AMC Investor Day Presentation Deck

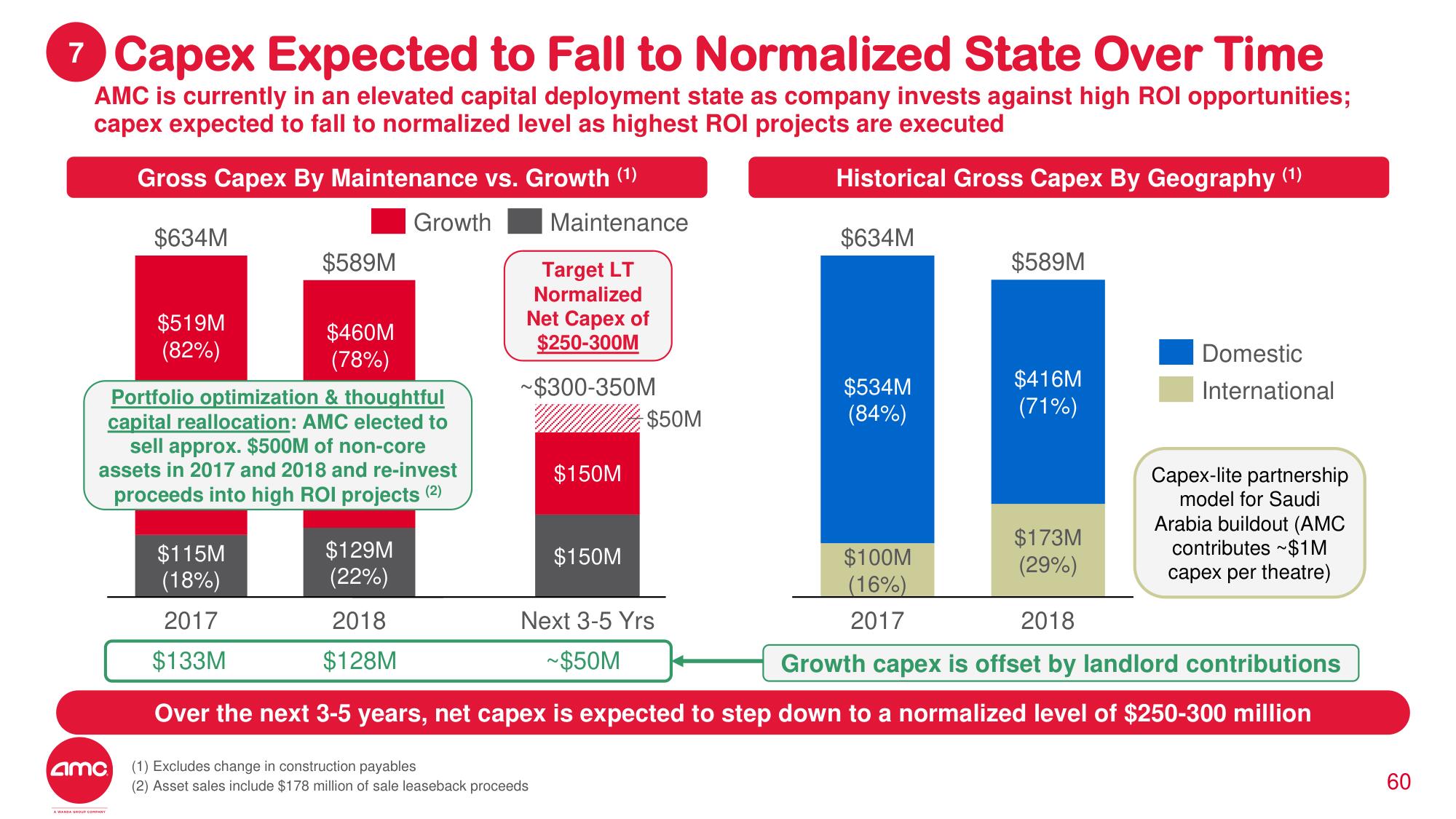

7 Capex Expected to Fall to Normalized State Over Time

AMC is currently in an elevated capital deployment state as company invests against high ROI opportunities;

capex expected to fall to normalized level as highest ROI projects are executed

Historical Gross Capex By Geography (¹)

$634M

Gross Capex By Maintenance vs. Growth (1)

$634M

amc

$519M

(82%)

$589M

$115M

(18%)

2017

$133M

$460M

(78%)

Portfolio optimization & thoughtful

capital reallocation: AMC elected to

sell approx. $500M of non-core

assets in 2017 and 2018 and re-invest

proceeds into high ROI projects (2)

$129M

(22%)

Growth

2018

$128M

Maintenance

Target LT

Normalized

Net Capex of

$250-300M

~$300-350M

$150M

(1) Excludes change in construction payables

(2) Asset sales include $178 million of sale leaseback proceeds

$150M

-$50M

Next 3-5 Yrs

~$50M

$534M

(84%)

$100M

(16%)

2017

$589M

$416M

(71%)

$173M

(29%)

Domestic

International

2018

Growth capex is offset by landlord contributions

Over the next 3-5 years, net capex is expected to step down to a normalized level of $250-300 million

Capex-lite partnership

model for Saudi

Arabia buildout (AMC

contributes ~$1M

capex per theatre)

60View entire presentation