Kinnevik Results Presentation Deck

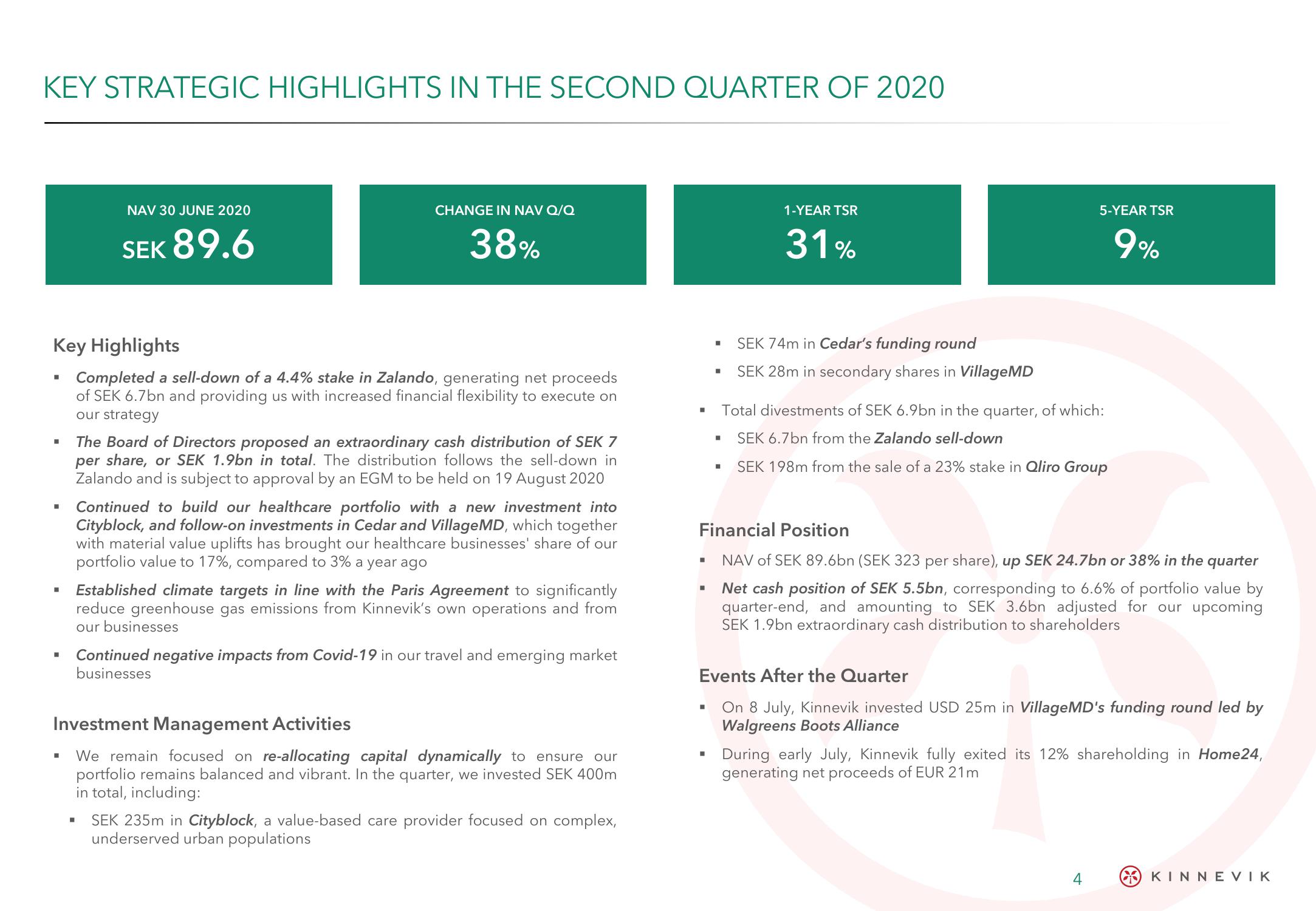

KEY STRATEGIC HIGHLIGHTS IN THE SECOND QUARTER OF 2020

■

Key Highlights

Completed a sell-down of a 4.4% stake in Zalando, generating net proceeds

of SEK 6.7bn and providing us with increased financial flexibility to execute on

our strategy

■

■

■

NAV 30 JUNE 2020

SEK 89.6

CHANGE IN NAV Q/Q

38%

The Board of Directors proposed an extraordinary cash distribution of SEK 7

per share, or SEK 1.9bn in total. The distribution follows the sell-down in

Zalando and is subject to approval by an EGM to be held on 19 August 2020

Continued to build our healthcare portfolio with a new investment into

Cityblock, and follow-on investments in Cedar and VillageMD, which together

with material value uplifts has brought our healthcare businesses' share of our

portfolio value to 17%, compared to 3% a year ago

Established climate targets in line with the Paris Agreement to significantly

reduce greenhouse gas emissions from Kinnevik's own operations and from

our businesses

■

Continued negative impacts from Covid-19 in our travel and emerging market

businesses

Investment Management Activities

We remain focused on re-allocating capital dynamically to ensure our

portfolio remains balanced and vibrant. In the quarter, we invested SEK 400m

in total, including:

SEK 235m in Cityblock, a value-based care provider focused on complex,

underserved urban populations

■

■

.

■

I

■

1-YEAR TSR

31%

■

SEK 74m in Cedar's funding round

SEK 28m in secondary shares in Village MD

Total divestments of SEK 6.9bn in the quarter, of which:

SEK 6.7bn from the Zalando sell-down

SEK 198m from the sale of a 23% stake in Qliro Group

Financial Position

NAV of SEK 89.6bn (SEK 323 per share), up SEK 24.7bn or 38% in the quarter

Net cash position of SEK 5.5bn, corresponding to 6.6% of portfolio value by

quarter-end, and amounting to SEK 3.6bn adjusted for our upcoming

SEK 1.9bn extraordinary cash distribution to shareholders

5-YEAR TSR

9%

Events After the Quarter

On 8 July, Kinnevik invested USD 25m in Village MD's funding round led by

Walgreens Boots Alliance

During early July, Kinnevik fully exited its 12% shareholding in Home24,

generating net proceeds of EUR 21m

4

Ο ΚΙΝΝΕVIKView entire presentation