Fiverr Investor Presentation Deck

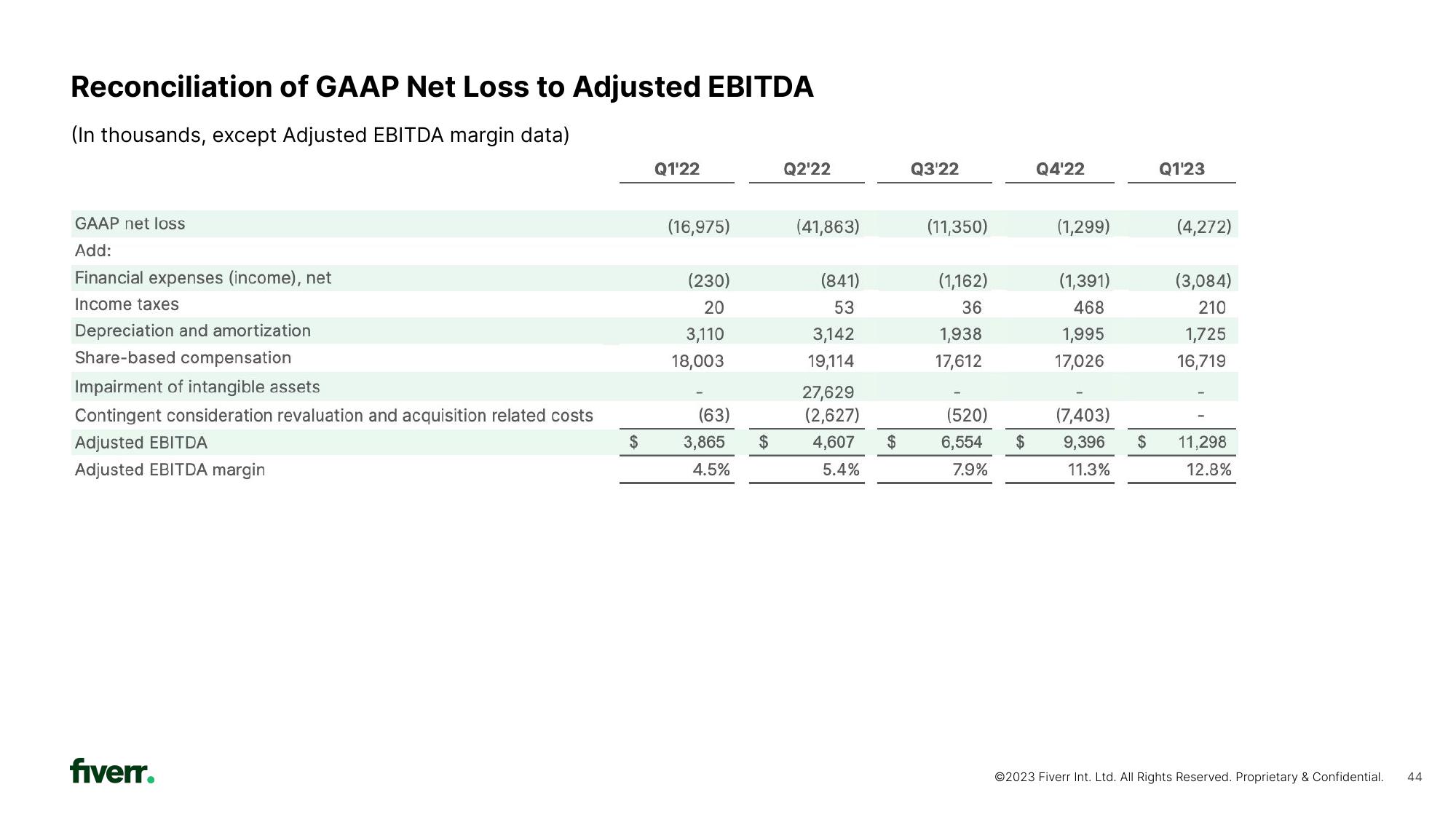

Reconciliation of GAAP Net Loss to Adjusted EBITDA

(In thousands, except Adjusted EBITDA margin data)

GAAP net loss.

Add:

Financial expenses (income), net

Income taxes

Depreciation and amortization

Share-based compensation

Impairment of intangible assets

Contingent consideration revaluation and acquisition related costs

Adjusted EBITDA

Adjusted EBITDA margin

fiverr.

$

Q1'22

(16,975)

(230)

20

3,110

18,003

(63)

3,865

4.5%

$

Q2'22

(41,863)

(841)

53

3,142

19,114

27,629

(2,627)

4,607

5.4%

$

Q3'22

(11,350)

(1,162)

36

1,938

17,612

(520)

6,554

7.9%

$

Q4'22

(1,299)

(1,391)

468

1,995

17,026

(7,403)

9,396

11.3%

$

Q1¹23

(4,272)

(3,084)

210

1,725

16,719

11,298

12.8%

Ⓒ2023 Fiverr Int. Ltd. All Rights Reserved. Proprietary & Confidential.

44View entire presentation