Forge SPAC Presentation Deck

■

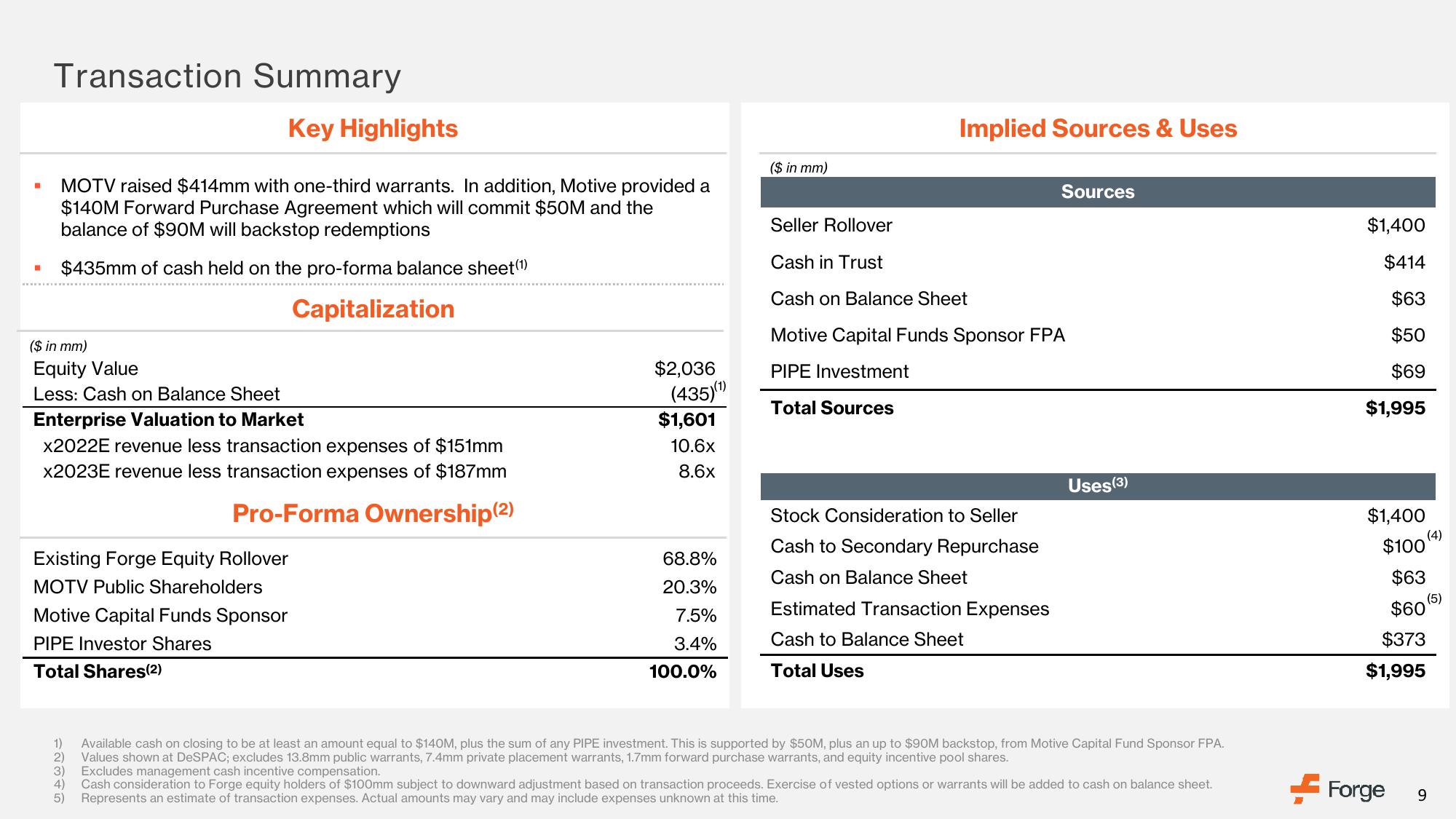

Transaction Summary

MOTV raised $414mm with one-third warrants. In addition, Motive provided a

$140M Forward Purchase Agreement which will commit $50M and the

balance of $90M will backstop redemptions

$435mm of cash held on the pro-forma balance sheet(¹)

Capitalization

($ in mm)

Equity Value

Less: Cash on Balance Sheet

Key Highlights

Enterprise Valuation to Market

x2022E revenue less transaction expenses of $151mm

x2023E revenue less transaction expenses of $187mm

Pro-Forma Ownership (2)

Existing Forge Equity Rollover

MOTV Public Shareholders

Motive Capital Funds Sponsor

PIPE Investor Shares

Total Shares(2)

12445

$2,036

(435)(¹)

$1,601

10.6x

8.6x

68.8%

20.3%

7.5%

3.4%

100.0%

($ in mm)

Implied Sources & Uses

Seller Rollover

Cash in Trust

Cash on Balance Sheet

Motive Capital Funds Sponsor FPA

PIPE Investment

Total Sources

Stock Consideration to Seller

Cash to Secondary Repurchase

Cash on Balance Sheet

Sources

Estimated Transaction Expenses

Cash to Balance Sheet

Total Uses

Uses (3)

Available cash on closing to be at least an amount equal to $140M, plus the sum of any PIPE investment. This is supported by $50M, plus an up to $90M backstop, from Motive Capital Fund Sponsor FPA.

Values shown at DeSPAC; excludes 13.8mm public warrants, 7.4mm private placement warrants, 1.7mm forward purchase warrants, and equity incentive pool shares.

Excludes management cash incentive compensation.

Cash consideration to Forge equity holders of $100mm subject to downward adjustment based on transaction proceeds. Exercise of vested options or warrants will be added to cash on balance sheet.

Represents an estimate of transaction expenses. Actual amounts may vary and may include expenses unknown at this time.

$1,400

$414

$63

$50

$69

$1,995

$1,400

$100

$63

$60

$373

$1,995

Forge

(5)

9View entire presentation