Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

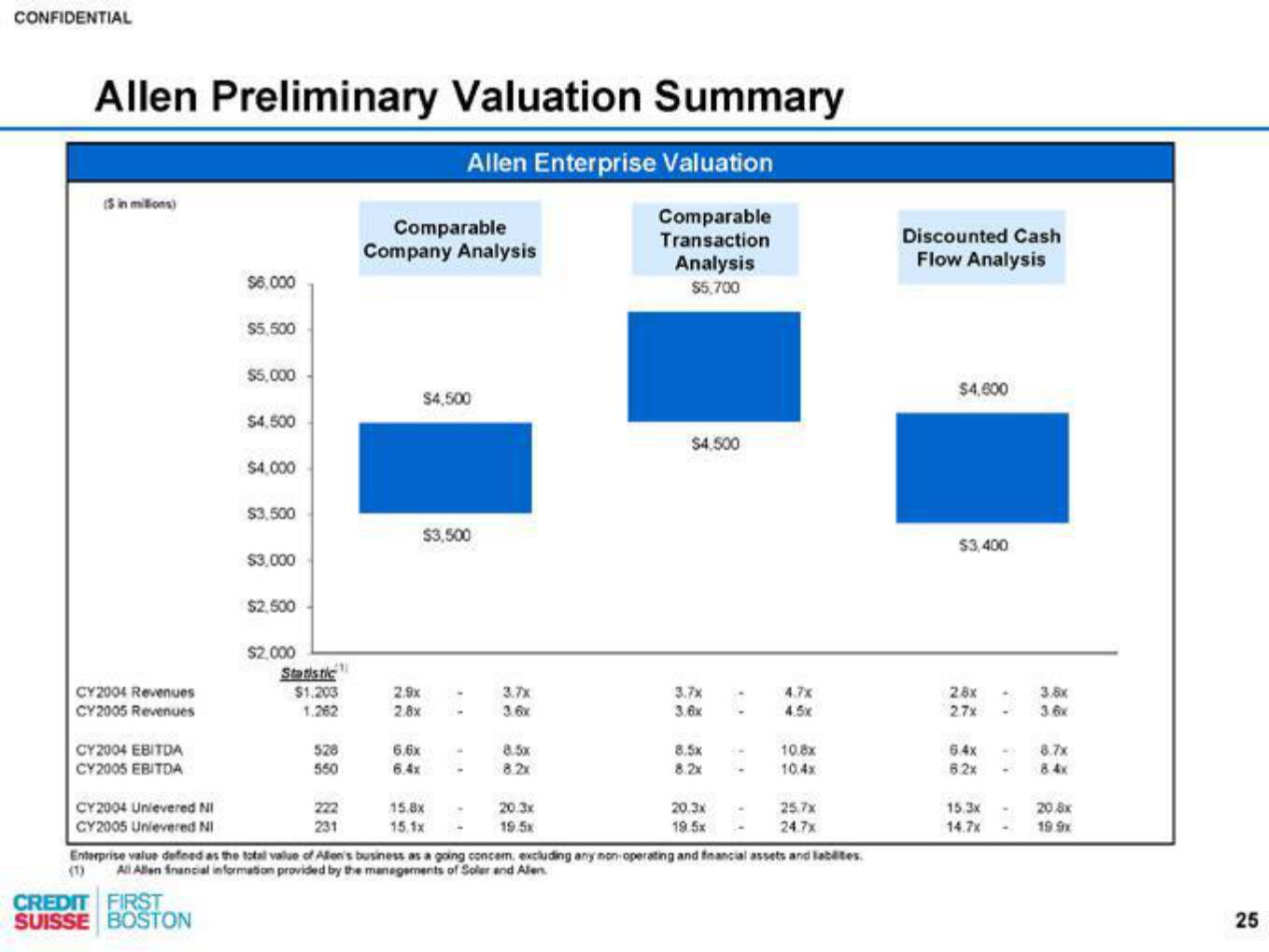

Allen Preliminary Valuation Summary

Allen Enterprise Valuation

Comparable

Transaction

Analysis

$5,700

(5 in millions)

CY 2004 Revenues

CY2005 Revenues

CY2004 EBITDA

CY2005 EBITDA

CY 2004 Unlevered Ni

CY2005 Unievered NI

$6,000

CREDIT FIRST

SUISSE BOSTON

$5,500

$5,000

$4.500

$4,000

$3,500

$3,000

$2,500

$2,000

Statistic

$1.203

1.262

528

550

222

231

Comparable

Company Analysis

2.9x

2.8x

6.6x

6.4x

$4,500

$3,500

15.8x

15,1x

3.7x

3.6x

8.5x

8.2x

20.3x

1958

$4.500

3.7x

3.6x

8.5x

8.2x

20.3x

1958

4.7x

4.5x

10.8x

10.4x

25.7x

24.7x

Enterprise value defeed as the total value of Allen's business as a going concem, excluding any non-operating and financial assets and tables.

All Allen financial information provided by the managements of Soler and Alen.

Discounted Cash

Flow Analysis

$4,600

$3,400

2.8x

2.7x

-

6.4x

6.2x -

15.3x .

14.7x -

3.8x

3.6x

8.7x

20.8x

19.9x

25View entire presentation