Q2 2018 Fixed Income Investor Conference Call

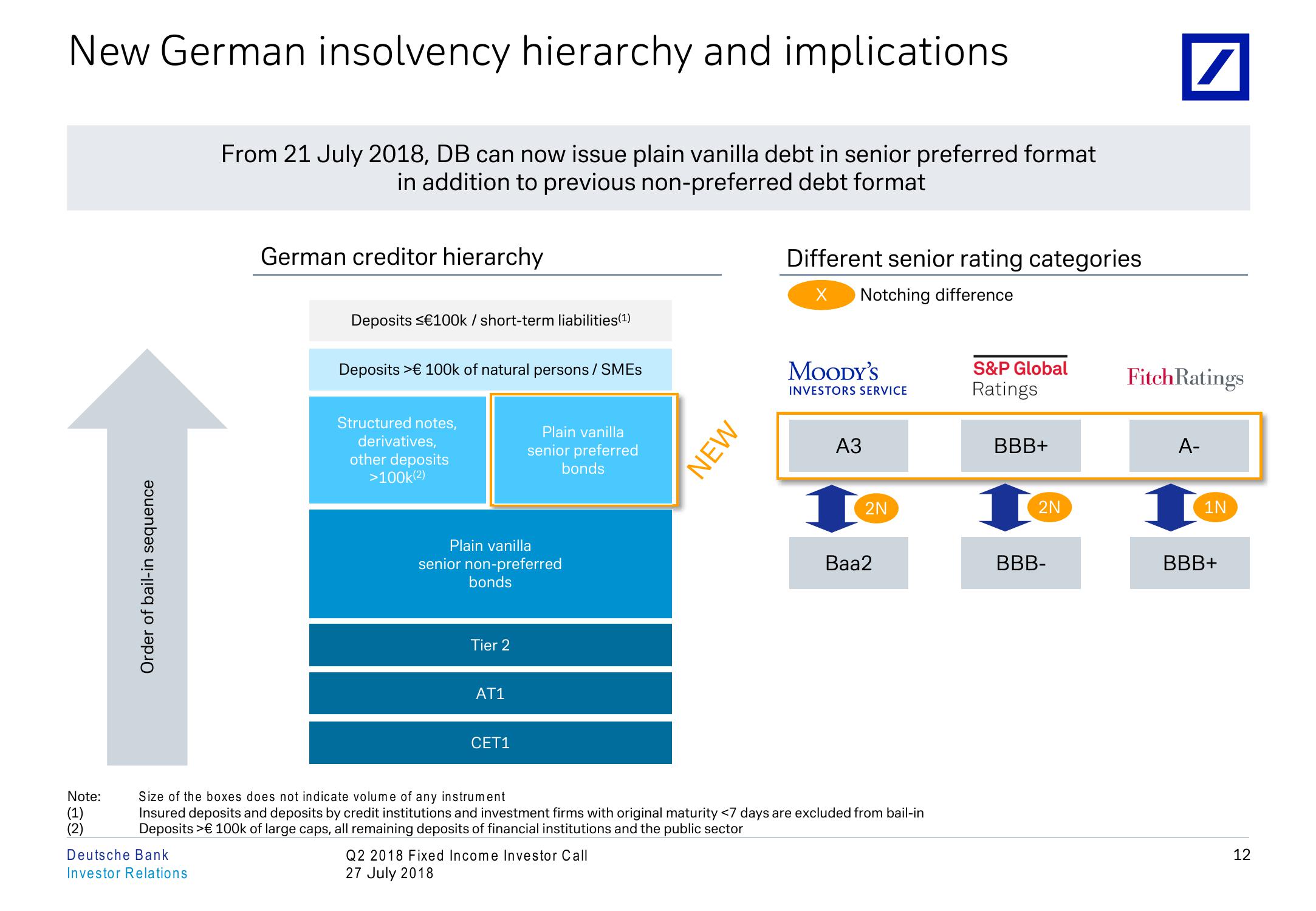

New German insolvency hierarchy and implications

Order of bail-in sequence

From 21 July 2018, DB can now issue plain vanilla debt in senior preferred format

in addition to previous non-preferred debt format

German creditor hierarchy

Different senior rating categories

Notching difference

Deposits €100k / short-term liabilities(1)

Deposits >€ 100k of natural persons / SMEs

Structured notes,

derivatives,

other deposits

>100k(2)

Plain vanilla

senior preferred

bonds

Plain vanilla

senior non-preferred

bonds

Tier 2

AT1

CET1

NEW

MOODY'S

INVESTORS SERVICE

A3

Baa2

2N

Size of the boxes does not indicate volume of any instrument

Insured deposits and deposits by credit institutions and investment firms with original maturity <7 days are excluded from bail-in

Deposits >€ 100k of large caps, all remaining deposits of financial institutions and the public sector

Note:

(1)

(2)

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

S&P Global

Ratings

Fitch Ratings

BBB+

BBB-

2N

A-

1N

BBB+

122

12View entire presentation