T-Mobile Investor Day Presentation Deck

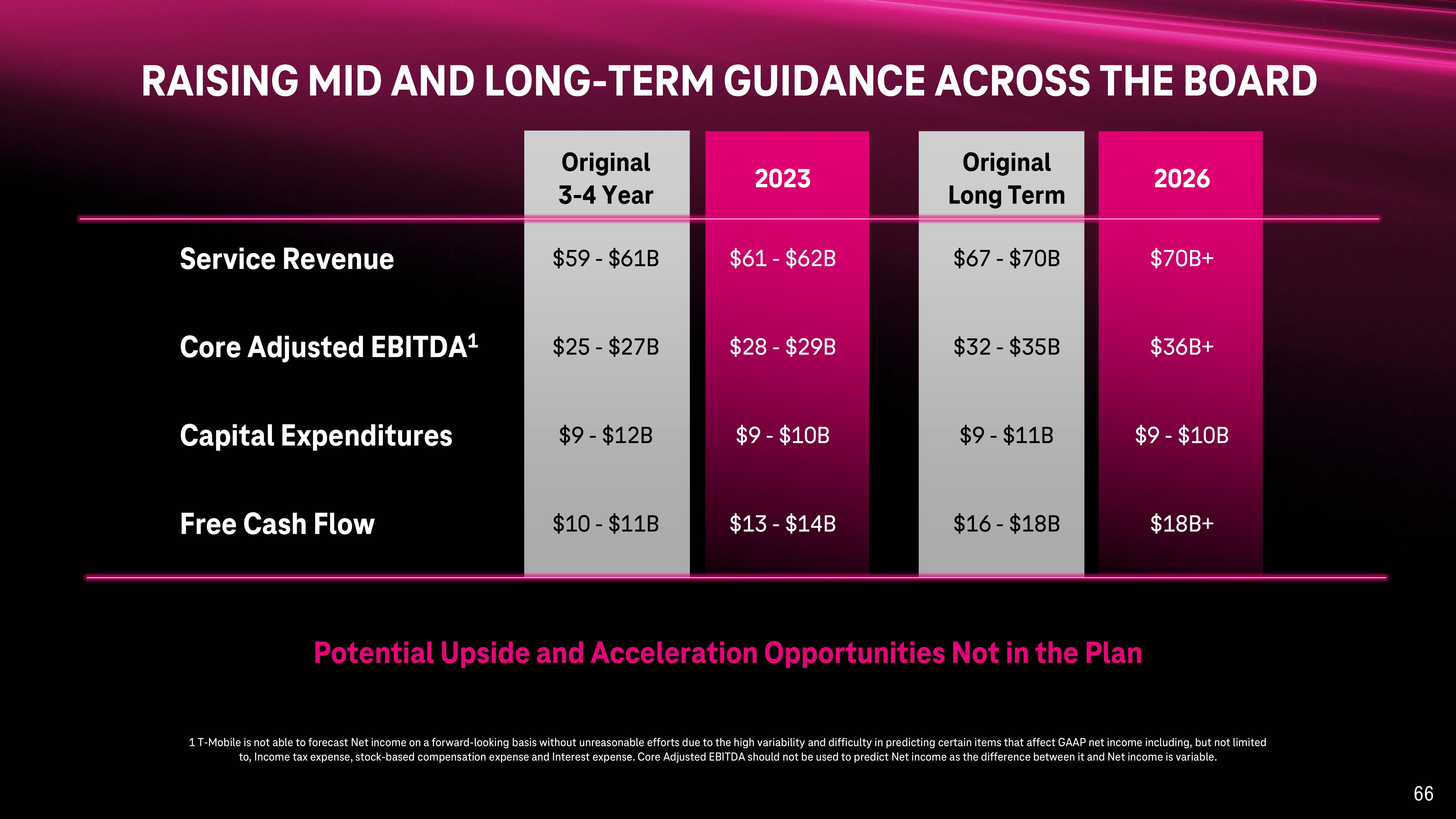

RAISING MID AND LONG-TERM GUIDANCE ACROSS THE BOARD

Original

3-4 Year

Original

Long Term

Service Revenue

Core Adjusted EBITDA¹

Capital Expenditures

Free Cash Flow

$59- $61B

$25 - $27B

$9 - $12B

$10-$11B

2023

$61 - $62B

$28-$29B

$9 - $10B

$13-$14B

$67 - $70B

$32- $35B

$9 - $11B

$16-$18B

2026

Potential Upside and Acceleration Opportunities Not in the Plan

$70B+

$36B+

$9 - $10B

$18B+

1 T-Mobile is not able to forecast Net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP net income including, but not limited

to, Income tax expense, stock-based compensation expense and Interest expense. Core Adjusted EBITDA should not be used to predict Net income as the difference between it and Net income is variable.

66View entire presentation