Synchrony Financial Results Presentation Deck

Financial Results

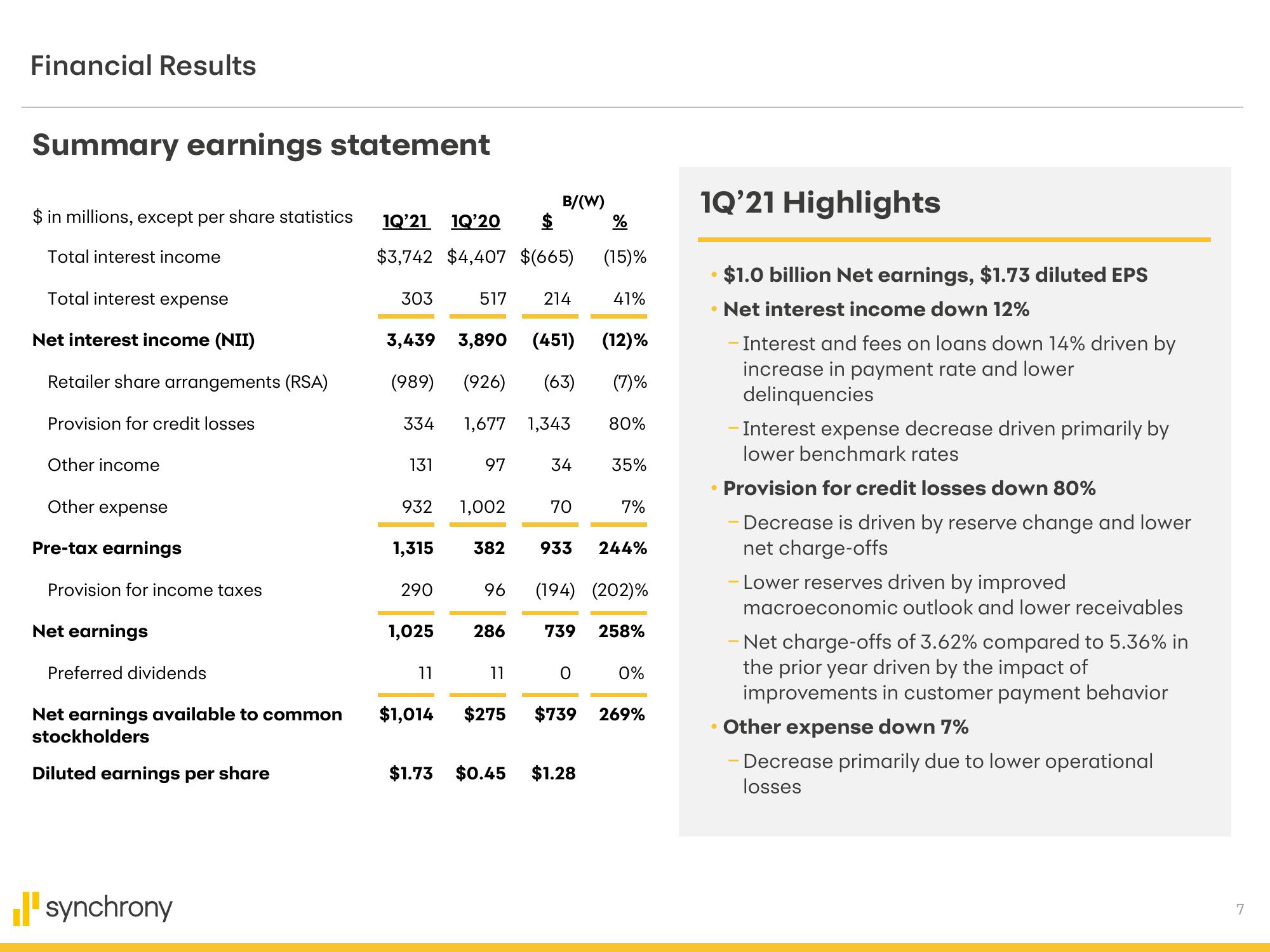

Summary earnings statement

$ in millions, except per share statistics

Total interest income

Total interest expense

Net interest income (NII)

Retailer share arrangements (RSA)

Provision for credit losses

Other income

Other expense

Pre-tax earnings

Provision for income taxes

Net earnings

Preferred dividends

Net earnings available to common

stockholders

Diluted earnings per share

synchrony

1Q'21 1Q'20 $

%

$3,742 $4,407 $(665) (15)%

303

517 214

(451)

(63)

3,439

3,890

(989) (926)

334

131

932

1,315

290

1,025

11

$1,014

1,677 1,343

97

1,002

B/(W)

286

34

382 933

11

70

0

41%

(12)%

(7)%

$1.73 $0.45 $1.28

80%

96 (194) (202)%

739 258%

35%

7%

244%

0%

$275 $739 269%

1Q'21 Highlights

●

●

$1.0 billion Net earnings, $1.73 diluted EPS

Net interest income down 12%

Interest and fees on loans down 14% driven by

increase in payment rate and lower

delinquencies

- Interest expense decrease driven primarily by

lower benchmark rates

Provision for credit losses down 80%

Decrease is driven by reserve change and lower

net charge-offs

Lower reserves driven by improved

macroeconomic outlook and lower receivables

Net charge-offs of 3.62% compared to 5.36% in

the prior year driven by the impact of

improvements in customer payment behavior

Other expense down 7%

Decrease primarily due to lower operational

losses

7View entire presentation