Repay SPAC

Historical and Forecasted Financials

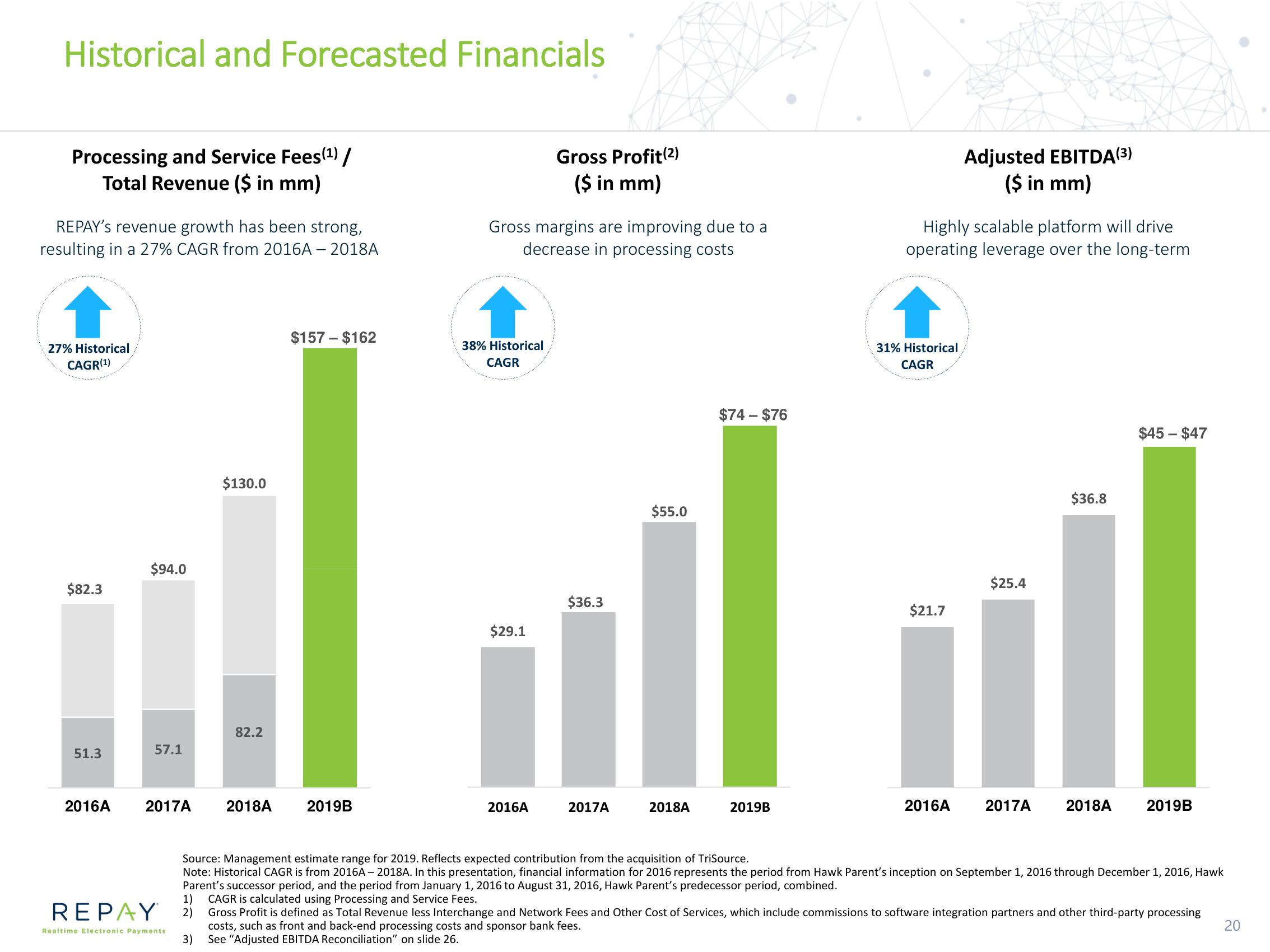

Processing and Service Fees (¹) /

Total Revenue ($ in mm)

REPAY's revenue growth has been strong,

resulting in a 27% CAGR from 2016A - 2018A

27% Historical

CAGR (¹)

$82.3

51.3

2016A

$94.0

57.1

REPAY

Realtime Electronic Payments

$130.0

82.2

2017A 2018A 2019B

1)

2)

3)

$157 - $162

Gross margins are improving due to a

decrease in processing costs

38% Historical

CAGR

$29.1

Gross Profit(²)

($ in mm)

2016A

$36.3

2017A

$55.0

2018A

$74 - $76

2019B

Highly scalable platform will drive

operating leverage over the long-term

31% Historical

CAGR

$21.7

Adjusted EBITDA(3)

($ in mm)

2016A

$25.4

2017A

$36.8

$45 - $47

2018A 2019B

Source: Management estimate range for 2019. Reflects expected contribution from the acquisition of TriSource.

Note: Historical CAGR is from 2016A-2018A. In this presentation, financial information for 2016 represents the period from Hawk Parent's inception on September 1, 2016 through December 1, 2016, Hawk

Parent's successor period, and the period from January 1, 2016 to August 31, 2016, Hawk Parent's predecessor period, combined.

CAGR is calculated using Processing and Service Fees.

Gross Profit is defined as Total Revenue less Interchange and Network Fees and Other Cost of Services, which include commissions to software integration partners and other third-party processing

costs, such as front and back-end processing costs and sponsor bank fees.

See "Adjusted EBITDA Reconciliation" on slide 26.

20View entire presentation