PJT Partners Investment Banking Pitch Book

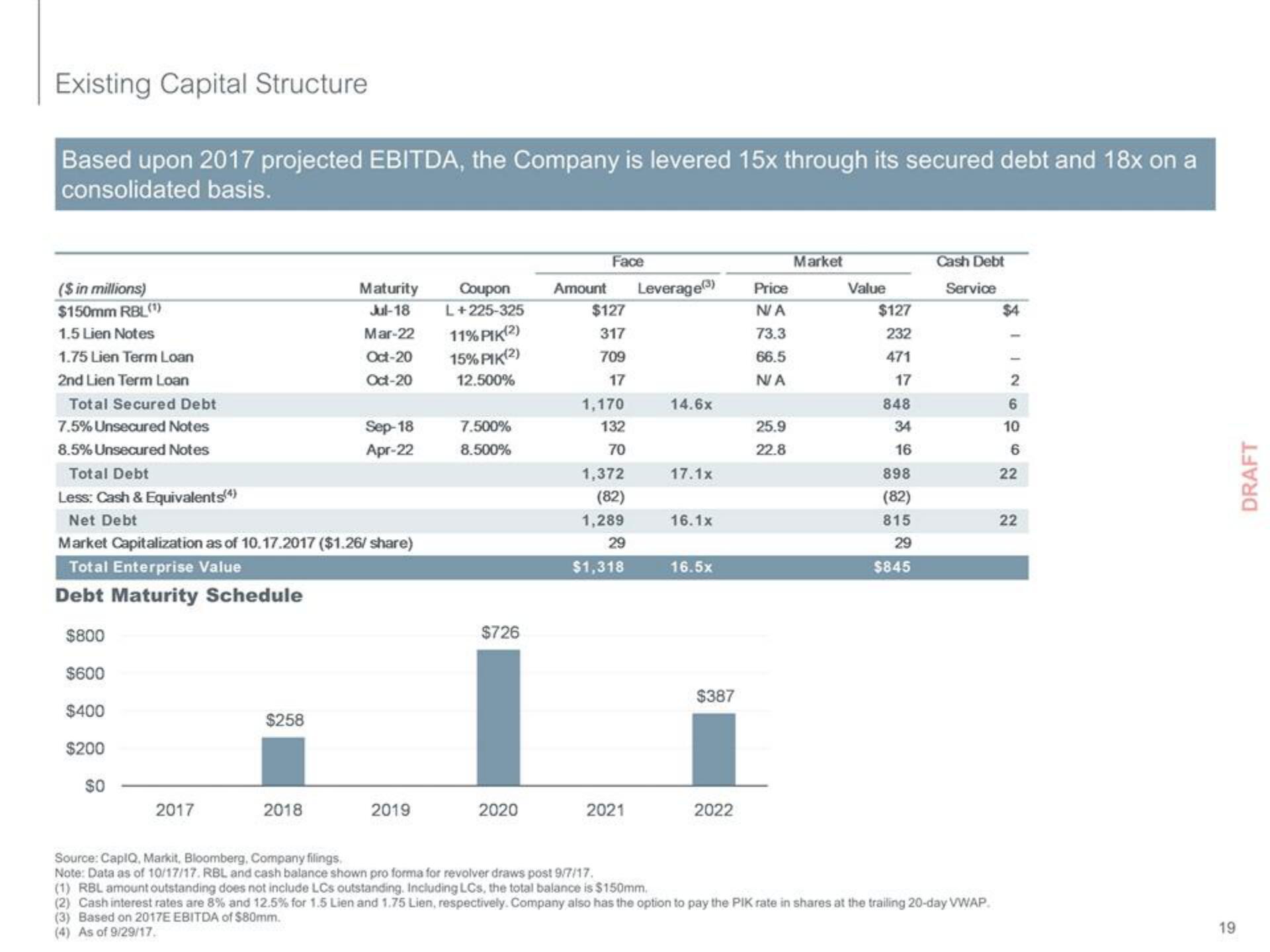

Existing Capital Structure

Based upon 2017 projected EBITDA, the Company is levered 15x through its secured debt and 18x on a

consolidated basis.

($ in millions)

$150mm RBL (¹)

1.5 Lien Notes

1.75 Lien Term Loan

2nd Lien Term Loan

Total Secured Debt

7.5% Unsecured Notes

8.5% Unsecured Notes

Total Debt

Less: Cash & Equivalents(4)

2017

Net Debt

Market Capitalization as of 10.17.2017 ($1.26/share)

Total Enterprise Value

Debt Maturity Schedule

$800

$600

$400

$200

$0

$258

Maturity Coupon

Jul-18

Mar-22

Oct-20

Oct-20

2018

Sep-18

Apr-22

2019

L+225-325

11% PIK(2)

15% PIK(2)

12.500%

7.500%

8.500%

$726

2020

Face

Amount Leverage(3)

$127

317

709

17

1,170

132

70

1,372

(82)

1,289

29

$1,318

2021

Source: CapIQ, Markit, Bloomberg, Company filings,

Note: Data as of 10/17/17. RBL and cash balance shown pro forma for revolver draws post 9/7/17.

14.6x

17.1x

16.1x

16.5x

$387

2022

Price

N/A

73.3

66.5

N/A

25.9

22.8

Market

Value

$127

232

471

17

848

34

16

898

(82)

815

29

$845

Cash Debt

Service

(1) RBL amount outstanding does not include LCs outstanding. Including LCs, the total balance is $150mm.

(2) Cash interest rates are 8% and 12.5% for 1.5 Lien and 1.75 Lien, respectively. Company also has the option to pay the PIK rate in shares at the trailing 20-day VWAP.

(3) Based on 2017E EBITDA of $80mm.

(4) As of 9/29/17.

$4

2

6

10

6

22

22

19

DRAFTView entire presentation