Trian Partners Activist Presentation Deck

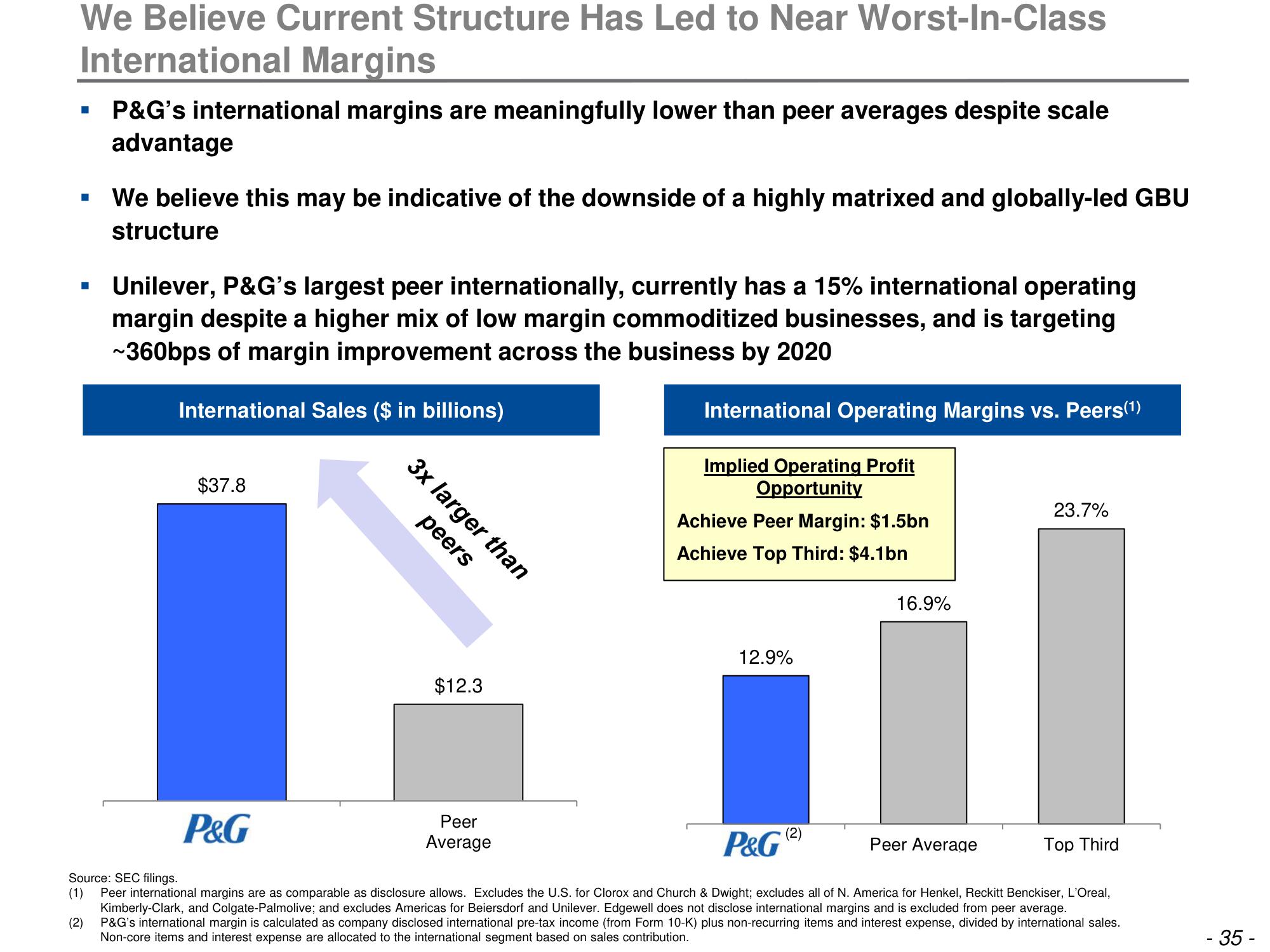

We Believe Current Structure Has Led to Near Worst-In-Class

International Margins

■

■

P&G's international margins are meaningfully lower than peer averages despite scale

advantage

We believe this may be indicative of the downside of a highly matrixed and globally-led GBU

structure

Unilever, P&G's largest peer internationally, currently has a 15% international operating

margin despite a higher mix of low margin commoditized businesses, and is targeting

~360bps of margin improvement across the business by 2020

International Sales ($ in billions)

International Operating Margins vs. Peers(¹)

Implied Operating Profit

Opportunity

$37.8

3x larger than

peers

$12.3

Peer

Average

Achieve Peer Margin: $1.5bn

Achieve Top Third: $4.1bn

12.9%

16.9%

P&G

P&G

Source: SEC filings.

(1) Peer international margins are as comparable as disclosure allows. Excludes the U.S. for Clorox and Church & Dwight; excludes all of N. America for Henkel, Reckitt Benckiser, L'Oreal,

Kimberly-Clark, and Colgate-Palmolive; and excludes Americas for Beiersdorf and Unilever. Edgewell does not disclose international margins and is excluded from peer average.

(2) P&G's international margin is calculated as company disclosed international pre-tax income (from Form 10-K) plus non-recurring items and interest expense, divided by international sales.

Non-core items and interest expense are allocated to the international segment based on sales contribution.

23.7%

Peer Average

Top Third

- 35 -View entire presentation