¹

Adjusted Operating Margin²

affirm

Actual FY

2020

77%

93%

11%

3%

32%

45%

(13)%

"Hyper Growth"

Actual FY

2021

79%

71%

10%

5%

50%

48%

2%

Outlook FY

2022P

78%+

50%+

~9%

~4%

~46%

57-59%

(13)-(11) %

"Growth"

@ 30-40% GMV

Growth

30-40%

20-30%

~8%

3-4%

37.5-50%

37.5-40%

0-10%

"Long Term"

@ <30% GMV

Growth

6-8%

3-4%

37.5-50%

17.5-20%

20-30%

FY 2022P growth rates and margins correspond to Affirm's latest FY22 Financial Outlook, as provided on March 14, 2022; "Growth" and "Long Term" Growth rates and margins correspond to Affirm's long-term financial framework

presented on September 28, 2021. All metrics are unaudited.

1. Adjusted Other Operating Expenses is a non-GAAP financial measure that is equal to total operating expenses excluding (a) transaction costs; (b) depreciation and amortization; (c) stock-based compensation included in GAAP

operating expenses; (d) the expense related to warrants and share-based payments granted to enterprise partners; and (e) certain other costs.

2. Adjusted Operating Margin is a non-GAAP financial measure that is equal to operating income (loss) excluding (a) depreciation and amortization; (b) stock-based compensation included in GAAP operating expenses; (c) the

expense related to warrants and share-based payments granted to enterprise partners; and (d) certain other costs, divided by total revenue..

27View entire presentation