Bakkt Results Presentation Deck

NOTES

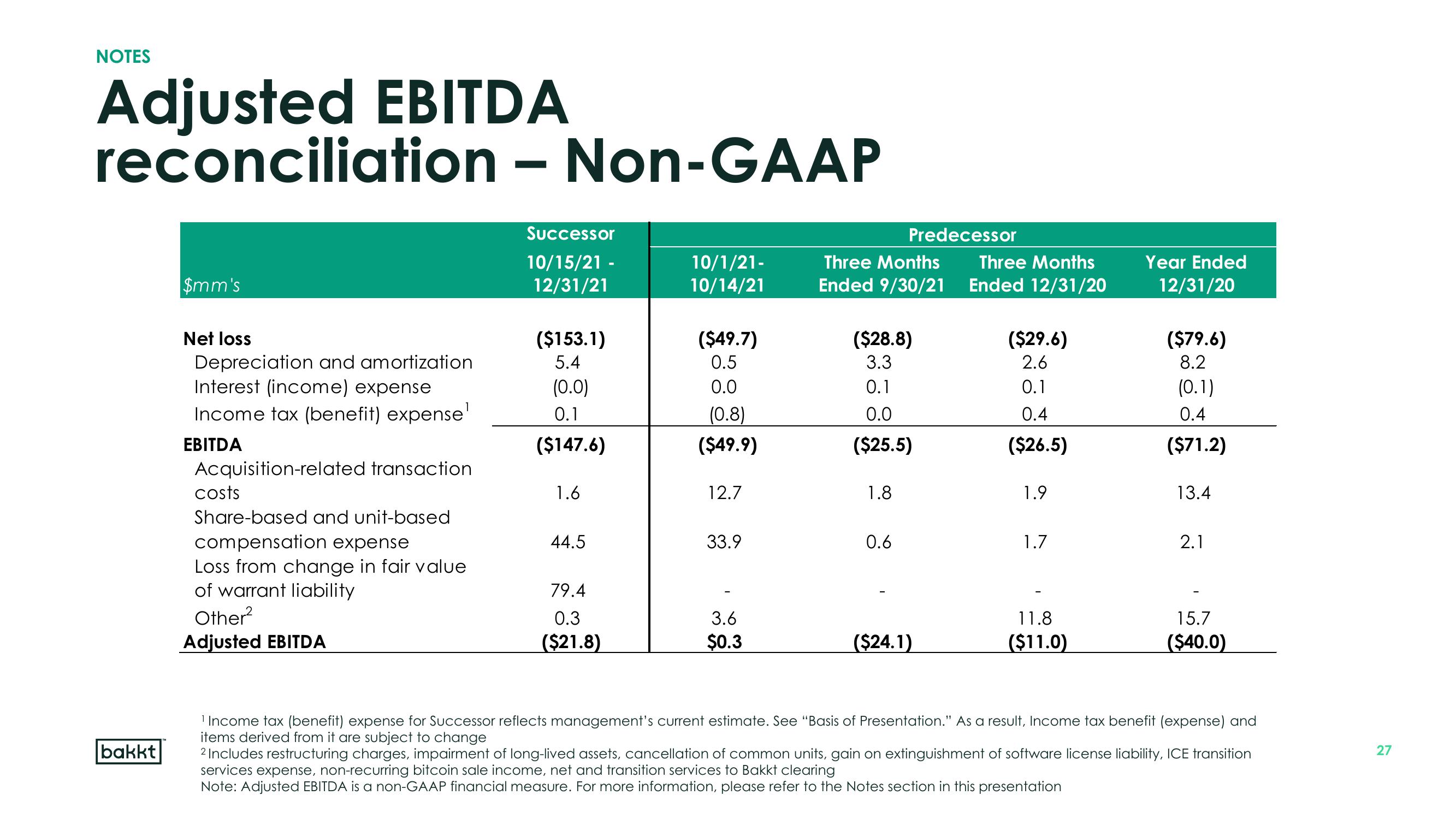

Adjusted EBITDA

reconciliation - Non-GAAP

bakkt

$mm's

Net loss

Depreciation and amortization

Interest (income) expense

Income tax (benefit) expense'

EBITDA

Acquisition-related transaction

costs

Share-based and unit-based

compensation expense

Loss from change in fair value

of warrant liability

Other²

Adjusted EBITDA

Successor

10/15/21 -

12/31/21

($153.1)

5.4

(0.0)

0.1

($147.6)

1.6

44.5

79.4

0.3

($21.8)

10/1/21-

10/14/21

($49.7)

0.5

0.0

(0.8)

($49.9)

12.7

33.9

3.6

$0.3

Three Months

Ended 9/30/21

Predecessor

($28.8)

3.3

0.1

0.0

($25.5)

1.8

0.6

($24.1)

Three Months

Ended 12/31/20

($29.6)

2.6

0.1

0.4

($26.5)

1.9

1.7

11.8

($11.0)

Year Ended

12/31/20

($79.6)

8.2

(0.1)

0.4

($71.2)

13.4

2.1

15.7

($40.0)

¹ Income tax (benefit) expense for Successor reflects management's current estimate. See "Basis of Presentation." As a result, Income tax benefit (expense) and

items derived from it are subject to change

2 Includes restructuring charges, impairment of long-lived assets, cancellation of common units, gain on extinguishment of software license liability, ICE transition

services expense, non-recurring bitcoin sale income, net and transition services to Bakkt clearing

Note: Adjusted EBITDA is a non-GAAP financial measure. For more information, please refer to the Notes section in this presentation

27View entire presentation