One Medical SPAC Presentation Deck

lora Health: Business Model

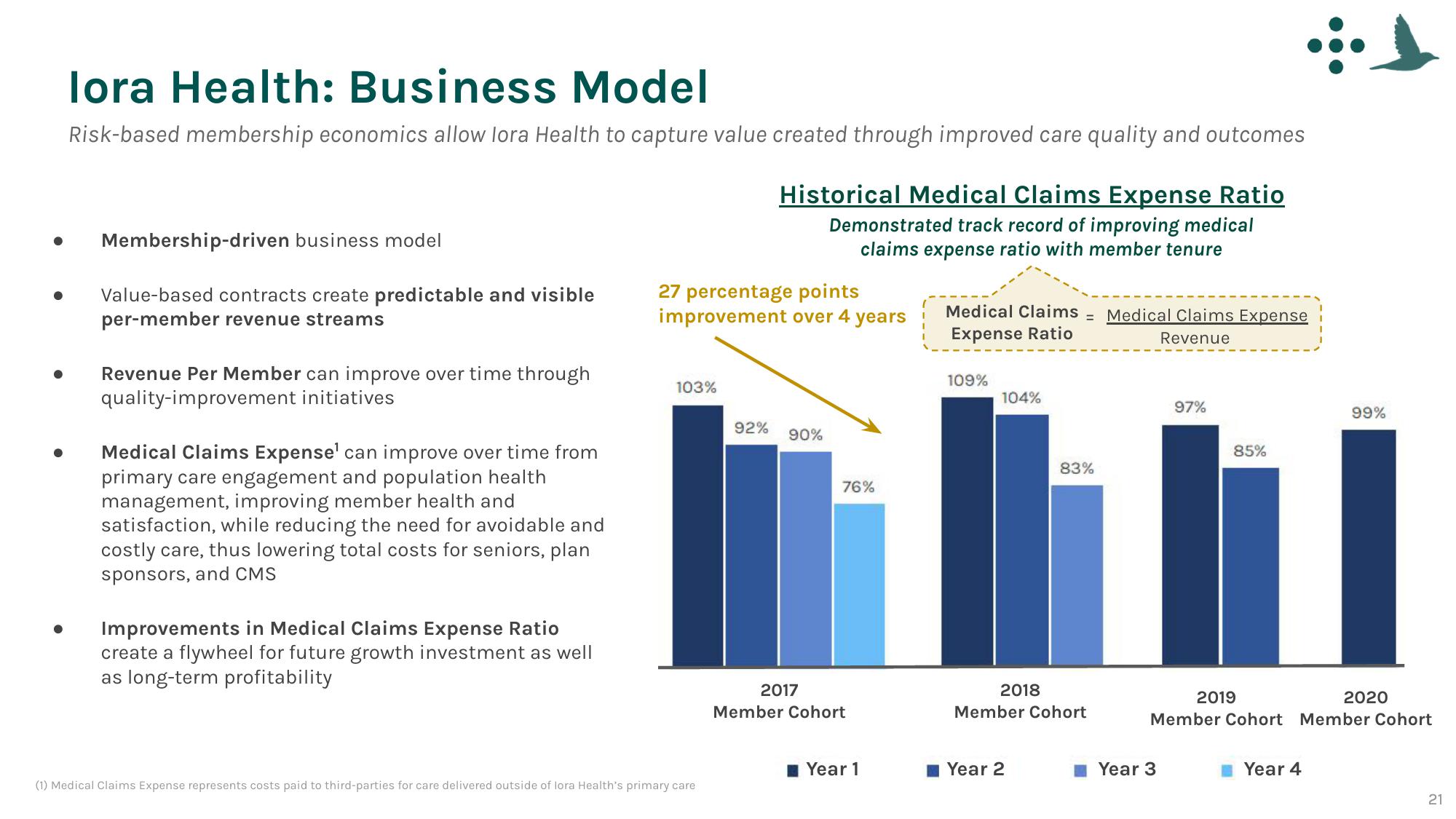

Risk-based membership economics allow lora Health to capture value created through improved care quality and outcomes

● Membership-driven business model

● Value-based contracts create predictable and visible

per-member revenue streams

●

Revenue Per Member can improve over time through

quality-improvement initiatives

Medical Claims Expense¹ can improve over time from

primary care engagement and population health

management, improving member health and

satisfaction, while reducing the need for avoidable and

costly care, thus lowering total costs for seniors, plan

sponsors, and CMS

Improvements in Medical Claims Expense Ratio

create a flywheel for future growth investment as well

as long-term profitability

27 percentage points

improvement over 4 years

103%

(1) Medical Claims Expense represents costs paid to third-parties for care delivered outside of lora Health's primary care

Historical Medical Claims Expense Ratio

Demonstrated track record of improving medical

claims expense ratio with member tenure

92%

90%

2017

76%

Member Cohort

Year 1

Medical Claims

Expense Ratio

109%

104%

2018

=

Year 2

83%

Member Cohort

Medical Claims Expense

Revenue

97%

Year 3

85%

2019

Member Cohort Member Cohort

99%

Year 4

2020

21View entire presentation