Brivo SPAC Presentation Deck

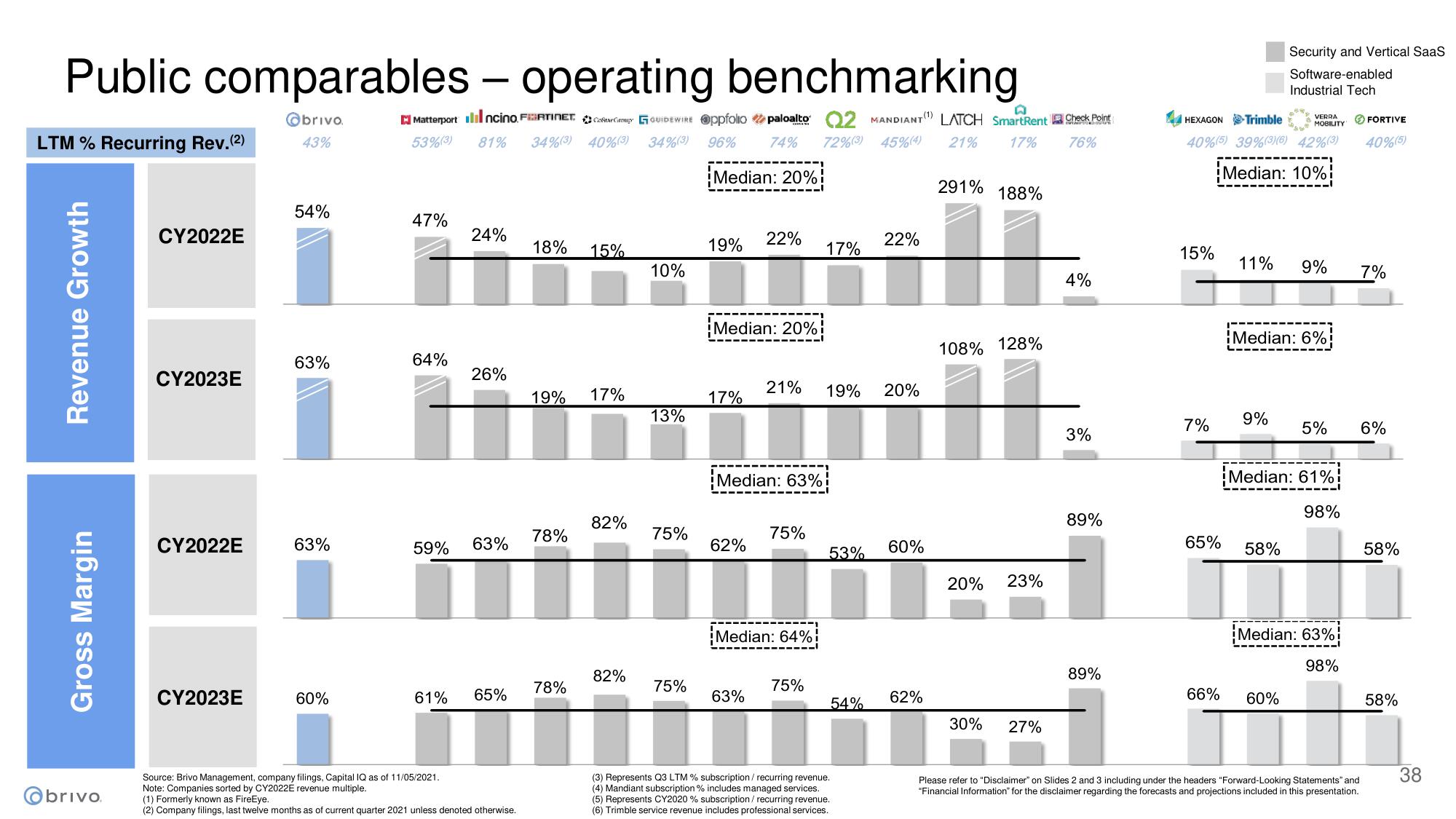

Public comparables - operating benchmarking

Matterport Ilincino. FIRTINET.Com GUIDEWIRE Oppfolio paloalto 2 MANDIANT(1) LATCH SmartRent Check Point

53% (3) 81% 34% (3) 40% (3) 34% (3) 96% 74% 72%(3) 45%(4) 21% 17% 76%

LTM % Recurring Rev. (²)

Median: 20%

291% 188%

Revenue Growth

Gross Margin

Obrivo

CY2022E

CY2023E

CY2022E

CY2023E

@brivo.

43%

54%

63%

47%

60%

64%

24%

26%

59% 63%

61% 65%

18%

Source: Brivo Management, company filings, Capital IQ as of 11/05/2021.

Note: Companies sorted by CY2022E revenue multiple.

(1) Formerly known as FireEye.

(2) Company filings, last twelve months as of current quarter 2021 unless denoted otherwise.

19%

78%

15%

78%

17%

82%

10%

82%

13%

19%

75%

Median: 20%

17%

22%

63%

21%

17%

75%

19%

54%

22%

(3) Represents Q3 LTM % subscription/ recurring revenue.

(4) Mandiant subscription % includes managed services.

(5) Represents CY2020 % subscription / recurring revenue.

(6) Trimble service revenue includes professional services.

20%

60%

108% 128%

11

62%

Median: 61%!

Median: 63%!

98%

75%

75%

65%

63%

62%

53%

58%

i miitid:=1 nh

Median: 64%!

Median: 63%!

98%

20%

23%

4%

30% 27%

3%

89%

HEXAGON-Trimble

89%

15%

40%(5) 39%(3)(6) 42%(3)

Median: 10%!

7%

11%

66%

Security and Vertical SaaS

Software-enabled

Industrial Tech

9%

VERRA

MORE IT

MOBILITY

Median: 6%

60%

9%

5%

FORTIVE

40%(5)

Please refer to "Disclaimer" on Slides 2 and 3 including under the headers "Forward-Looking Statements and

"Financial Information for the disclaimer regarding the forecasts and projections included in this presentation.

7%

6%

58%

58%

38View entire presentation