Navitas SPAC Presentation Deck

Valuation Summary

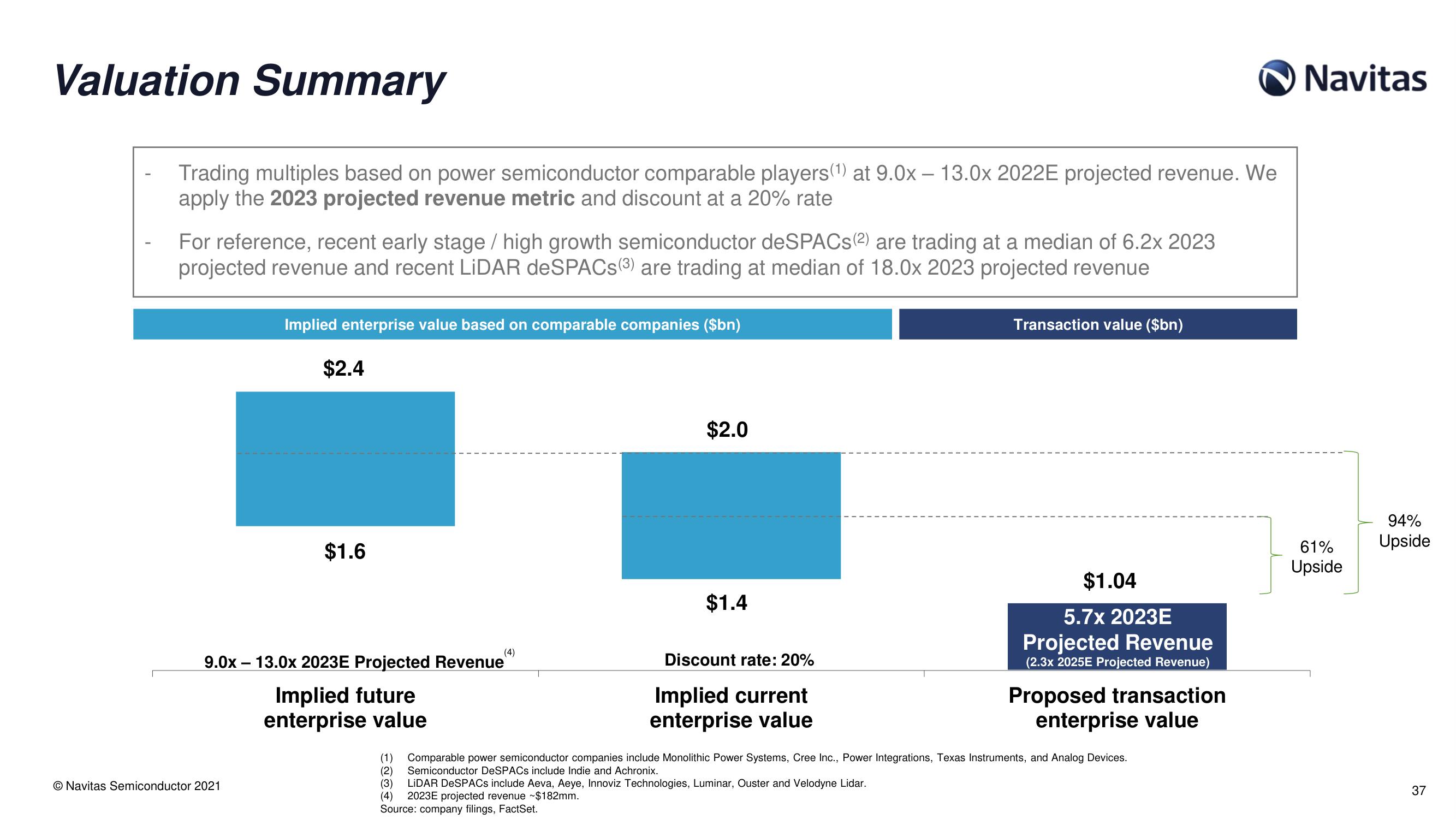

Trading multiples based on power semiconductor comparable players (1) at 9.0x 13.0x 2022E projected revenue. We

apply the 2023 projected revenue metric and discount at a 20% rate

For reference, recent early stage / high growth semiconductor deSPACs (2) are trading at a median of 6.2x 2023

projected revenue and recent LiDAR deSPACs (3) are trading at median of 18.0x 2023 projected revenue

Implied enterprise value based on comparable companies ($bn)

O Navitas Semiconductor 2021

$2.4

$1.6

(4)

9.0x 13.0x 2023E Projected Revenue

Implied future

enterprise value

$2.0

$1.4

Discount rate: 20%

Implied current

enterprise value

Transaction value ($bn)

$1.04

5.7x 2023E

Projected Revenue

(2.3x 2025E Projected Revenue)

Proposed transaction

enterprise value

(1) Comparable power semiconductor companies include Monolithic Power Systems, Cree Inc., Power Integrations, Texas Instruments, and Analog Devices.

(2) Semiconductor DeSPACs include Indie and Achronix.

(3) LiDAR DESPACs include Aeva, Aeye, Innoviz Technologies, Luminar, Ouster and Velodyne Lidar.

(4) 2023E projected revenue ~$182mm.

Source: company filings, FactSet.

Navitas

61%

Upside

94%

Upside

37View entire presentation