Greystar Equity Partners XI (May-23)

GREYSTAR

DISCRETIONARY

US VALUE-ADD

TRACK RECORD¹

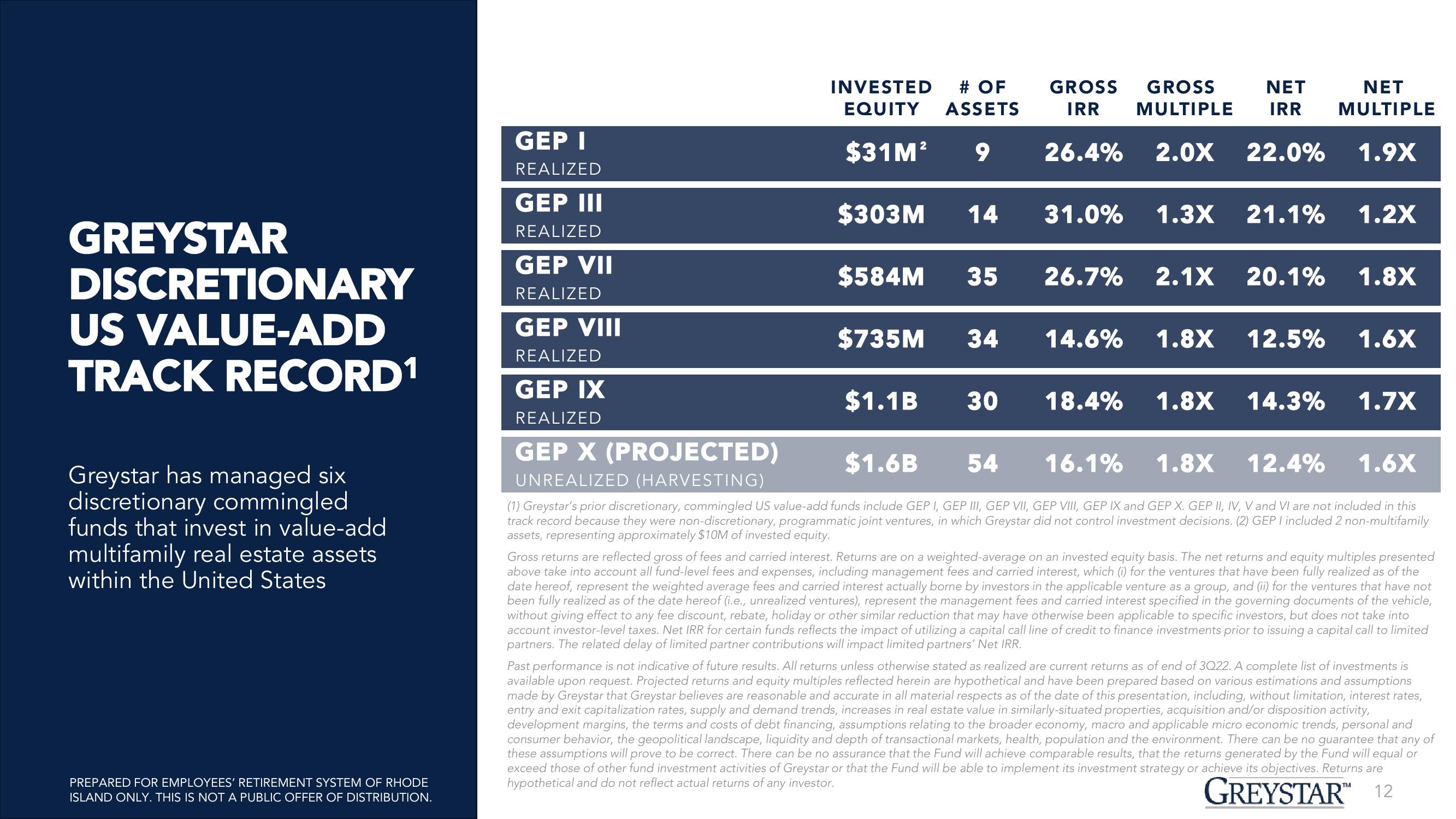

Greystar has managed six

discretionary commingled

funds that invest in value-add

multifamily real estate assets

within the United States

PREPARED FOR EMPLOYEES' RETIREMENT SYSTEM OF RHODE

ISLAND ONLY. THIS IS NOT A PUBLIC OFFER OF DISTRIBUTION.

GEP I

REALIZED

GEP III

REALIZED

GEP VII

REALIZED

GEP VIII

REALIZED

GEP IX

REALIZED

GEP X (PROJECTED)

UNREALIZED (HARVESTING)

INVESTED # OF

EQUITY ASSETS

GROSS GROSS NET

NET

IRR MULTIPLE IRR MULTIPLE

$31M² 9 26.4% 2.0X 22.0% 1.9X

$303M

14 31.0% 1.3X

$584M 35

$735M 34

$1.1B

30

26.7% 2.1X

14.6% 1.8X

18.4% 1.8X

21.1% 1.2X

20.1% 1.8X

12.5%

14.3%

1.6X

1.7X

$1.6B 54

16.1% 1.8X

12.4%

1.6X

(1) Greystar's prior discretionary, commingled US value-add funds include GEP I, GEP III, GEP VII, GEP VIII, GEP IX and GEP X. GEP II, IV, V and VI are not included in this

track record because they were non-discretionary, programmatic joint ventures, in which Greystar did not control investment decisions. (2) GEP I included 2 non-multifamily

assets, representing approximately $10M of invested equity.

Gross returns are reflected gross of fees and carried interest. Returns are on a weighted-average on an invested equity basis. The net returns and equity multiples presented

above take into account all fund-level fees and expenses, including management fees and carried interest, which (i) for the ventures that have been fully realized as of the

date hereof, represent the weighted average fees and carried interest actually borne by investors in the applicable venture as a group, and (ii) for the ventures that have not

been fully realized as of the date hereof (i.e., unrealized ventures), represent the management fees and carried interest specified in the governing documents of the vehicle,

without giving effect to any fee discount, rebate, holiday or other similar reduction that may have otherwise been applicable to specific investors, but does not take into

account investor-level taxes. Net IRR for certain funds reflects the impact of utilizing a capital call line of credit to finance investments prior to issuing a capital call to limited

partners. The related delay of limited partner contributions will impact limited partners' Net IRR.

Past performance is not indicative of future results. All returns unless otherwise stated as realized are current returns as of end of 3Q22. A complete list of investments is

available upon request. Projected returns and equity multiples reflected herein are hypothetical and have been prepared based on various estimations and assumptions

made by Greystar that Greystar believes are reasonable and accurate in all material respects as of the date of this presentation, including, without limitation, interest rates,

entry and exit capitalization rates, supply and demand trends, increases in real estate value in similarly-situated properties, acquisition and/or disposition activity,

development margins, the terms and costs of debt financing, assumptions relating to the broader economy, macro and applicable micro economic trends, personal and

consumer behavior, the geopolitical landscape, liquidity and depth of transactional markets, health, population and the environment. There can be no guarantee that any of

these assumptions will prove to be correct. There can be no assurance that the Fund will achieve comparable results, that the returns generated by the Fund will equal or

exceed those of other fund investment activities of Greystar or that the Fund will be able to implement its investment strategy or achieve its objectives. Returns are

hypothetical and do not reflect actual returns of any investor.

GREYSTAR™ 12View entire presentation