J.P.Morgan Investment Banking

APPENDIX

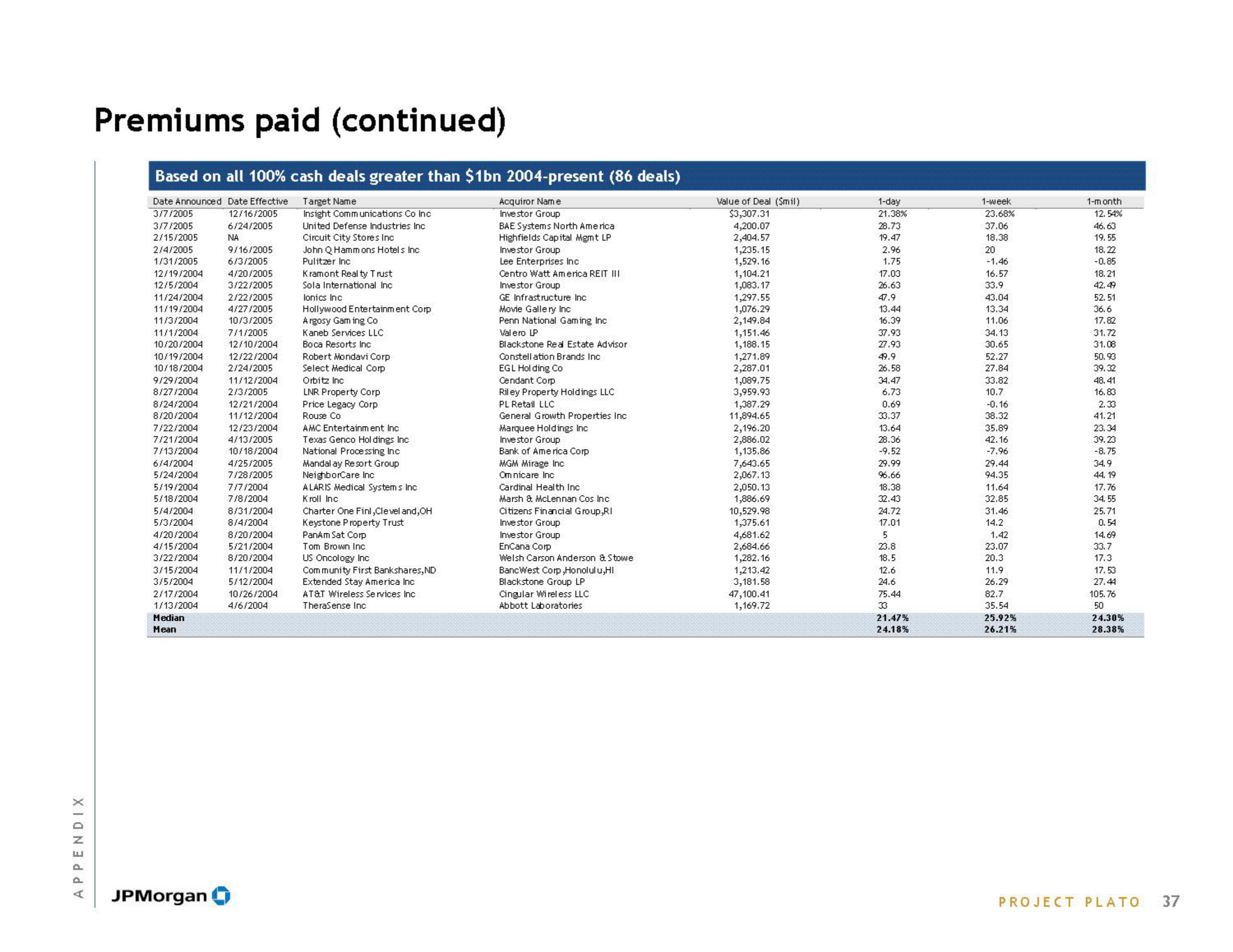

Premiums paid (continued)

Based on all 100% cash deals greater than $1bn 2004-present (86 deals)

