Astra SPAC Presentation Deck

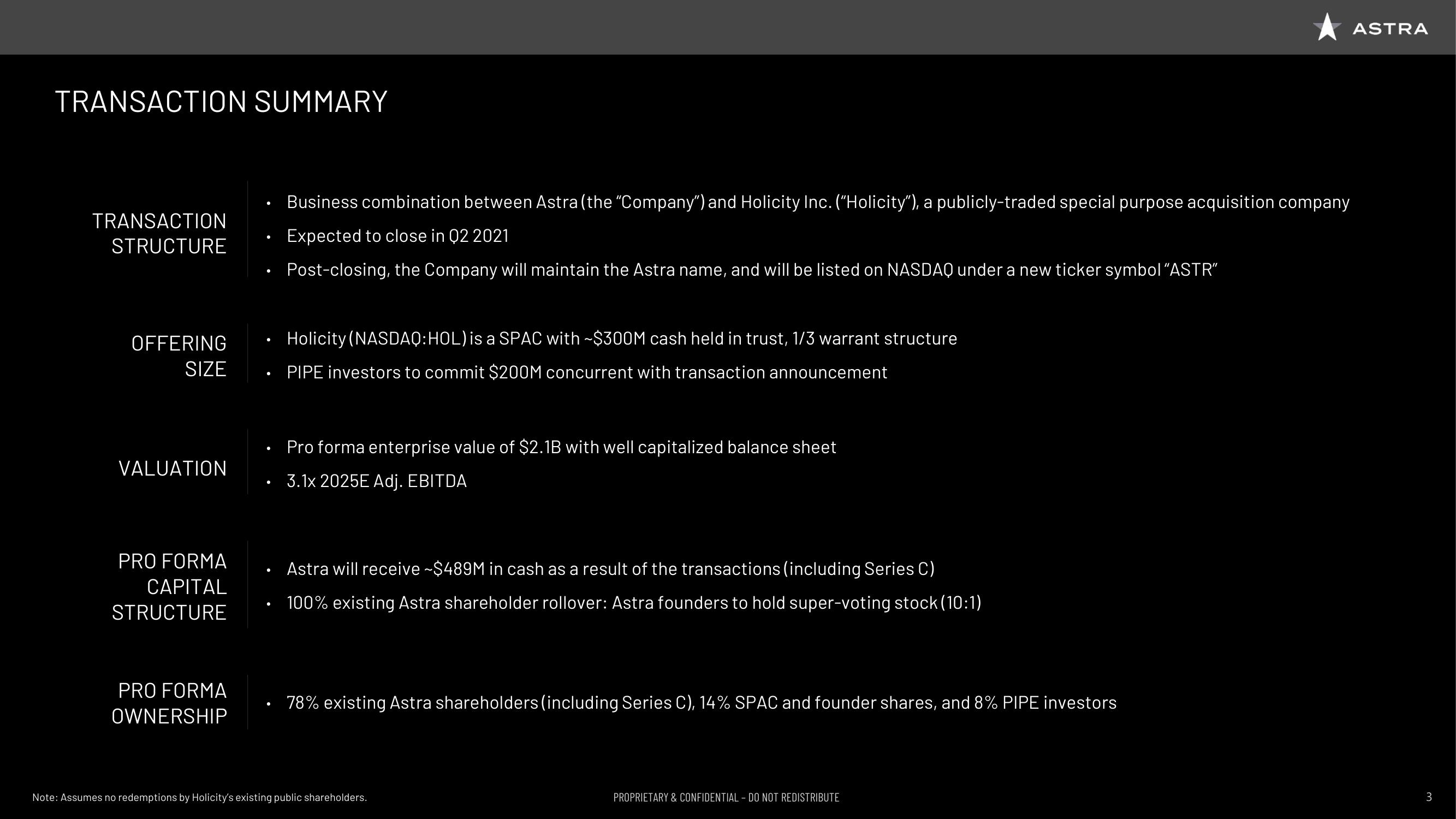

TRANSACTION SUMMARY

TRANSACTION

STRUCTURE

OFFERING

SIZE

VALUATION

PRO FORMA

CAPITAL

STRUCTURE

PRO FORMA

OWNERSHIP

●

●

●

●

●

Business combination between Astra (the "Company") and Holicity Inc. ("Holicity"), a publicly-traded special purpose acquisition company

Expected to close in Q2 2021

Post-closing, the Company will maintain the Astra name, and will be listed on NASDAQ under a new ticker symbol "ASTR"

Holicity (NASDAQ:HOL) is a SPAC with ~$300M cash held in trust, 1/3 warrant structure

PIPE investors to commit $200M concurrent with transaction announcement

Pro forma enterprise value of $2.1B with well capitalized balance sheet

3.1x 2025E Adj. EBITDA

Astra will receive ~$489M in cash as a result of the transactions (including Series C)

100% existing Astra shareholder rollover: Astra founders to hold super-voting stock (10:1)

3% existing Astra shareholders (including Series C), 14% SPAC and founder shares, and 8% PIPE investors

Note: Assumes no redemptions by Holicity's existing public shareholders.

ASTRA

PROPRIETARY & CONFIDENTIAL - DO NOT REDISTRIBUTE

3View entire presentation