Docebo Investor Presentation Deck

METRIC

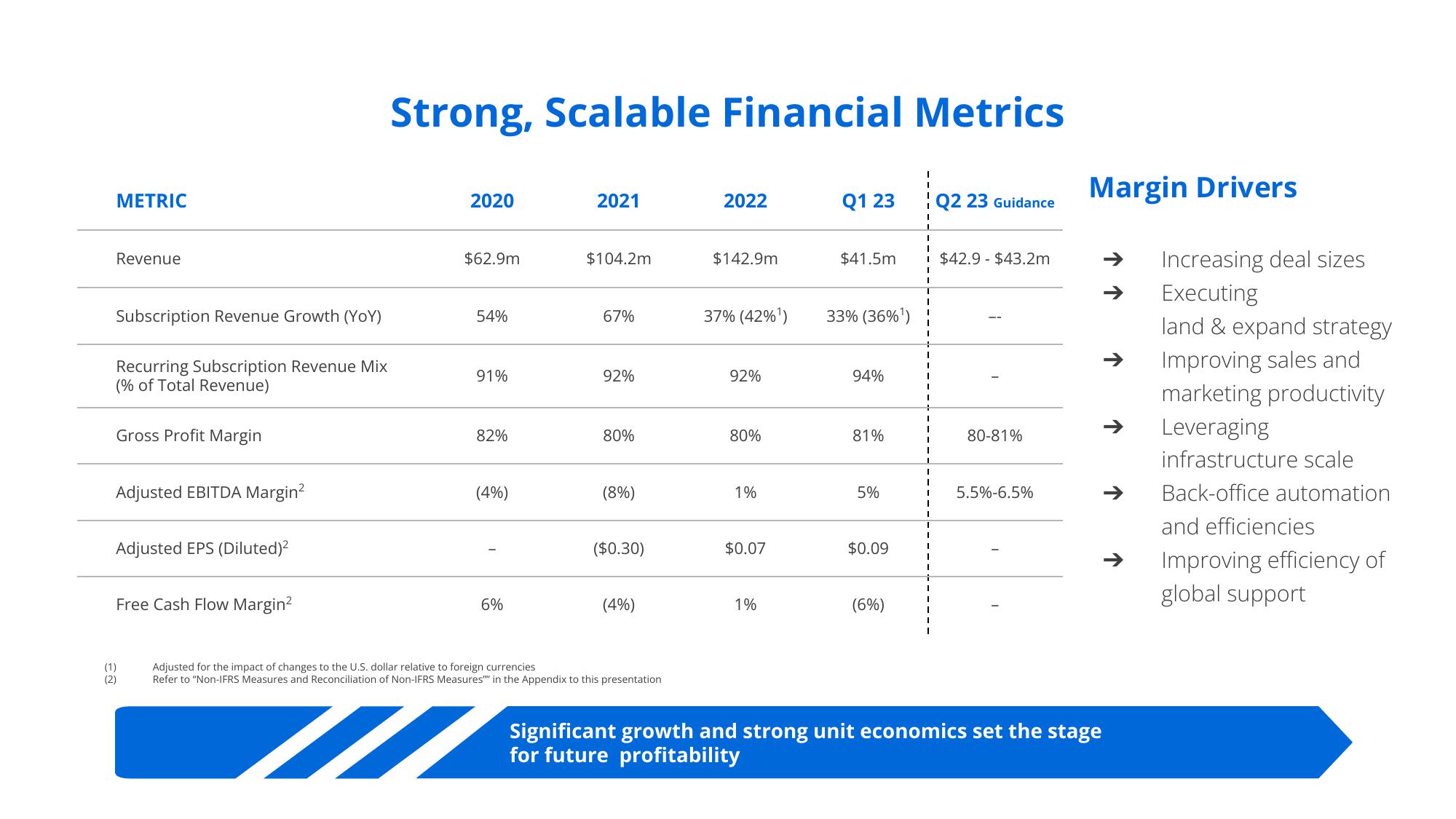

Revenue

Subscription Revenue Growth (YoY)

Recurring Subscription Revenue Mix

(% of Total Revenue)

Gross Profit Margin

Adjusted EBITDA Margin²

Adjusted EPS (Diluted)²

Free Cash Flow Margin²

(1)

(2)

Strong, Scalable Financial Metrics

2020

$62.9m

54%

91%

82%

(4%)

6%

2021

$104.2m

67%

92%

80%

(8%)

($0.30)

(4%)

Adjusted for the impact of changes to the U.S. dollar relative to foreign currencies

Refer to "Non-IFRS Measures and Reconciliation of Non-IFRS Measures in the Appendix to this presentation

M

2022

$142.9m

37% (42%¹)

92%

80%

1%

$0.07

1%

Q1 23

33% (36%¹)

94%

$41.5m i $42.9 $43.2m

81%

5%

$0.09

I

(6%)

I

I

Q2 23 Guidance

I

80-81%

5.5%-6.5%

Margin Drivers

Significant growth and strong unit economics set the stage

for future profitability

↑

→

Increasing deal sizes

Executing

land & expand strategy

Improving sales and

marketing productivity

Leveraging

infrastructure scale

Back-office automation

and efficiencies

Improving efficiency of

global supportView entire presentation