Covalto SPAC Presentation Deck

7

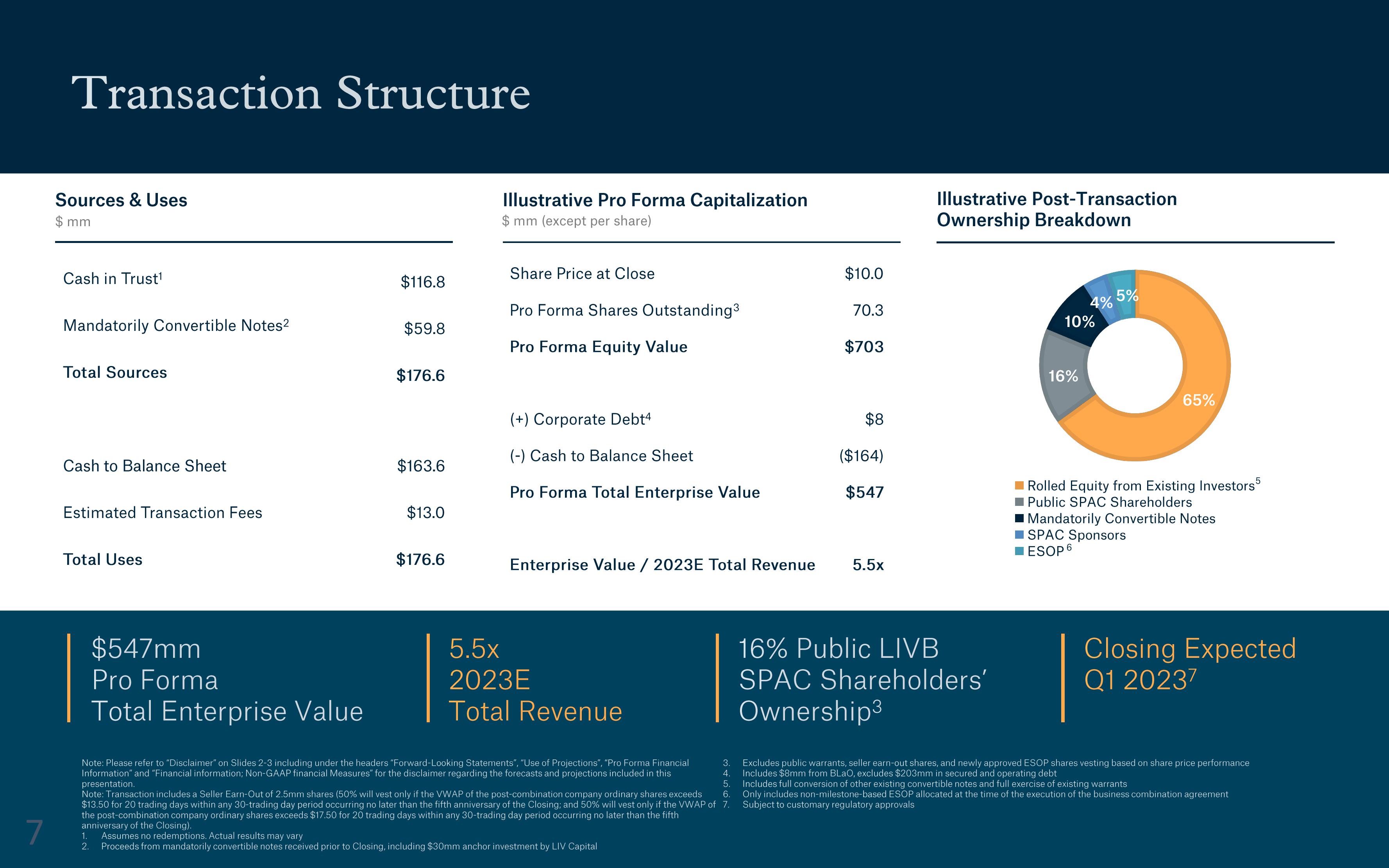

Transaction Structure

Sources & Uses

$mm

Cash in Trust¹

Mandatorily Convertible Notes²

Total Sources

Cash to Balance Sheet

Estimated Transaction Fees

Total Uses

$547mm

Pro Forma

Total Enterprise Value

$116.8

$59.8

$176.6

$163.6

$13.0

$176.6

Illustrative Pro Forma Capitalization

$ mm (except per share)

Share Price at Close

Pro Forma Shares Outstanding³

Pro Forma Equity Value

(+) Corporate Debt4

(-) Cash to Balance Sheet

Pro Forma Total Enterprise Value

5.5x

2023E

Total Revenue

Note: Please refer to "Disclaimer" on Slides 2-3 including under the headers "Forward-Looking Statements", "Use of Projections", "Pro Forma Financial

Information" and "Financial information; Non-GAAP financial Measures" for the disclaimer regarding the forecasts and projections included in this

presentation.

$10.0

70.3

Enterprise Value / 2023E Total Revenue 5.5x

5.

6.

Note: Transaction includes a Seller Earn-Out of 2.5mm shares (50% will vest only if the VWAP of the post-combination company ordinary shares exceeds

$13.50 for 20 trading days within any 30-trading day period occurring no later than the fifth anniversary of the Closing; and 50% will vest only if the VWAP of 7.

the post-combination company ordinary shares exceeds $17.50 for 20 trading days within any 30-trading day period occurring no later than the fifth

anniversary of the Closing).

1.

Assumes no redemptions. Actual results may vary

2. Proceeds from mandatorily convertible notes received prior to Closing, including $30mm anchor investment by LIV Capital

$703

$8

($164)

$547

Illustrative Post-Transaction

Ownership Breakdown

16% Public LIVB

SPAC Shareholders'

Ownership³

4%

10%

16%

5%

65%

Rolled Equity from Existing Investors5

Public SPAC Shareholders

Mandatorily Convertible Notes

SPAC Sponsors

■ESOP 6

Closing Expected

Q1 20237

3. Excludes public warrants, seller earn-out shares, and newly approved ESOP shares vesting based on share price performance

4. Includes $8mm from BLaO, excludes $203mm in secured and operating debt

Includes full conversion of other existing convertible notes and full exercise of existing warrants

Only includes non-milestone-based ESOP allocated at the time of the execution of the business combination agreement

Subject to customary regulatory approvalsView entire presentation