Greenlight Company Presentation

Large On-Going Share Repurchases

Lower Share Count Drives Accelerated Earnings Growth

Net income before repurchases

Shares outstanding before repurchase

EPS before repurchase

Repurchases

Average repurchase price per share

Shares repurchased (millions)

% Outstanding shares

Pro forma net income

Pro forma shares outstanding (millions)

Pro forma EPS

% Accretion

Greenlight Capital, Inc.

2013

$42.5 B

945

$45

$16.7 B

$525

32

3%

$42.5 B

913

$47

3%

2014

$48.5 B

945

$51

$39.5 B

$604

65

7%

$46.8 B

848

$55

8%

2015

$ 52.8 B

945

$56

$38.0 B

$694

55

6%

$45.8 B

793

$58

3%

25

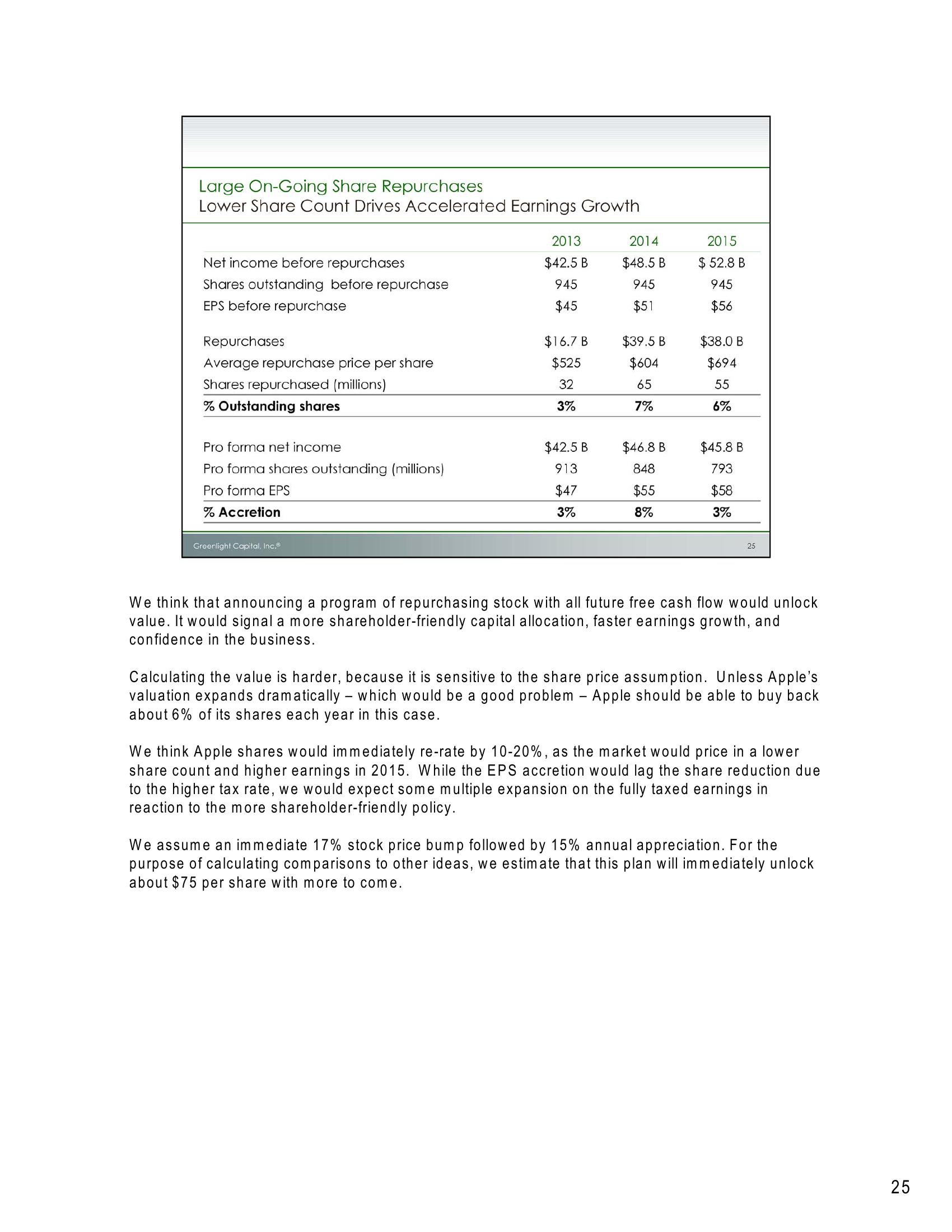

We think that announcing a program of repurchasing stock with all future free cash flow would unlock

value. It would signal a more shareholder-friendly capital allocation, faster earnings growth, and

confidence in the business.

Calculating the value is harder, because it is sensitive to the share price assumption. Unless Apple's

valuation expands dramatically - which would be a good problem - Apple should be able to buy back

about 6% of its shares each year in this case.

We think Apple shares would immediately re-rate by 10-20%, as the market would price in a lower

share count and higher earnings in 2015. While the EPS accretion would lag the share reduction due

to the higher tax rate, we would expect some multiple expansion on the fully taxed earnings in

reaction to the more shareholder-friendly policy.

We assume an immediate 17% stock price bump followed by 15% annual appreciation. For the

purpose of calculating comparisons to other ideas, we estimate that this plan will immediately unlock

about $75 per share with more to come.

25View entire presentation