Target Name

Acquiror Name

Investor Group

Insight Communications Co Inc

United Defense Industries Inc

Circuit City Stores Inc

Date Announced Date Effective

3/7/2005

12/16/2005

3/7/2005

6/24/2005

2/15/2005

NA

2/4/2005

1/31/2005

12/19/2004

12/5/2

11/24/2004

11/19/2004

11/3/2004

11/1/2004

10/20/2004

10/19/2004

10/18/2004

9/29/2004

8/27/2004

8/24/2004

8/20/2004

7/22/2004

7/21/2004

7/13/2004

6/4/2004

5/24/2004

5/19/2004

5/18/2004

5/4/2004

5/3/2004

4/20/2004

4/15/2004

3/22/2004

3/15/2004

3/5/2004

2/17/2004

1/13/2004

Median

Mean

JPMorgan

9/16/2005

6/3/2005

4/20/2005

2/22/2005

4/27/2005

10/3/2005

7/1/2005

12/10/2004

12/22/2004

2/24/2005

11/12/2004

2/3/2005

12/21/2004

11/12/2004

12/23/2004

4/13/2005

10/18/2004

4/25/2005

7/28/2005

7/7/2004

7/8/2004

8/31/2004

8/4/2004

8/20/2004

5/21/2004

8/20/2004

11/1/2004

5/12/2004

10/26/2004

4/6/2004

John Q Hamm ons Hotels Inc

Pulitzer Inc

Kramont Realty Trust

Sola International

lonics Inc

Hollywood Entertainment Corp

Argosy Gaming Co

Kaneb Services LLC

Boca Resorts Inc

Robert Mondavi Corp

Select Medical Corp

Orbitz Inc

LNR Property Corp

Price Legacy Corp

Rouse Co

AMC Entertainment Inc

Texas Genco Holdings Inc

National Processing Inc

Mandalay Resort Group

NeighborCare Inc

A LARIS Medical Systems Inc

Kroll Inc

Charter One Finl,Cleveland, OH

Keystone Property Trust

PanAm Sat Corp

Tom Brown Inc.

US Oncology Inc

Community First Bankshares, ND

Extended Stay America Inc

AT&T Wireless Services Inc

TheraSense Inc

BAE Systems North America

Highfields Capital Mgmt LP

Investor Group

Lee Enterprises Inc

Centro Watt America REIT III

Investor Group

GE Infrastructure Inc

Movie Gallery Inc

Penn National Gaming Inc

Valero LP

Blackstone Real Estate Advisor

Constellation Brands Inc

EGL Holding Co

Cendant Corp

Riley Property Holdings LLC

PL Retail LLC

General Growth Properties Inc

Marquee Holdings Inc

Investor Group

Bank of America Corp

MGM Mirage Inc

Om nicare Inc

Cardinal Health Inc

Marsh & McLennan Cos Inc

Citizens Financial Group,RI

Investor Group

Investor Group

EnCana Corp

Welsh Carson Anderson & Stowe

BancWest Corp,Honolulu, HI

Blackstone Group LP

Cingular Wireless LLC

Abbott Laboratories

Value of Deal (Smil)

$3,307.31

4,200.07

2,404.57

1,235.15

1,529.16

1,104.21

1,083.17

1,297.55

1,076.29

2,149.84

1,151.46

1,188.15

1,271.89

2,287.01

1,089.75

3,959.93

1,387.29

11,894.65

2,196.20

2,886.02

1,135.86

7,643.65

2,067.13

2,050.13

1,886.69

10,529.98

1,375.61

4,681.62

2,684.66

1,282.16

1,213.42

3,181.58

47,100.41

1,169.72

1-day

21.38%

28.73

19.47

2.96

1.75

17.03

26.63

47.9

13.44

16.39

37.93

27.93

49.9

26.58

34.47

6.73

0.69

33.37

13.64

28.36

-9.52

29.99

96.66

18.38

32.43

24.72

17.01

5

23.8

18.5

12.6

24.6

75.44

33

21.47%

24.18%

1-week

23.68%

37.06

18.38

20

-1.46

16.57

33.9

43.04

13.34

11.06

34.13

30.65

52.27

27.84

33.82

10.7

-0.16

38.32

35.89

42.16

-7.96

29.44

94.35

11.64

32.85

31.46

14.2

1.42

23.07

20.3

11.9

26.29

82.7

35.54

25.92%

26.21%

1-month

12.54%

46.63

19.55

18.22

-0.85

18.21

42.49

52.51

36.6

17.82

31.72

31.08

50.93

39.32

48.41

16.83

2.33

41.21

23.34

39.23

-8.75

34.9

44. 19

17.76

34.55

25.71

0.54

14.69

33.7

17.3

17.53

27.44

105.76

50

24.30%

28.38%

PROJECT PLATO

37View entire presentation