Altus Power Investor Presentation Deck

Non-GAAP

Reconciliation

ALTUSPOWER

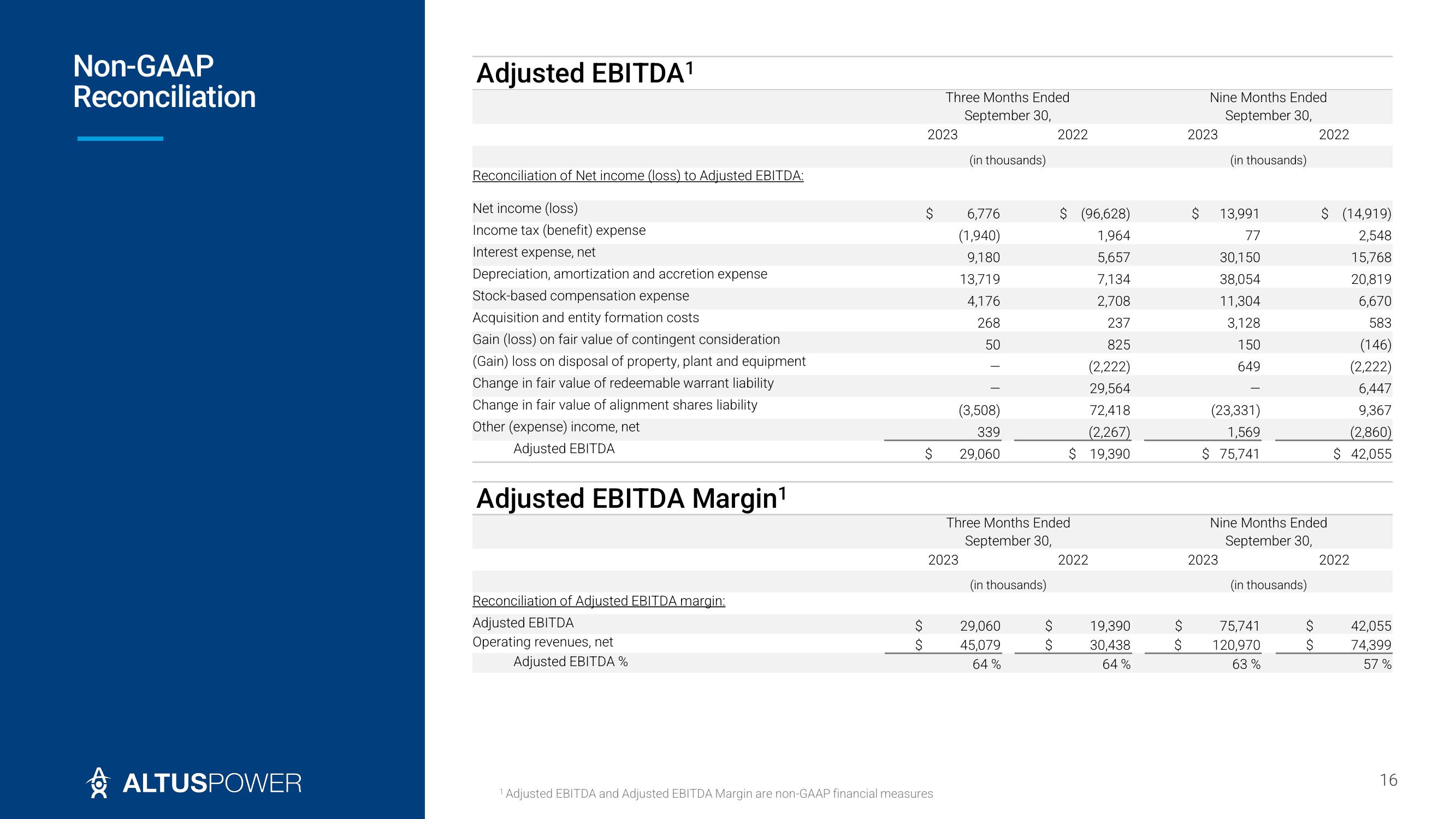

Adjusted EBITDA¹

Reconciliation of Net income (loss) to Adjusted EBITDA:

Net income (loss)

Income tax (benefit) expense

Interest expense, net

Depreciation, amortization and accretion expense

Stock-based compensation expense

Acquisition and entity formation costs

Gain (loss) on fair value of contingent consideration

(Gain) loss on disposal of property, plant and equipment

Change in fair value of redeemable warrant liability

Change in fair value of alignment shares liability

Other (expense) income, net

Adjusted EBITDA

Adjusted EBITDA Margin¹

Reconciliation of Adjusted EBITDA margin:

Adjusted EBITDA

Operating revenues, net

Adjusted EBITDA %

$

$

2023

$

Three Months Ended

September 30,

1 Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures

(in thousands)

6,776

(1,940)

9,180

13,719

4,176

268

50

(3,508)

339

29,060

2023

Three Months Ended

September 30,

(in thousands)

29,060

45,079

64%

$

$

2022

es es

$ (96,628)

1,964

5,657

7,134

2,708

237

825

(2,222)

29,564

72,418

(2,267)

$ 19,390

2022

19,390

30,438

64%

$

$

Nine Months Ended

September 30,

2023

(in thousands)

13,991

77

30,150

38,054

11,304

3,128

150

649

(23,331)

1,569

$ 75,741

2023

Nine Months Ended

September 30,

(in thousands)

75,741

120,970

63%

2022

$

$

$ (14,919)

2,548

15,768

20,819

6,670

583

(146)

(2,222)

6,447

9,367

(2,860)

$ 42,055

2022

42,055

74,399

57 %

16View entire presentation