Hostess Investor Presentation Deck

H₁

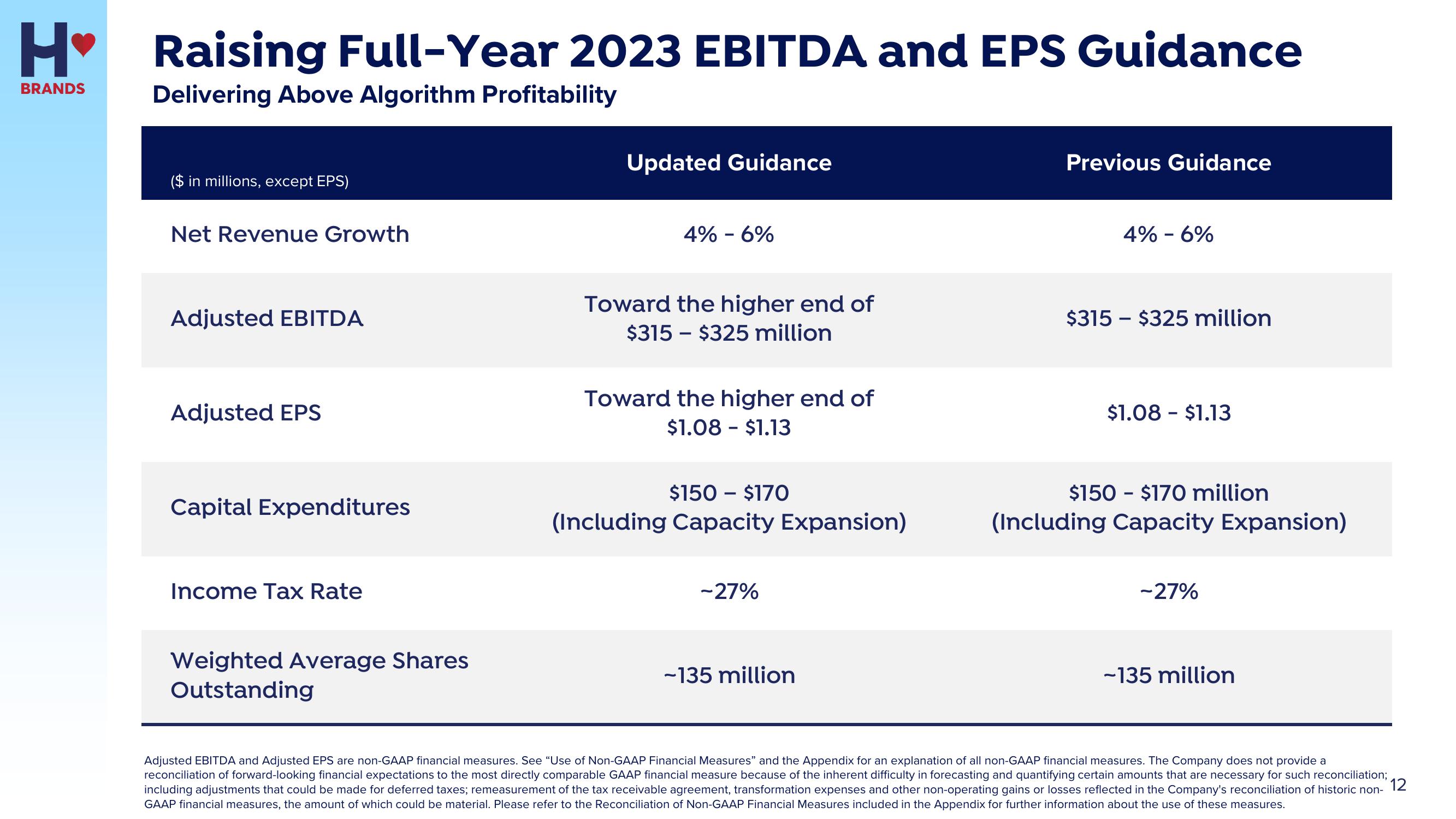

H❤ Raising Full-Year 2023 EBITDA and EPS Guidance

BRANDS

Delivering Above Algorithm Profitability

($ in millions, except EPS)

Net Revenue Growth

Adjusted EBITDA

Adjusted EPS

Capital Expenditures

Income Tax Rate

Weighted Average Shares

Outstanding

Updated Guidance

4% -6%

Toward the higher end of

$315 $325 million

Toward the higher end of

$1.08 - $1.13

$150 - $170

(Including Capacity Expansion)

-27%

-135 million

Previous Guidance

4% -6%

$315 - $325 million

$1.08 - $1.13

$150 - $170 million

(Including Capacity Expansion)

-27%

-135 million

Adjusted EBITDA and Adjusted EPS are non-GAAP financial measures. See "Use of Non-GAAP Financial Measures" and the Appendix for an explanation of all non-GAAP financial measures. The Company does not provide a

reconciliation of forward-looking financial expectations to the most directly comparable GAAP financial measure because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation;

including adjustments that could be made for deferred taxes; remeasurement of the tax receivable agreement, transformation expenses and other non-operating gains or losses reflected in the Company's reconciliation of historic non- 12

GAAP financial measures, the amount of which could be material. Please refer to the Reconciliation of Non-GAAP Financial Measures included in the Appendix for further information about the use of these measures.View entire presentation