Nikola Investor Day Presentation Deck

PAG

V1OXIN

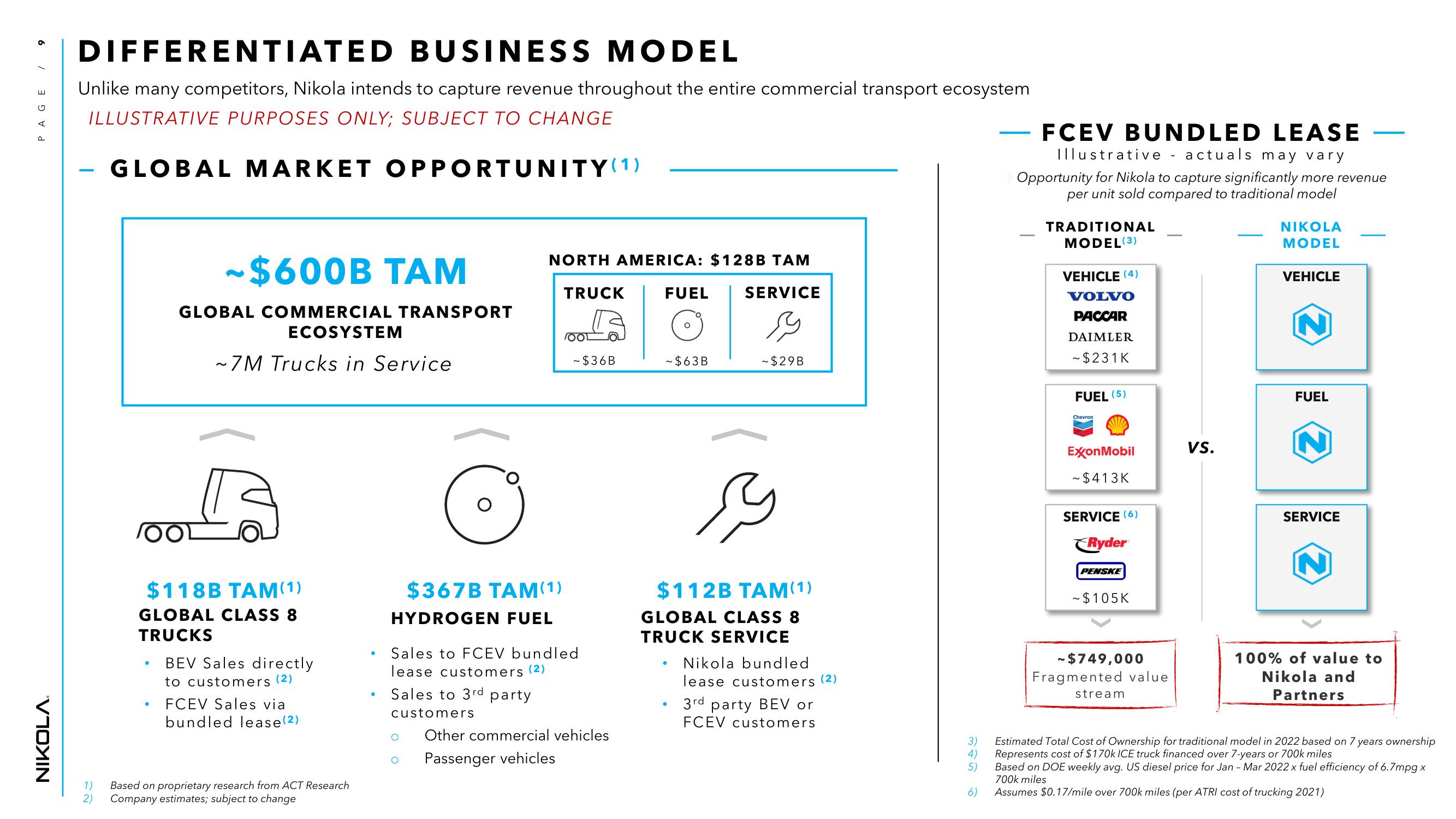

DIFFERENTIATED BUSINESS MODEL

Unlike many competitors, Nikola intends to capture revenue throughout the entire commercial transport ecosystem

ILLUSTRATIVE PURPOSES ONLY; SUBJECT TO CHANGE

GLOBAL MARKET OPPORTUNITY (1)

~$600B TAM

GLOBAL COMMERCIAL TRANSPORT

ECOSYSTEM

~7M Trucks in Service

a

$118B TAM (1)

GLOBAL CLASS 8

TRUCKS

BEV Sales directly

to customers (2)

FCEV Sales via

bundled lease (2)

1)

2) Company estimates; subject to change

Based on proprietary research from ACT Research

NORTH AMERICA: $128B TAM

FUEL SERVICE

TRUCK

TOOL

☹

$367B TAM(1)

HYDROGEN FUEL

~$36B

Sales to FCEV bundled

lease customers (2)

Sales to 3rd party

customers

Other commercial vehicles

Passenger vehicles

O

~$63B

•

ویر

~$29B

$112B TAM (1)

GLOBAL CLASS 8

TRUCK SERVICE

Nikola bundled

lease customers (2)

3rd party BEV or

FCEV customers

3)

4)

5)

6)

FCEV BUNDLED LEASE

Illustrative - actuals may vary

Opportunity for Nikola to capture significantly more revenue

per unit sold compared to traditional model

TRADITIONAL

MODEL (3)

VEHICLE (4)

VOLVO

PACCAR

DAIMLER

~$231K

FUEL (5)

Chevron

ExxonMobil

~$413K

SERVICE (6)

Ryder

PENSKE

~$105K

- $749,000

Fragmented value

stream

VS.

NIKOLA

MODEL

VEHICLE

N

FUEL

N

SERVICE

N

-

100% of value to

Nikola and

Partners

Estimated Total Cost of Ownership for traditional model in 2022 based on 7 years ownership

Represents cost of $170k ICE truck financed over 7-years or 700k miles

Based on DOE weekly avg. US diesel price for Jan - Mar 2022 x fuel efficiency of 6.7mpg x

700k miles

Assumes $0.17/mile over 700k miles (per ATRI cost of trucking 2021)View entire presentation