Ford Investor Conference Presentation Deck

FORD CREDIT

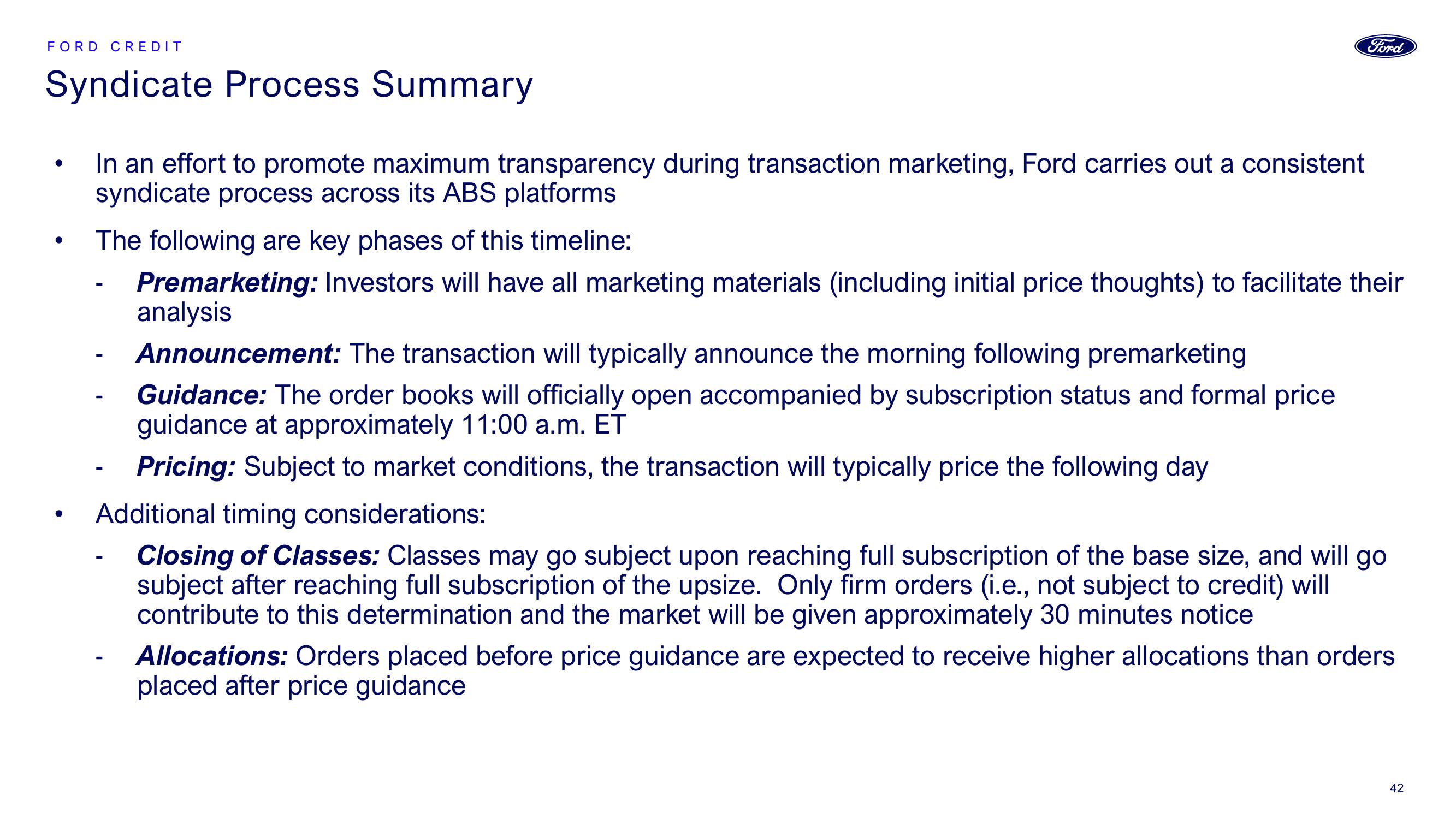

Syndicate Process Summary

●

In an effort to promote maximum transparency during transaction marketing, Ford carries out a consistent

syndicate process across its ABS platforms

The following are key phases of this timeline:

Premarketing: Investors will have all marketing materials (including initial price thoughts) to facilitate their

analysis

-

Ford

Announcement: The transaction will typically announce the morning following premarketing

Guidance: The order books will officially open accompanied by subscription status and formal price

guidance at approximately 11:00 a.m. ET

Pricing: Subject to market conditions, the transaction will typically price the following day

Additional timing considerations:

Closing of Classes: Classes may go subject upon reaching full subscription of the base size, and will go

subject after reaching full subscription of the upsize. Only firm orders (i.e., not subject to credit) will

contribute to this determination and the market will be given approximately 30 minutes notice

Allocations: Orders placed before price guidance are expected to receive higher allocations than orders

placed after price guidance

42View entire presentation