Pershing Square Activist Presentation Deck

III. Pershing's Proposal to McDonald's:

McOpCo IPO

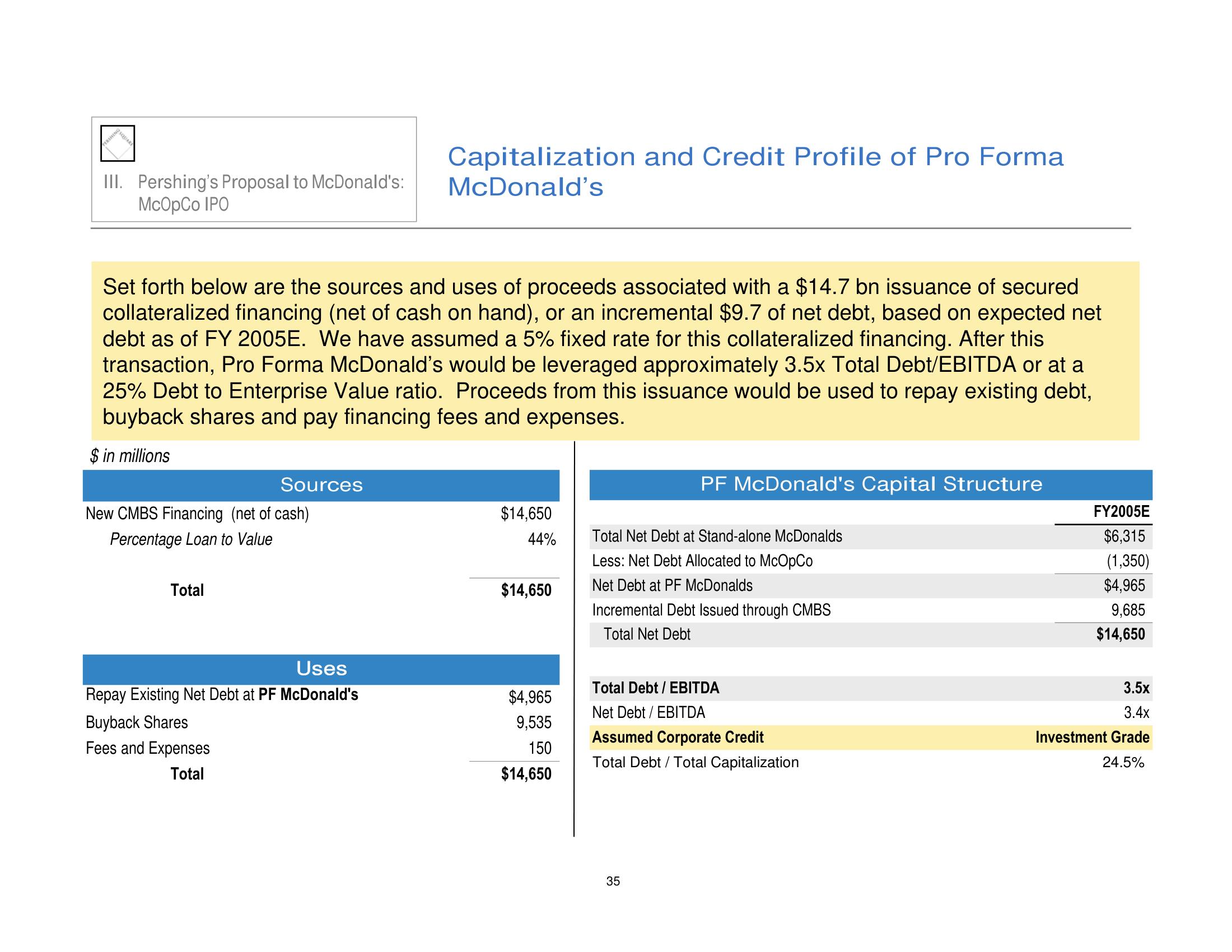

Set forth below are the sources and uses of proceeds associated with a $14.7 bn issuance of secured

collateralized financing (net of cash on hand), or an incremental $9.7 of net debt, based on expected net

debt as of FY 2005E. We have assumed a 5% fixed rate for this collateralized financing. After this

transaction, Pro Forma McDonald's would be leveraged approximately 3.5x Total Debt/EBITDA or at a

25% Debt to Enterprise Value ratio. Proceeds from this issuance would be used to repay existing debt,

buyback shares and pay financing fees and expenses.

$ in millions

Sources

New CMBS Financing (net of cash)

Percentage Loan to Value

Total

Capitalization and Credit Profile of Pro Forma

McDonald's

Uses

Repay Existing Net Debt at PF McDonald's

Buyback Shares

Fees and Expenses

Total

$14,650

44%

$14,650

$4,965

9,535

150

$14,650

PF McDonald's Capital Structure

Total Net Debt at Stand-alone McDonalds

Less: Net Debt Allocated to McOpCo

Net Debt at PF McDonalds

Incremental Debt Issued through CMBS

Total Net Debt

Total Debt / EBITDA

Net Debt / EBITDA

Assumed Corporate Credit

Total Debt / Total Capitalization

35

FY2005E

$6,315

(1,350)

$4,965

9,685

$14,650

3.5x

3.4x

Investment Grade

24.5%View entire presentation