LSE Mergers and Acquisitions Presentation Deck

2

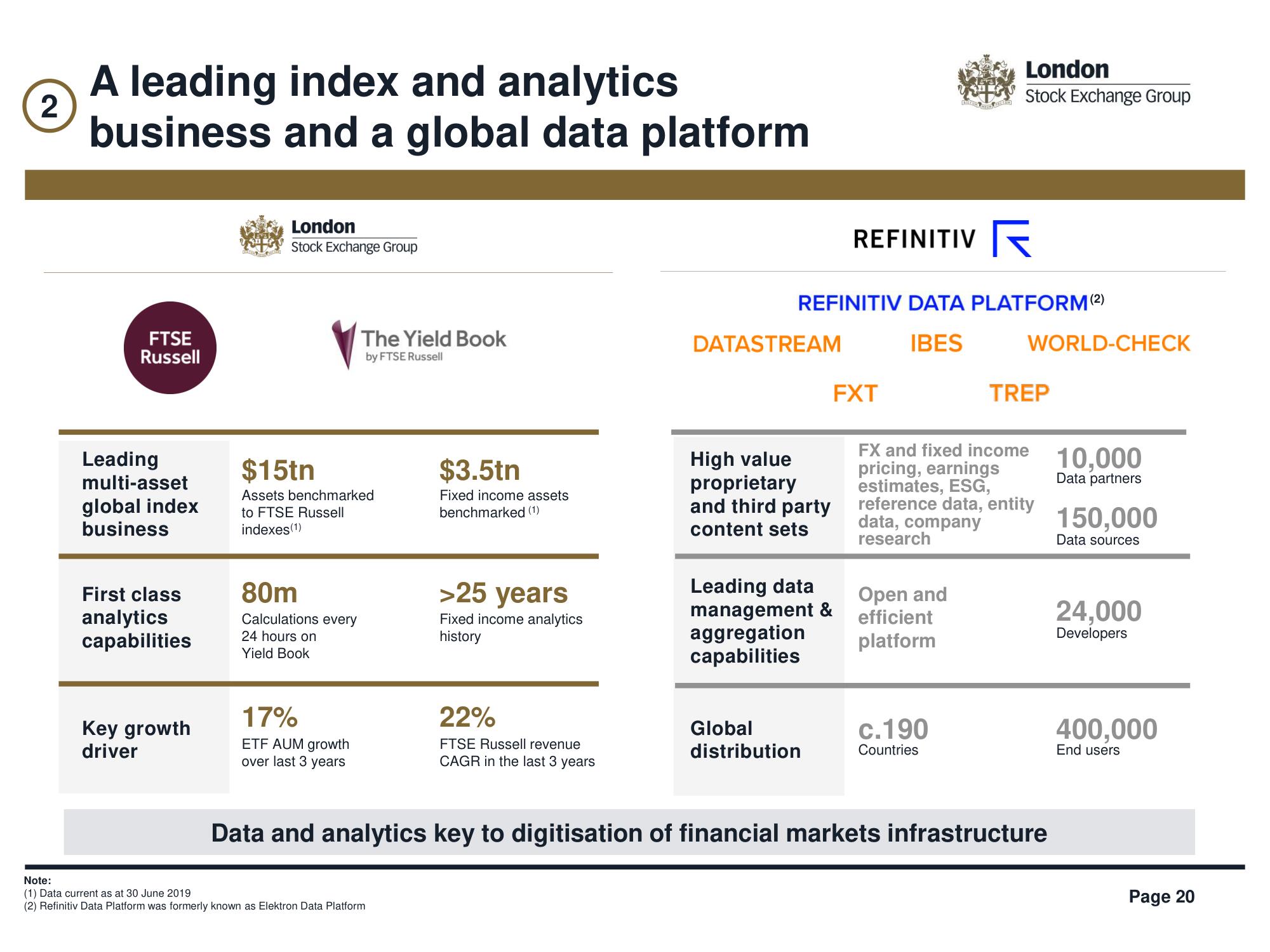

A leading index and analytics

business and a global data platform

FTSE

Russell

Leading

multi-asset

global index

business

First class

analytics

capabilities

Key growth

driver

London

Stock Exchange Group

$15tn

Assets benchmarked

to FTSE Russell

indexes (1)

80m

Calculations every

24 hours on

Yield Book

The Yield Book

by FTSE Russell

17%

ETF AUM growth

over last 3 years

$3.5tn

Fixed income assets

benchmarked (1)

Note:

(1) Data current as at 30 June 2019

(2) Refinitiv Data Platform was formerly known as Elektron Data Platform

>25 years

Fixed income analytics

history

22%

FTSE Russell revenue

CAGR in the last 3 years

DATASTREAM

High value

proprietary

and third party

content sets

REFINITIV DATA PLATFORM (²)

IBES

Leading data

management &

aggregation

capabilities

Global

distribution

REFINITIV

FXT

Dukeratin

Open and

efficient

platform

London

Stock Exchange Group

c.190

Countries

WORLD-CHECK

FX and fixed income

pricing, earnings

estimates, ESG,

reference data, entity

data, company

research

TREP

Data and analytics key to digitisation of financial markets infrastructure

10,000

Data partners

150,000

Data sources

24,000

Developers

400,000

End users

Page 20View entire presentation