Trian Partners Activist Presentation Deck

Gave Up / Sold

Struggling

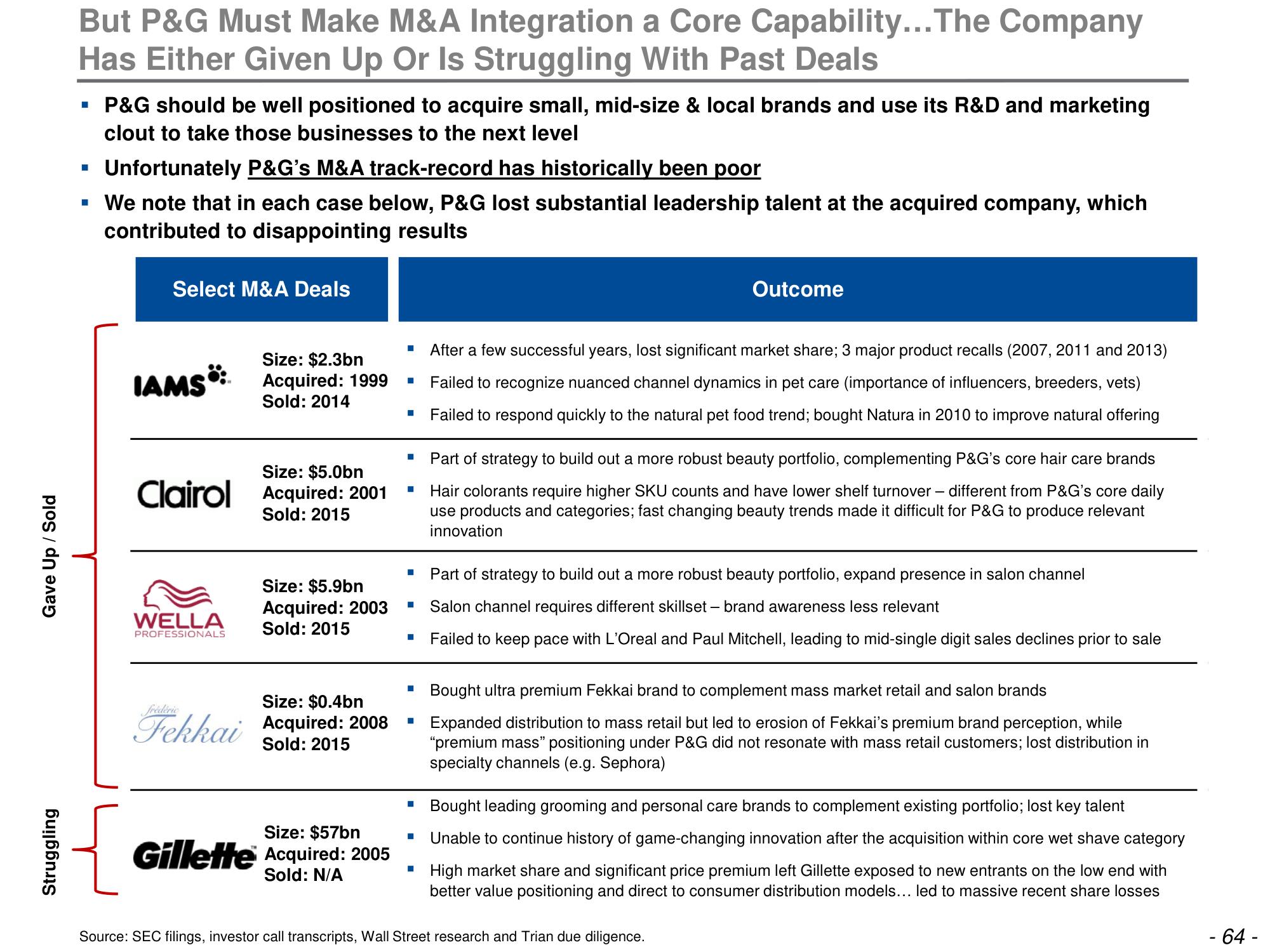

But P&G Must Make M&A Integration a Core Capability... The Company

Has Either Given Up Or Is Struggling With Past Deals

■

P&G should be well positioned to acquire small, mid-size & local brands and use its R&D and marketing

clout to take those businesses to the next level

Unfortunately P&G's M&A track-record has historically been poor

▪ We note that in each case below, P&G lost substantial leadership talent at the acquired company, which

contributed to disappointing results

{

Select M&A Deals

IAMS":

Size: $2.3bn

Acquired: 1999

Sold: 2014

Size: $5.0bn

Clairol Acquired: 2001

Sold: 2015

WELLA

PROFESSIONALS

Size: $5.9bn

Acquired: 2003

Sold: 2015

Size: $0.4bn

Fekkai Acquired: 2008

Sold: 2015

Size: $57bn

Gillette Acquired: 2005

Sold: N/A

I After a few successful years, lost significant market share; 3 major product recalls (2007, 2011 and 2013)

Failed to recognize nuanced channel dynamics in pet care (importance of influencers, breeders, vets)

Failed to respond quickly to the natural pet food trend; bought Natura in 2010 to improve natural offering

■

■ Part of strategy to build out a more robust beauty portfolio, complementing P&G's core hair care brands

Hair colorants require higher SKU counts and have lower shelf turnover - different from P&G's core daily

use products and categories; fast changing beauty trends made it difficult for P&G to produce relevant

innovation

■ Part of strategy to build out a more robust beauty portfolio, expand presence in salon channel

Salon channel requires different skillset - brand awareness less relevant

Failed to keep pace with L'Oreal and Paul Mitchell, leading to mid-single digit sales declines prior to sale

■

Outcome

■ Bought ultra premium Fekkai brand to complement mass market retail and salon brands

Expanded distribution to mass retail but led to erosion of Fekkai's premium brand perception, while

"premium mass" positioning under P&G did not resonate with mass retail customers; lost distribution in

specialty channels (e.g. Sephora)

■

Bought leading grooming and personal care brands to complement existing portfolio; lost key talent

■ Unable to continue history of game-changing innovation after the acquisition within core wet shave category

High market share and significant price premium left Gillette exposed to new entrants on the low end with

better value positioning and direct to consumer distribution models... led to massive recent share losses

■

Source: SEC filings, investor call transcripts, Wall Street research and Trian due diligence.

- 64 -View entire presentation