Melrose Investor Presentation Deck

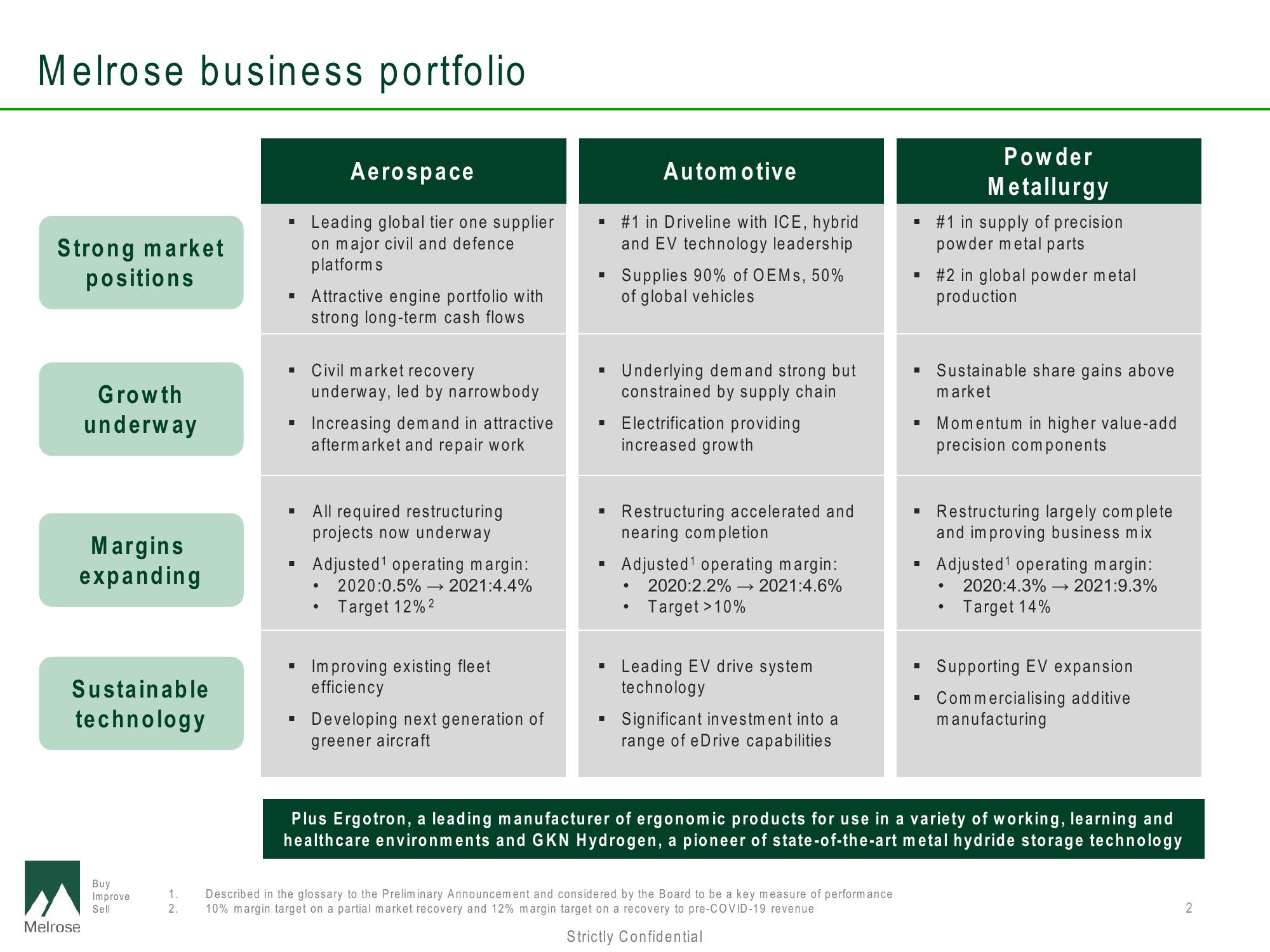

Melrose business portfolio

Strong market

positions

Growth

underway

Margins

expanding

Sustainable

technology

Melrose

Buy

Improve

Sell

IN

■

1.

■

I

■

I

■

Aerospace

Leading global tier one supplier

on major civil and defence

platforms

Attractive engine portfolio with

strong long-term cash flows

Civil market recovery

underway, led by narrowbody

Increasing demand in attractive

aftermarket and repair work

All required restructuring

projects now underway

Adjusted¹ operating margin:

2020:0.5%→ 2021:4.4%

Target 12% ²

●

●

Improving existing fleet

efficiency

Developing next generation of

greener aircraft

I

I

I

I

I

■

#1 in Driveline with ICE, hybrid

and EV technology leadership

Supplies 90% of OEMs, 50%

of global vehicles

Automotive

Underlying demand strong but

constrained by supply chain

Electrification providing

increased growth

Restructuring accelerated and

nearing completion

Adjusted¹ operating margin:

2020:2.2% -> 2021:4.6%

Target >10%

●

●

Leading EV drive system

technology

Significant investment into a

range of eDrive capabilities

Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

2. 10% margin target on a partial market recovery and 12% margin target on a recovery to pre-COVID-19 revenue

Strictly Confidential

▪ #1 in supply of precision

powder metal parts

▪ #2 in global powder metal

production

Powder

Metallurgy

■

Sustainable share gains above

market

▪ Momentum in higher value-add

precision components

Restructuring largely complete

and improving business mix

Adjusted¹ operating margin:

2021:9.3%

●

●

2020:4.3%

Target 14%

Supporting EV expansion

Commercialising additive

manufacturing

Plus Ergotron, a leading manufacturer of ergonomic products for use in a variety of working, learning and

healthcare environments and GKN Hydrogen, a pioneer of state-of-the-art metal hydride storage technology

2View entire presentation