Axos Financial, Inc. Fixed Income Investor Presentation

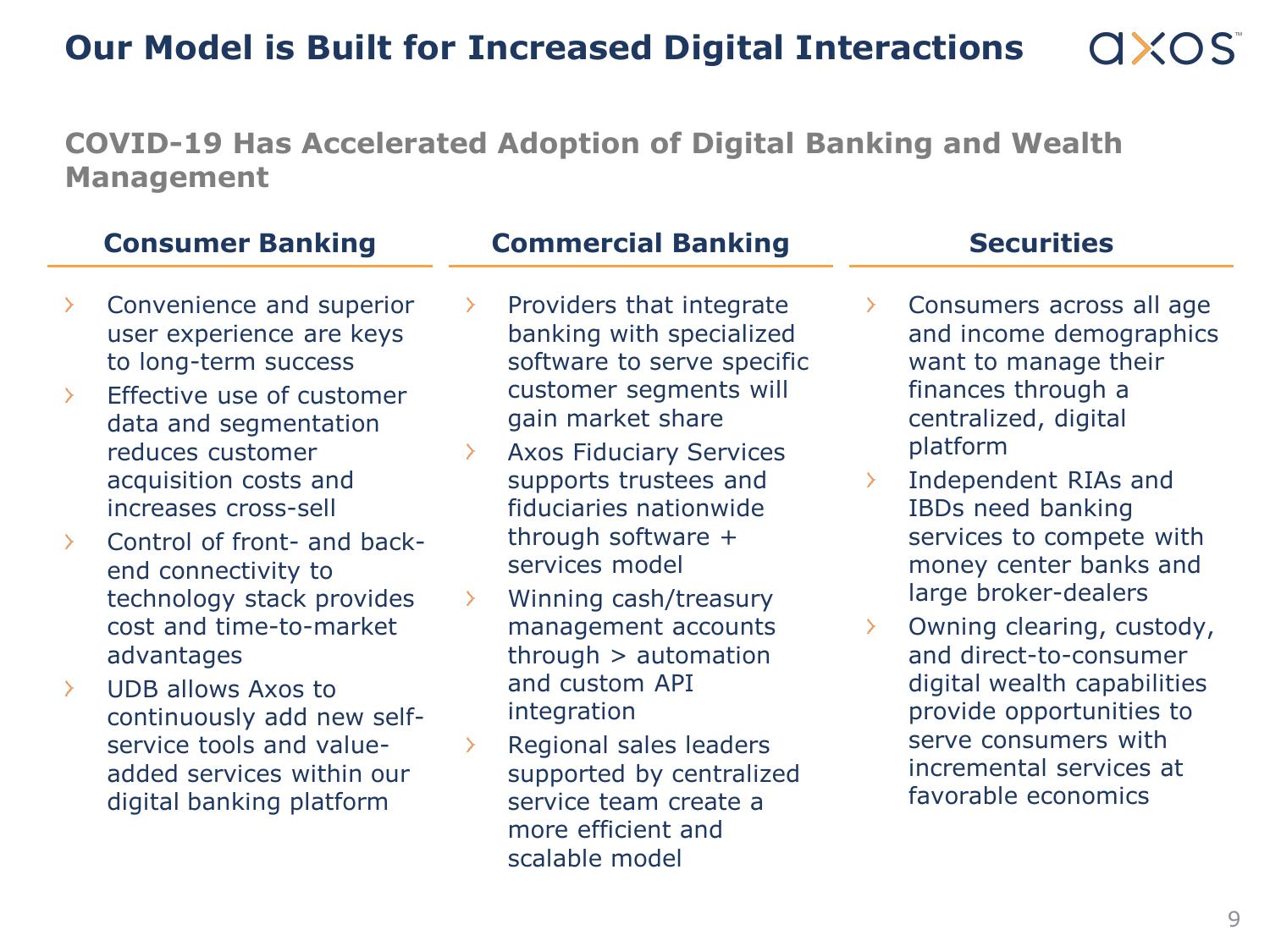

Our Model is Built for Increased Digital Interactions axos

COVID-19 Has Accelerated Adoption of Digital Banking and Wealth

Management

Consumer Banking

Convenience and superior

user experience are keys

to long-term success

Effective use of customer

data and segmentation

reduces customer

acquisition costs and

increases cross-sell

>

>

>

Control of front- and back-

end connectivity to

technology stack provides

cost and time-to-market

advantages

UDB allows Axos to

continuously add new self-

service tools and value-

added services within our

digital banking platform

>

Commercial Banking

Providers that integrate

banking with specialized

software to serve specific

customer segments will

gain market share

Axos Fiduciary Services

supports trustees and

fiduciaries nationwide

through software +

services model

Winning cash/treasury

management accounts

through > automation

and custom API

integration

Regional sales leaders

supported by centralized

service team create a

more efficient and

scalable model

Securities

Consumers across all age

and income demographics

want to manage their

finances through a

centralized, digital

platform

Independent RIAS and

IBDS need banking

services to compete with

money center banks and

large broker-dealers

Owning clearing, custody,

and direct-to-consumer

digital wealth capabilities

provide opportunities to

serve consumers with

incremental services at

favorable economics

9View entire presentation