J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

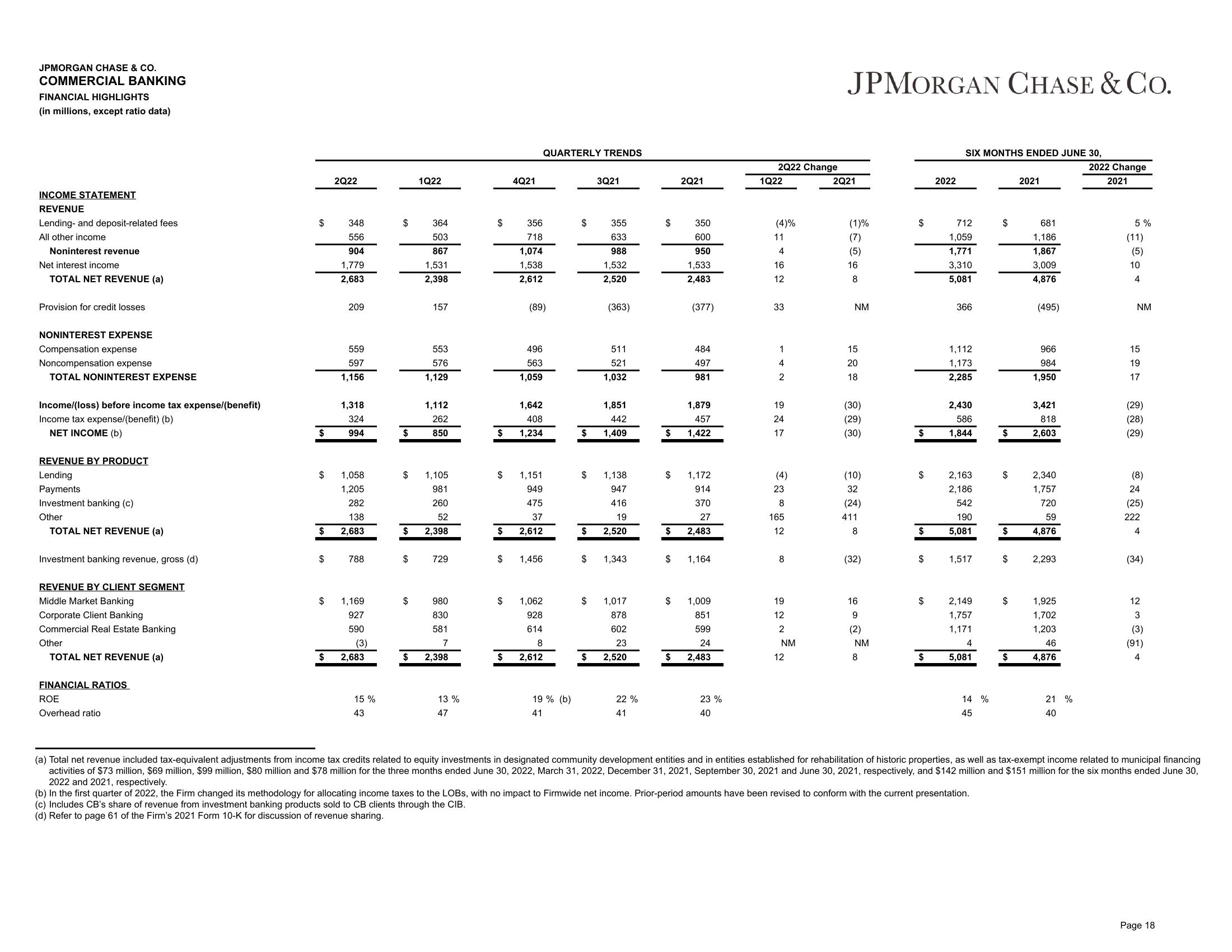

COMMERCIAL BANKING

FINANCIAL HIGHLIGHTS

(in millions, except ratio data)

INCOME STATEMENT

REVENUE

Lending- and deposit-related fees

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE (a)

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Noncompensation expense

TOTAL NONINTEREST EXPENSE

Income/(loss) before income tax expense/(benefit)

Income tax expense/(benefit) (b)

NET INCOME (b)

REVENUE BY PRODUCT

Lending

Payments

Investment banking (c)

Other

TOTAL NET REVENUE (a)

Investment banking revenue, gross (d)

REVENUE BY CLIENT SEGMENT

Middle Market Banking

Corporate Client Banking

Commercial Real Estate Banking

Other

TOTAL NET REVENUE (a)

FINANCIAL RATIOS

ROE

Overhead ratio

$

$

$

$

$

$

$

2Q22

348

556

904

1,779

2,683

209

559

597

1,156

1,318

324

994

1,058

1,205

282

138

2,683

788

1,169

927

590

(3)

2,683

15 %

43

$

$

$

$

$

1Q22

364

503

867

1,531

2,398

157

553

576

1,129

1,112

262

850

1,105

981

260

52

2,398

729

980

830

581

7

$ 2,398

13%

47

$

$

$

$

$

4Q21

$

356

718

1,074

1,538

2,612

(89)

496

563

1,059

1,642

408

1,234

QUARTERLY TRENDS

1,151

949

475

37

2,612

1,456

$ 1,062

928

614

8

2,612

19% (b)

41

$

$

$

3Q21

355

633

988

1,532

2,520

(363)

$

511

521

1,032

1,851

442

1,409

1,138

947

416

19

$ 2,520

$ 1,343

1,017

878

602

23

$ 2,520

22%

41

$

$

$

$

$

2Q21

$

350

600

950

1,533

2,483

(377)

484

497

981

1,879

457

1,422

1,172

914

370

27

2,483

1,164

1,009

851

599

24

$ 2,483

23 %

40

2Q22 Change

1Q22

(4)%

11

4

16

12

33

1

4

2

19

24

17

(4)

23

8

165

12

8

19

12

2

NM

12

JPMORGAN CHASE & Co.

2Q21

(1)%

(7)

(5)

16

8

NM

15

20

18

(30)

(29)

(30)

(10)

32

(24)

411

8

(32)

16

9

(2)

NM

8

$

$

$

$

$

2022

$

SIX MONTHS ENDED JUNE 30,

712

1,059

1,771

3,310

5,081

366

2,163

2,186

542

190

$ 5,081

1,112

1,173

2,285

2,430

586

1,844

1,517

2,149

1,757

1,171

4

5,081

14 %

45

$

$

$

$

$

$

$

2021

681

1,186

1,867

3,009

4,876

(495)

966

984

1,950

3,421

818

2,603

2,340

1,757

720

59

4,876

2,293

1,925

1,702

1,203

46

4,876

21 %

40

2022 Change

2021

5 %

(11)

(5)

10

4

NM

15

19

17

(29)

(28)

(29)

(8)

24

(25)

222

4

(34)

12

3

(3)

(91)

4

(a) Total net revenue included tax-equivalent adjustments from income tax credits related to equity investments in designated community development entities and in entities established for rehabilitation of historic properties, as well as tax-exempt income related to municipal financing

activities of $73 million, $69 million, $99 million, $80 million and $78 million for the three months ended June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021, respectively, and $142 million and $151 million for the six months ended June 30,

2022 and 2021, respectively.

(b) In the first quarter of 2022, the Firm changed its methodology for allocating income taxes to the LOBS, with no impact to Firmwide net income. Prior-period amounts have been revised to conform with the current presentation.

(c) Includes CB's share of revenue from investment banking products sold to CB clients through the CIB.

(d) Refer to page 61 of the Firm's 2021 Form 10-K for discussion of revenue sharing.

Page 18View entire presentation