Antero Midstream Partners Mergers and Acquisitions Presentation Deck

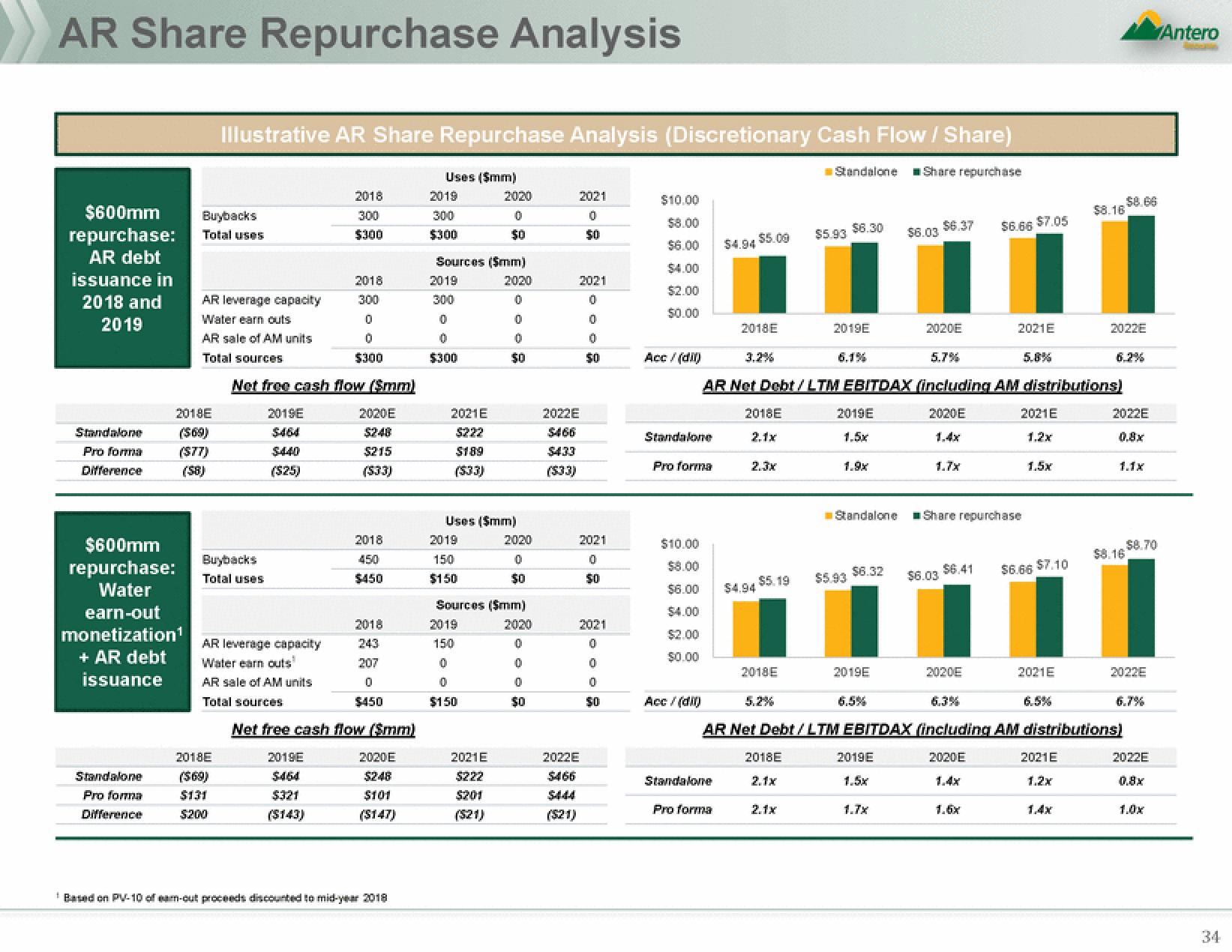

AR Share Repurchase Analysis

$600mm

repurchase:

AR debt

issuance in

2018 and

2019

Standalone

Pro forma

Difference

$600mm

repurchase:

Water

earn-out

monetization¹

+ AR debt

issuance

Standalone

Pro forma

Difference

Buybacks

Total uses

2018E

($69)

($77)

(S8)

Illustrative AR Share Repurchase Analysis (Discretionary Cash Flow / Share)

Share repurchase

AR leverage capacity

Water earn outs

AR sale of AM units

Total sources

Buybacks

Total uses

2018E

($69)

$131

$200

Net free cash flow (Smm)

2019E

($25)

AR leverage capacity

Water earn outs

AR sale of AM units

Total sources

2018

300

$300

2018

300

0

10

$300

2020E

$215

(533)

2018

450

$450

2018

243

207

0

$450

Net free cash flow (Smm)

2019E

$464

$321

2020E

$248

$101

($147)

*Based on PV-10 of eam-out proceeds discounted to mid-year 2018

Uses ($mm)

2019

300

$300

Sources ($mm)

2020

0

0

2019

300

0

0

$300

2021E

$222

$189

2019

150

$150

2020

0

50

Uses ($mm)

2019

150

0

0

$150

10

50

2021E

$222

$201

($21)

Sources ($mm)

2020

0

0

0

$0

2020

0

50

2022E

$433

($33)

2021

0

$0

2021

0

0

0

50

($21)

|||

2021

0

$0

2022E

$466

2021

0

0

0

$10.00

$8.00

$2.00

$0.00

Acc/(dil)

Standalone

Pro forma

$10.00

$6.00

$4.00

$0.00

Acc/(di)

$4.94 $5.00

Standalone

2018E

3.2%

Pro forma

2018E

$4.94

$5.19

2018E

5.2%

Standalone

2018E

2.1x

$5.93 $6.30

AR Net Debt / LTM EBITDAX (including AM distributions)

2020E

1.4x

2.1x

2019E

2019E

1.5x

Standalone

$5.93

$6.32

2019E

6.5%

$6.03

2019E

1.7x

$6.37

2020E

5.7%

1.7x

$6.03

$6.66 $7.05

2021E

$6.41

Share repurchase

2020E

6.3%

AR Net Debt / LTM EBITDAX (including AM distributions)

2020E

5.8%

2021E

1.2x

1.5x

$6.66 $7.10

$8.16

2021E

2021E

1.2x

2022E

$8.66

2022E

0.8x

$8.16

$8.70

2022E

6.7%

2022E

0.8x

Antero

34View entire presentation