Kinnevik Results Presentation Deck

WE CONTINUE TO STRENGTHEN AND BUILD OUT OUR GROWTH PORTFOLIO,

ADDING THREE NEW COMPANIES

3

omnipresent

Safety Wing

Transcarent

Agreena

LUNAR® Common

joint academy

Market

environment

DİVERSİTY VC

Note:

Highlights of The Quarter

Q1 2022

We doubled-down on our investment theme 'the future of work' through

two new investments - Omnipresent, a SaaS-based employment partner,

and SafetyWing, a workforce insurance provider

Transcarent, the first comprehensive health and care experience company

for self-insured employers, was added to the portfolio

We led a funding round in Agreena, supporting farmers' transition to

regenerative agriculture practices through the voluntary carbon market

Follow-on investments were concluded in Lunar, Common and Joint

Academy

Private market valuations are increasingly coming in line with public

market levels, putting short-term pressure on our net asset value but

creating long-term opportunities as the pendulum shifts in favor of active,

hands-on investors with long investment horizons

Kinnevik ranked first in the VC category of Equality Group's "Equality,

Diversity and Inclusion 2022 Private Equity & Venture Capital Index"

Net Asset Value pro forma Zalando and adjusted for Other Net Assets/Liabilities. A more detailed breakdown of NAV can be found on p. 13

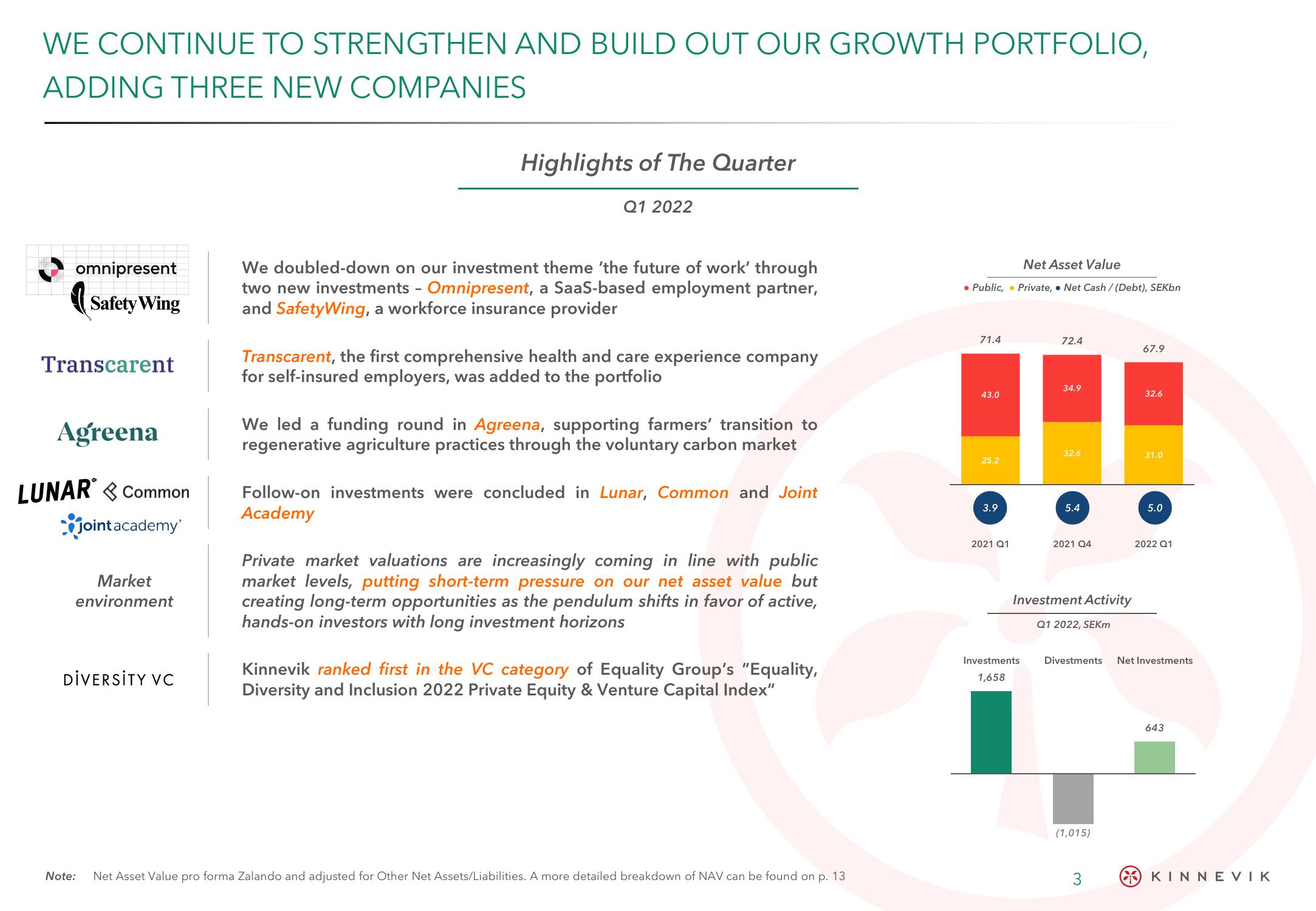

Net Asset Value

• Public, Private, Net Cash / (Debt), SEKbn

71.4

43.0

25.2

3.9

2021 Q1

72.4

Investments

1,658

34.9

32.6

5.4

2021 Q4

Investment Activity

Q1 2022, SEKM

Divestments

(1,015)

3

67.9

32.6

31.0

5.0

2022 Q1

Net Investments

643

KINNEVIKView entire presentation