Pershing Square Activist Presentation Deck

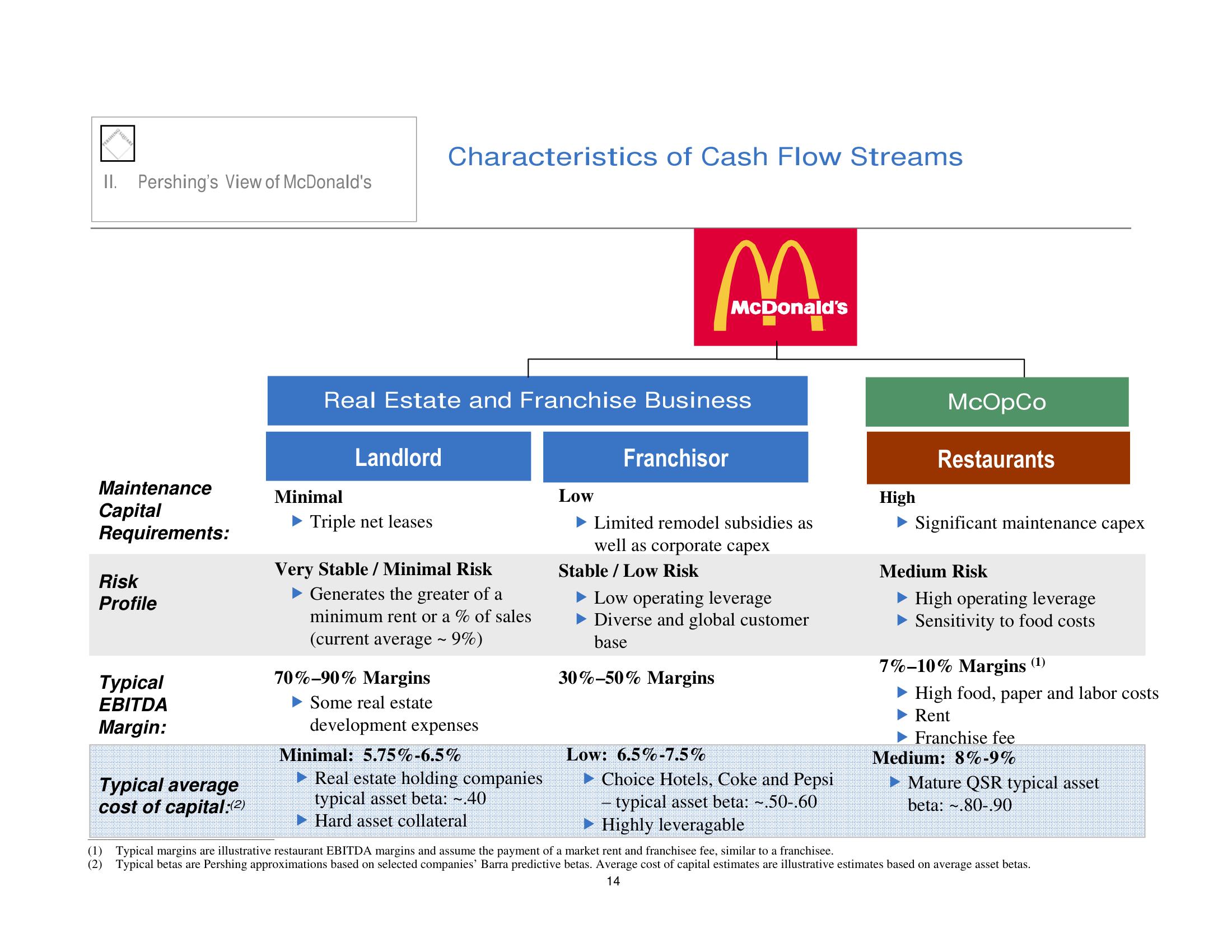

II. Pershing's View of McDonald's

Maintenance

Capital

Requirements:

Risk

Profile

Typical

EBITDA

Margin:

Typical average

cost of capital:(2)

Minimal

Landlord

Characteristics of Cash Flow Streams

Real Estate and Franchise Business

Triple net leases

Very Stable / Minimal Risk

Generates the greater of a

minimum rent or a % of sales

(current average ~ 9%)

70%-90% Margins

Some real estate

development expenses

Minimal: 5.75%-6.5%

Real estate holding companies

typical asset beta: ~.40

►Hard asset collateral

Low

Add

n

Franchisor

Stable / Low Risk

McDonald's

Limited remodel subsidies as

well as corporate capex

Low operating leverage

Diverse and global customer

base

30%-50% Margins

Low: 6.5%-7.5%

►Choice Hotels, Coke and Pepsi

- typical asset beta: ~.50-.60

Highly leveragable

High

McOpCo

Restaurants

Significant maintenance capex

Medium Risk

High operating leverage

Sensitivity to food costs

7%-10% Margins (¹)

High food, paper and labor costs

Rent

Franchise fee

Medium: 8%-9%

►Mature QSR typical asset

beta: ~.80-.90

(1) Typical margins are illustrative restaurant EBITDA margins and assume the payment of a market rent and franchisee fee, similar to a franchisee.

(2) Typical betas are Pershing approximations based on selected companies' Barra predictive betas. Average cost of capital estimates are illustrative estimates based on average asset betas.

14View entire presentation