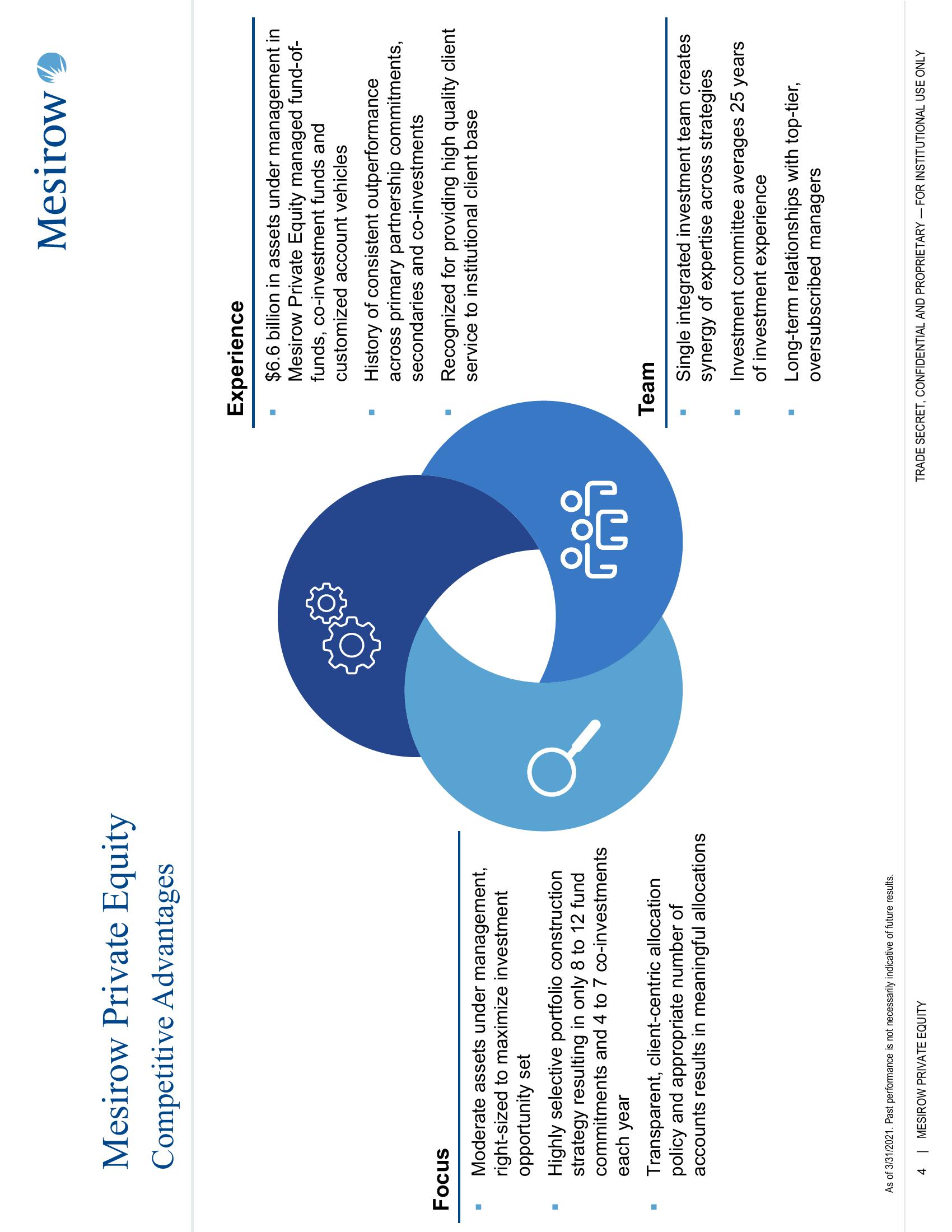

Mesirow Private Equity

Focus

■

Mesirow Private Equity

Competitive Advantages

■

Moderate assets under management,

right-sized to maximize investment

opportunity set

Highly selective portfolio construction

strategy resulting in only 8 to 12 fund

commitments and 4 to 7 co-investments

each year

Transparent, client-centric allocation

policy and appropriate number of

accounts results in meaningful allocations

As of 3/31/2021. Past performance is not necessarily indicative of future results.

4 | MESIROW PRIVATE EQUITY

Experience

$6.6 billion in assets under management in

Mesirow Private Equity managed fund-of-

funds, co-investment funds and

customized account vehicles

■

■

■

Team

■

Mesirow

■

History of consistent outperformance

across primary partnership commitments,

secondaries and co-investments

Recognized for providing high quality client

service to institutional client base

Single integrated investment team creates

synergy of expertise across strategies

Investment committee averages 25 years

of investment experience

Long-term relationships with top-tier,

oversubscribed managers

TRADE SECRET, CONFIDENTIAL AND PROPRIETARY FOR INSTITUTIONAL USE ONLYView entire presentation