Navitas SPAC Presentation Deck

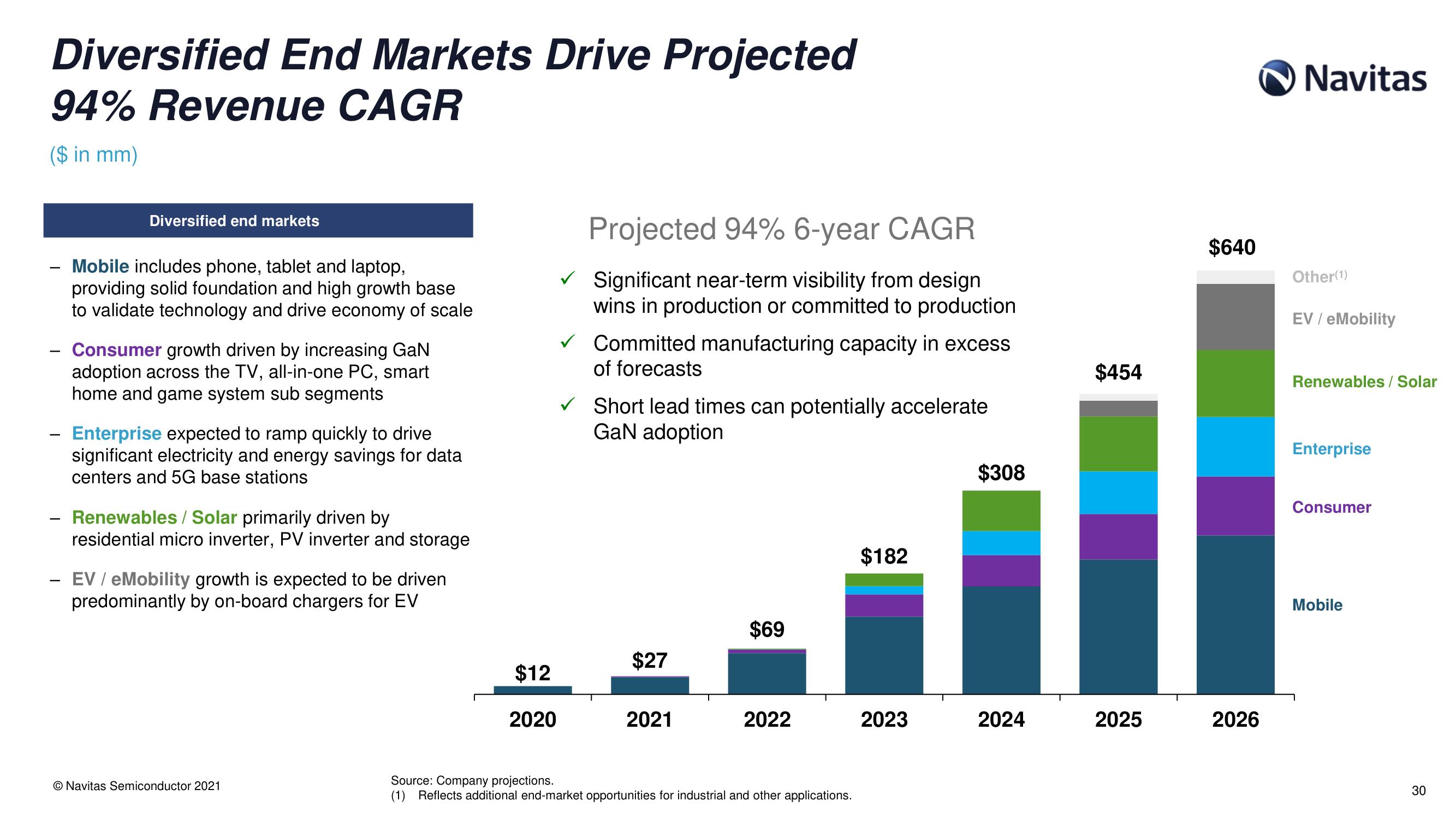

Diversified End Markets Drive Projected

94% Revenue CAGR

($ in mm)

-

Diversified end markets

Mobile includes phone, tablet and laptop,

providing solid foundation and high growth base

to validate technology and drive economy of scale

Consumer growth driven by increasing GaN

adoption across the TV, all-in-one PC, smart

home and game system sub segments

Enterprise expected to ramp quickly to drive

significant electricity and energy savings for data

centers and 5G base stations

Renewables/ Solar primarily driven by

residential micro inverter, PV inverter and storage

EV / eMobility growth is expected to be driven

predominantly by on-board chargers for EV

O Navitas Semiconductor 2021

$12

2020

Projected 94% 6-year CAGR

✓ Significant near-term visibility from design

wins in production or committed to production

Committed manufacturing capacity in excess

of forecasts

✓ Short lead times can potentially accelerate

GaN adoption

$27

2021

$69

2022

Source: Company projections.

(1) Reflects additional end-market opportunities for industrial and other applications.

$182

2023

$308

2024

$454

2025

$640

2026

Navitas

Other (1)

EV / eMobility

Renewables / Solar

Enterprise

Consumer

Mobile

30View entire presentation