SatixFy Investor Presentation Deck

Transaction Overview

#

.

■ PIPE includes non-dilutive downside protection to $6.50 per share via a share transfer from SPAC

Sponsor and SatixFy Rollover Equity

Downside protection measured based on average VWAP for the 30 consecutive trading days

immediately preceding the date that is 60 days following registration of the shares

.

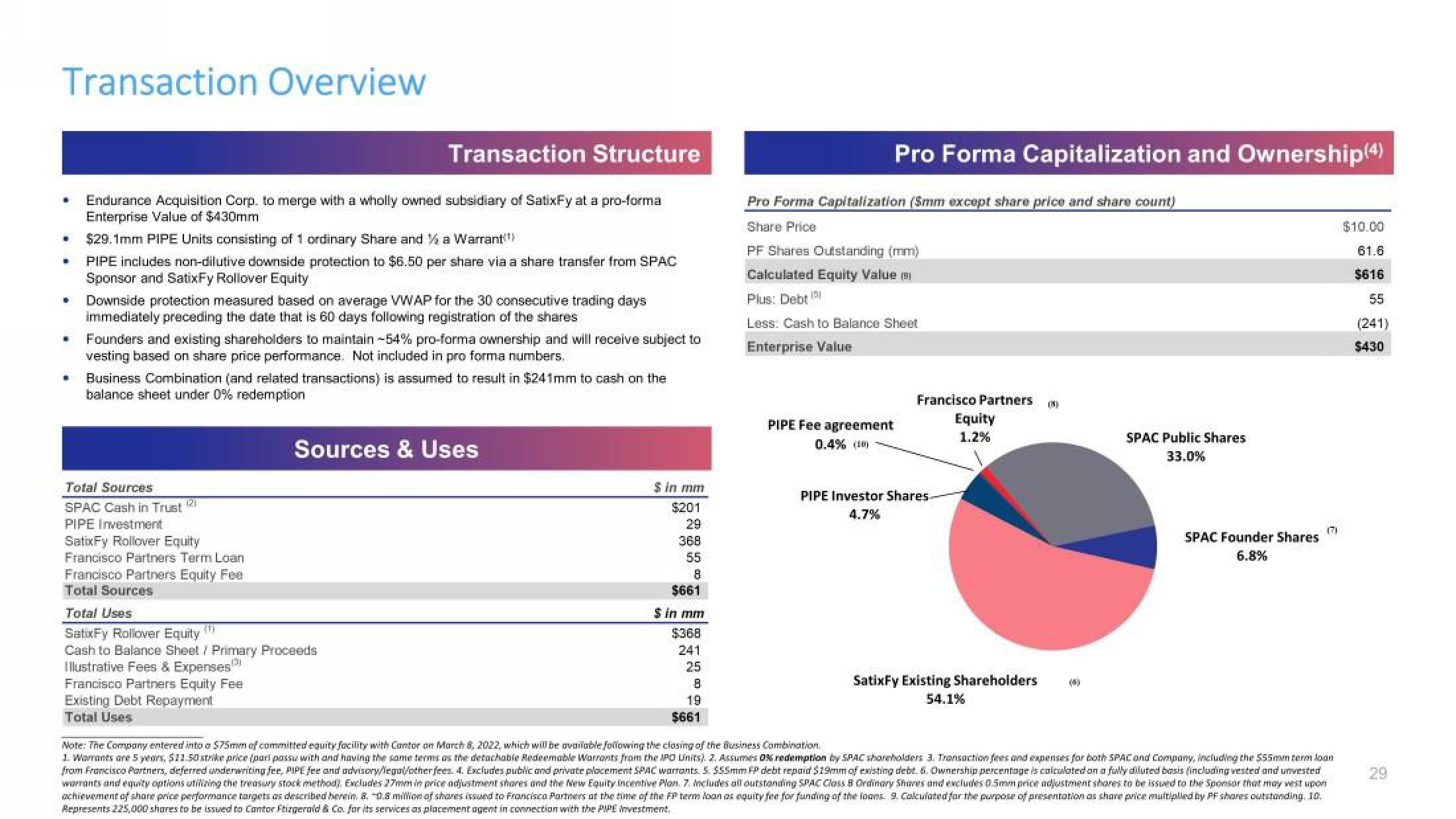

Transaction Structure

Endurance Acquisition Corp. to merge with a wholly owned subsidiary of SatixFy at a pro-forma

Enterprise Value of $430mm

$29.1mm PIPE Units consisting of 1 ordinary Share and a Warrant

.

Founders and existing shareholders to maintain -54% pro-forma ownership and will receive subject to

vesting based on share price performance. Not included in pro forma numbers.

Business Combination (and related transactions) is assumed to result in $241mm to cash on the

balance sheet under 0% redemption

Total Sources

SPAC Cash in Trust

PIPE Investment

SatixFy Rollover Equity

Francisco Partners Term Loan

Francisco Partners Equity Fee

Total Sources

Sources & Uses

Total Uses

(1)

SatixFy Rollover Equity

Cash to Balance Sheet / Primary Proceeds

Illustrative Fees & Expenses

Francisco Partners Equity Fee

Existing Debt Repayment

Total Uses

$ in mm

$201

29

368

55

8

$661

$ in mm

$368

241

25

8

19

$661

Pro Forma Capitalization and Ownership(4)

Pro Forma Capitalization (Smm except share price and share count)

Share Price

PF Shares Outstanding (mm)

Calculated Equity Value

Plus: Debt

Less: Cash to Balance Sheet

Enterprise Value

PIPE Fee agreement

0.4% (

Francisco Partners (8)

PIPE Investor Shares-

4.7%

Equity

1.2%

SatixFy Existing Shareholders

54.1%

SPAC Public Shares

33.0%

SPAC Founder Shares

6.8%

(7)

Note: The Company entered into a $75mm of committed equity facility with Contor on March 8, 2022, which will be available following the closing of the Business Combination.

1. Warrants are 5 years, $11.50 strike price (pari passu with and having the same terms as the detachable Redeemable Warrants from the IPO Units). 2. Assumes 0% redemption by SPAC shareholders 3. Transaction fees and expenses for both SPAC and Company, including the $55mm term loan

from Francisco Partners, deferred underwriting fee, PIPE fee and advisory/legal/otherfees. 4. Excludes public and private placement SPAC warrants. S. $55mm FP debt repaid $19mm of existing debt. 6. Ownership percentage is calculated on a fully diluted basis (including vested and unvested

warrants and equity options utilizing the treasury stock method). Excludes 27mm in price adjustment stores and the New Equity Incentive Plon. 7. Includes all outstanding SPAC Class B Ordinary Shares and excludes 0.5mm price adjustment shores to be issued to the Sponsor that may west upon

achievement of share price performance targets as described herein. 8. 0.8 million of shares issued to Francisco Partners at the time of the FP term loan as equity fee for funding of the loans. 9. Calculated for the purpose of presentation as share price multiplied by PF shares outstanding, 10.

Represents 225,000 shares to be issued to Cantor Ftizgerald & Co. for its services as placement agent in connection with the PIPE investment.

$10.00

61.6

$616

55

(241)

$430

29View entire presentation