Blackwells Capital Activist Presentation Deck

MONMOUTH + WPT

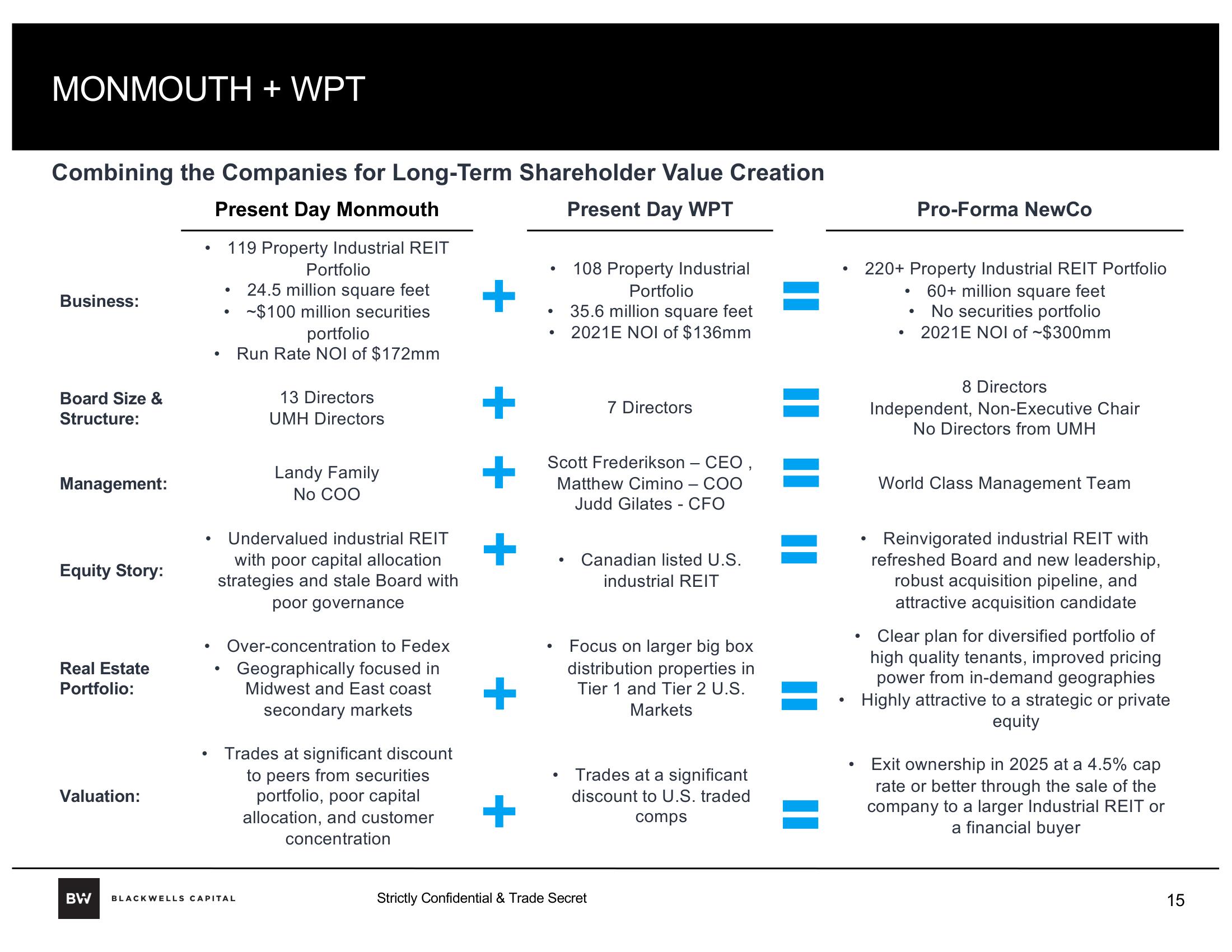

Combining the Companies for Long-Term Shareholder Value Creation

Present Day Monmouth

Present Day WPT

119 Property Industrial REIT

Portfolio

24.5 million square feet

-$100 million securities

Business:

Board Size &

Structure:

Management:

Equity Story:

Real Estate

Portfolio:

Valuation:

BW

●

●

●

●

●

portfolio

Run Rate NOI of $172mm

13 Directors

UMH Directors

Undervalued industrial REIT

with poor capital allocation

strategies and stale Board with

poor governance

Landy Family

No COO

BLACKWELLS CAPITAL

Over-concentration to Fedex

Geographically focused in

Midwest and East coast

secondary markets

Trades at significant discount

to peers from securities

portfolio, poor capital

allocation, and customer

concentration

+

+

+

+

+

+

●

●

●

108 Property Industrial

Portfolio

●

35.6 million square feet

2021E NOI of $136mm

Scott Frederikson - CEO,

Matthew Cimino - COO

Judd Gilates - CFO

7 Directors

Canadian listed U.S.

industrial REIT

Focus on larger big box

distribution properties in

Tier 1 and Tier 2 U.S.

Markets

Trades at a significant

discount to U.S. traded

comps

Strictly Confidential & Trade Secret

●

●

220+ Property Industrial REIT Portfolio

60+ million square feet

No securities portfolio

2021E NOI of ~$300mm

●

●

Pro-Forma NewCo

•

8 Directors

Independent, Non-Executive Chair

No Directors from UMH

World Class Management Team

Reinvigorated industrial REIT with

refreshed Board and new leadership,

robust acquisition pipeline, and

attractive acquisition candidate

Clear plan for diversified portfolio of

high quality tenants, improved pricing

power from in-demand geographies

Highly attractive to a strategic or private

equity

Exit ownership in 2025 at a 4.5% cap

rate or better through the sale of the

company to a larger Industrial REIT or

a financial buyer

15View entire presentation