SoftBank Investor Presentation Deck

SVF1

SVF2

LATAM

DRIVING FUTURE SUCCESS

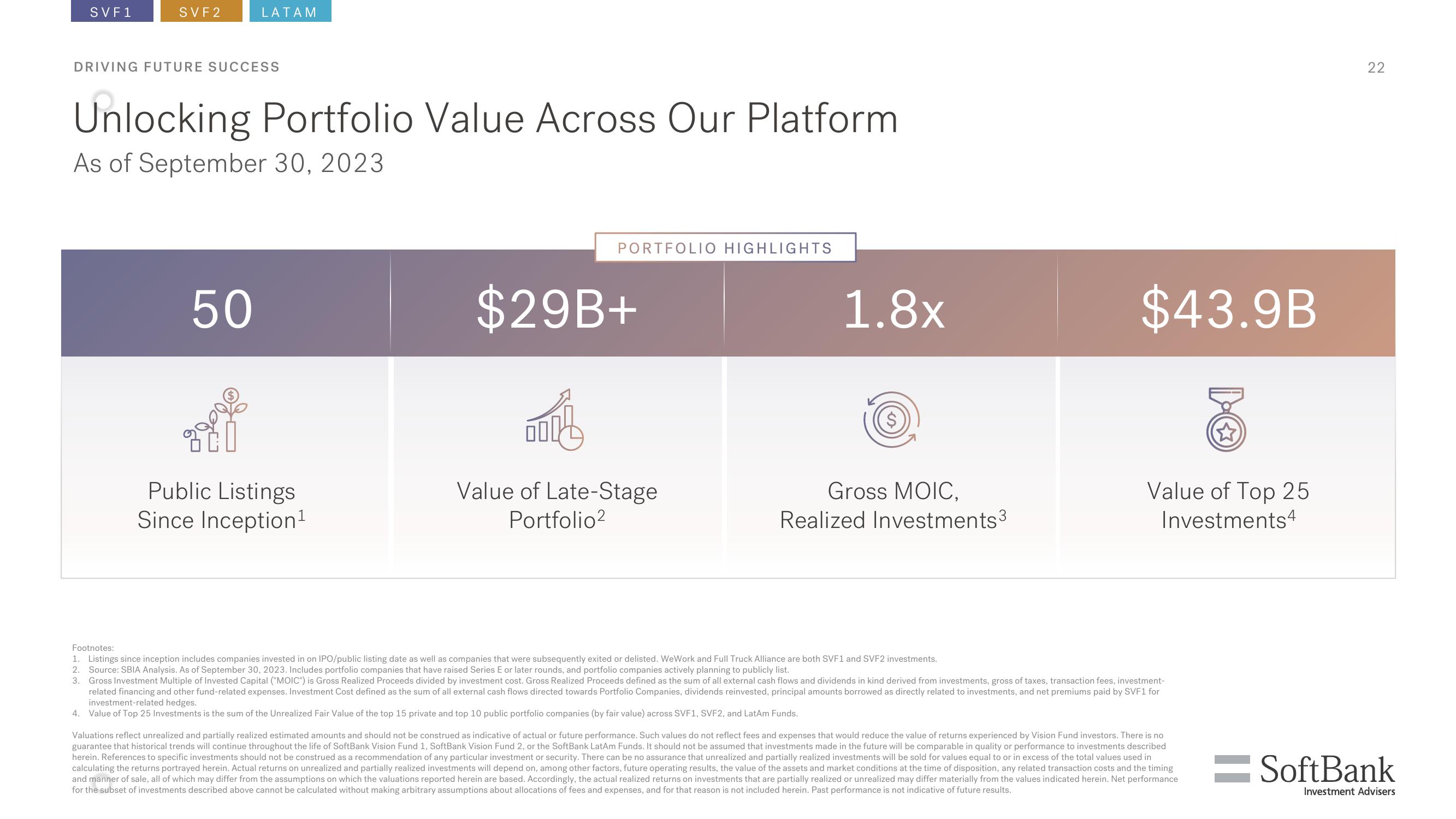

Unlocking Portfolio Value Across Our Platform

As of September 30, 2023

50

Public Listings

Since Inception ¹

PORTFOLIO HIGHLIGHTS

$29B+

DOLL

Value of Late-Stage

Portfolio²

1.8x

Gross MOIC,

Realized Investments³

Footnotes:

1. Listings since inception includes companies invested in on IPO/public listing date as well as companies that were subsequently exited or delisted. WeWork and Full Truck Alliance are both SVF1 and SVF2 investments.

2. Source: SBIA Analysis. As of September 30, 2023. Includes portfolio companies that have raised Series E or later rounds, and portfolio companies actively planning to publicly list.

$43.9B

Value of Top 25

Investments4

3. Gross Investment Multiple of Invested Capital ("MOIC") is Gross Realized Proceeds divided by investment cost. Gross Realized Proceeds defined as the sum of all external cash flows and dividends in kind derived from investments, gross of taxes, transaction fees, investment-

related financing and other fund-related expenses. Investment Cost defined as the sum of all external cash flows directed towards Portfolio Companies, dividends reinvested, principal amounts borrowed as directly related to investments, and net premiums paid by SVF1 for

investment-related hedges.

4. Value of Top 25 Investments is the sum of the Unrealized Fair Value of the top 15 private and top 10 public portfolio companies (by fair value) across SVF1, SVF2, and LatAm Funds.

Valuations reflect unrealized and partially realized estimated amounts and should not be construed as indicative of actual or future performance. Such values do not reflect fees and expenses that would reduce the value of returns experienced by Vision Fund investors. There is no

guarantee that historical trends will continue throughout the life of SoftBank Vision Fund 1, SoftBank Vision Fund 2, or the SoftBank LatAm Funds. It should not be assumed that investments made in the future will be comparable in quality or performance to investments described

herein. References to specific investments should not be construed as a recommendation of any particular investment or security. There can be no assurance that unrealized and partially realized investments will be sold for values equal to or in excess of the total values used in

calculating the returns portrayed herein. Actual returns on unrealized and partially realized investments will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing

and manner of sale, all of which may differ from the assumptions on which the valuations reported herein are based. Accordingly, the actual realized returns on investments that are partially realized or unrealized may differ materially from the values indicated herein. Net performance

for the subset of investments described above cannot be calculated without making arbitrary assumptions about allocations of fees and expenses, and for that reason is not included herein. Past performance is not indicative of future results.

22

SoftBank

Investment AdvisersView entire presentation