Baird Investment Banking Pitch Book

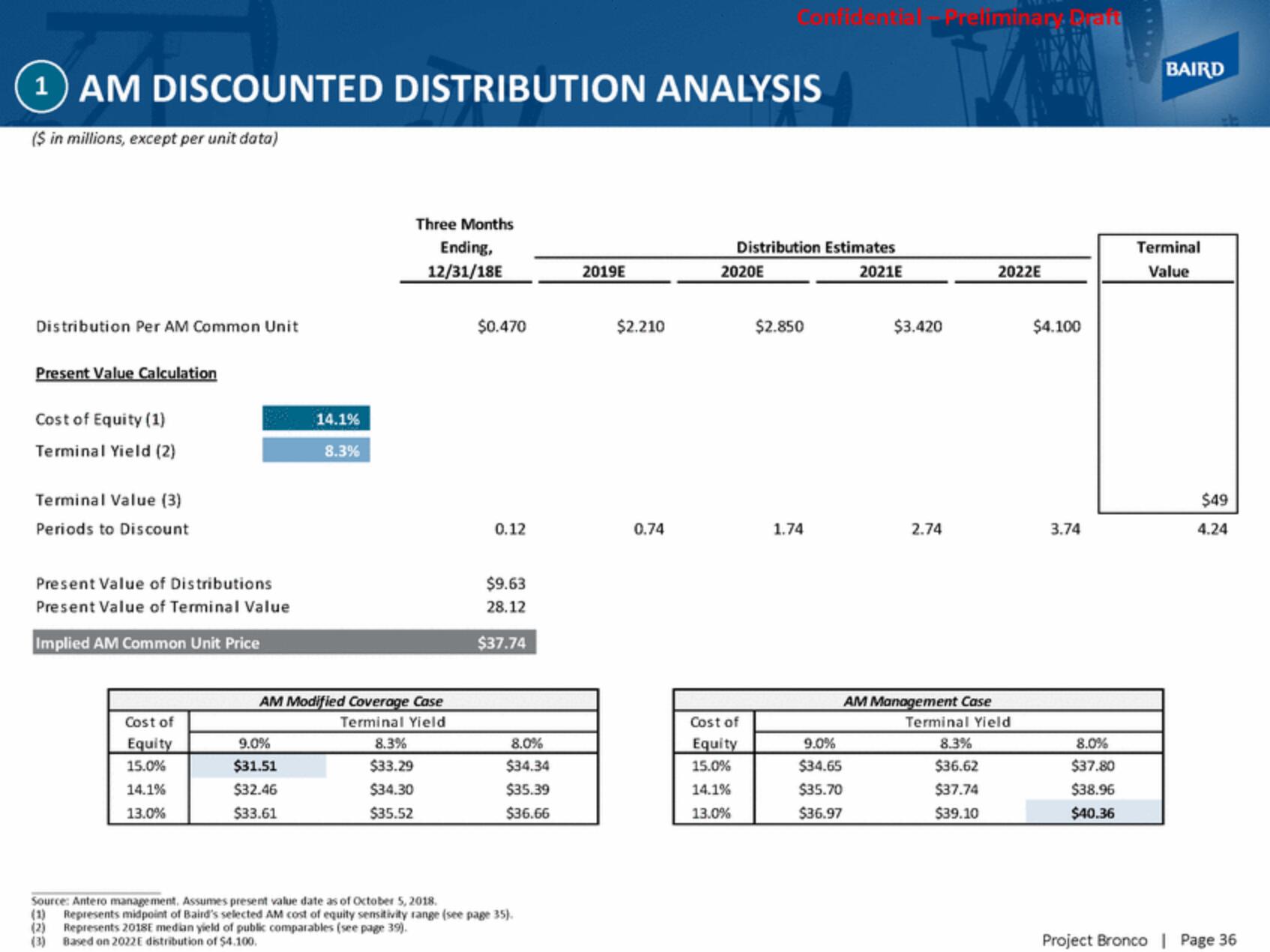

1 AM DISCOUNTED DISTRIBUTION ANALYSIS

($ in millions, except per unit data)

Distribution Per AM Common Unit

Present Value Calculation

Cost of Equity (1)

Terminal Yield (2)

Terminal Value (3)

Periods to Discount

Present Value of Distributions

Present Value of Terminal Value

Implied AM Common Unit Price

Cost of

Equity

15.0%

14.1%

13.0%

(2)

(3)

14.1%

8.3%

9.0%

$31.51

$32.46

$33.61

AM Modified Coverage Case

Terminal Yield

Three Months

Ending,

12/31/18E

8.3%

$33.29

$34.30

$35.52

$0.470

0.12

$9.63

28.12

$37.74

8.0%

$34.34

$35.39

$36.66

Source: Antero management. Assumes present value date as of October 5, 2018.

(1) Represents midpoint of Baird's selected AM cost of equity sensitivity range (see page 35).

Represents 2018E median yield of public comparables (see page 39).

Based on 2022E distribution of $4.100.

2019E

$2.210

0.74

Distribution Estimates

2021E

2020E

Cost of

Equity

15.0%

14.1%

13.0%

$2.850

1.74

9.0%

$34.65

$35.70

$36.97

Trellminan. Draft

$3.420

2.74

2022E

AM Management Case

Terminal Yield

8.3%

$36.62

$37.74

$39.10

$4.100

3.74

8.0%

$37.80

$38.96

$40.36

BAIRD

Terminal

Value

$49

4.24

Project Bronco | Page 36View entire presentation