Vertical Aerospace SPAC Presentation Deck

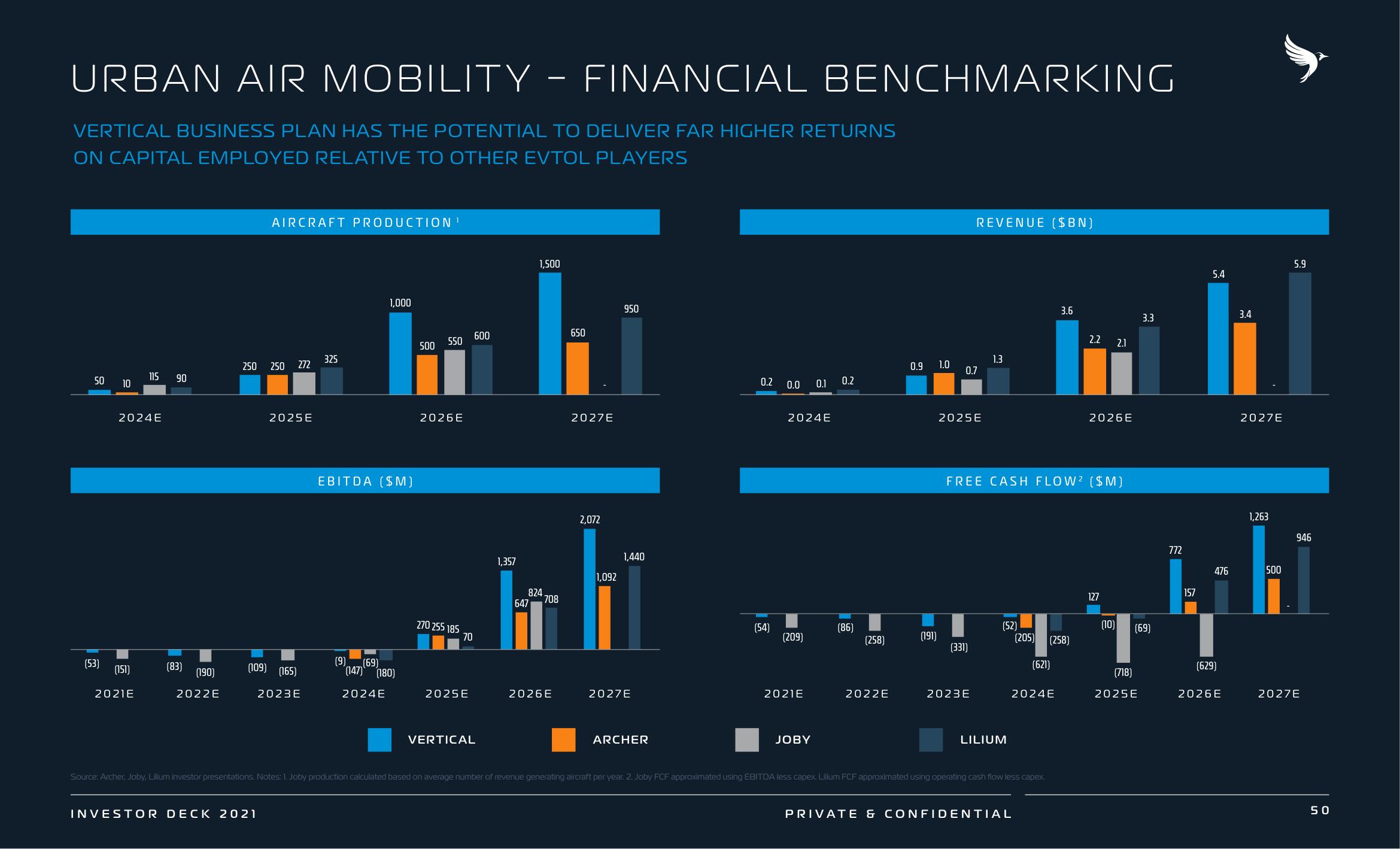

URBAN AIR MOBILITY - FINANCIAL BENCHMARKING

VERTICAL BUSINESS PLAN HAS THE POTENTIAL TO DELIVER FAR HIGHER RETURNS

ON CAPITAL EMPLOYED RELATIVE TO OTHER EVTOL PLAYERS

50

(53)

10

2024E

(151)

115

2021E

90

(83)

(190)

2022E

AIRCRAFT PRODUCTION ¹

250 250 272

2025E

(109) (165)

2023E

INVESTOR DECK 2021

325

1,000

EBITDA ($M)

(9)

(69)

(147) (180)

2024E

500

550

2026E

270 255 185

70

2025E

600

VERTICAL

1,357

1,500

824

708

647

2026E

650

2027E

2,072

1,092

950

1,440

2027E

ARCHER

0.2 0.0

(54)

2024E

(209)

2021E

0.1

JOBY

0.2

(86)

(258)

2022E

0.9 1.0

(191)

0.7

REVENUE ($BN)

2025E

(331)

2023E

1.3

FREE CASH FLOW2 ($M)

(52)

(205)

LILIUM

Source: Archer, Joby, Lilium investor presentations. Notes: 1. Joby production calculated based on average number of revenue generating aircraft per year. 2. Joby FCF approximated using EBITDA less capex. Lillum FCF approximated using operating cash flow less capex.

(621)

2024E

PRIVATE & CONFIDENTIAL

3.6

(258)

2.2 2.1

2026E

127

(10)

3.3

(69)

(718)

2025E

772

157

5.4

476

(629)

2026E

3.4

2027E

1,263

500

5.9

946

2027E

50View entire presentation