Bank of America Investment Banking Pitch Book

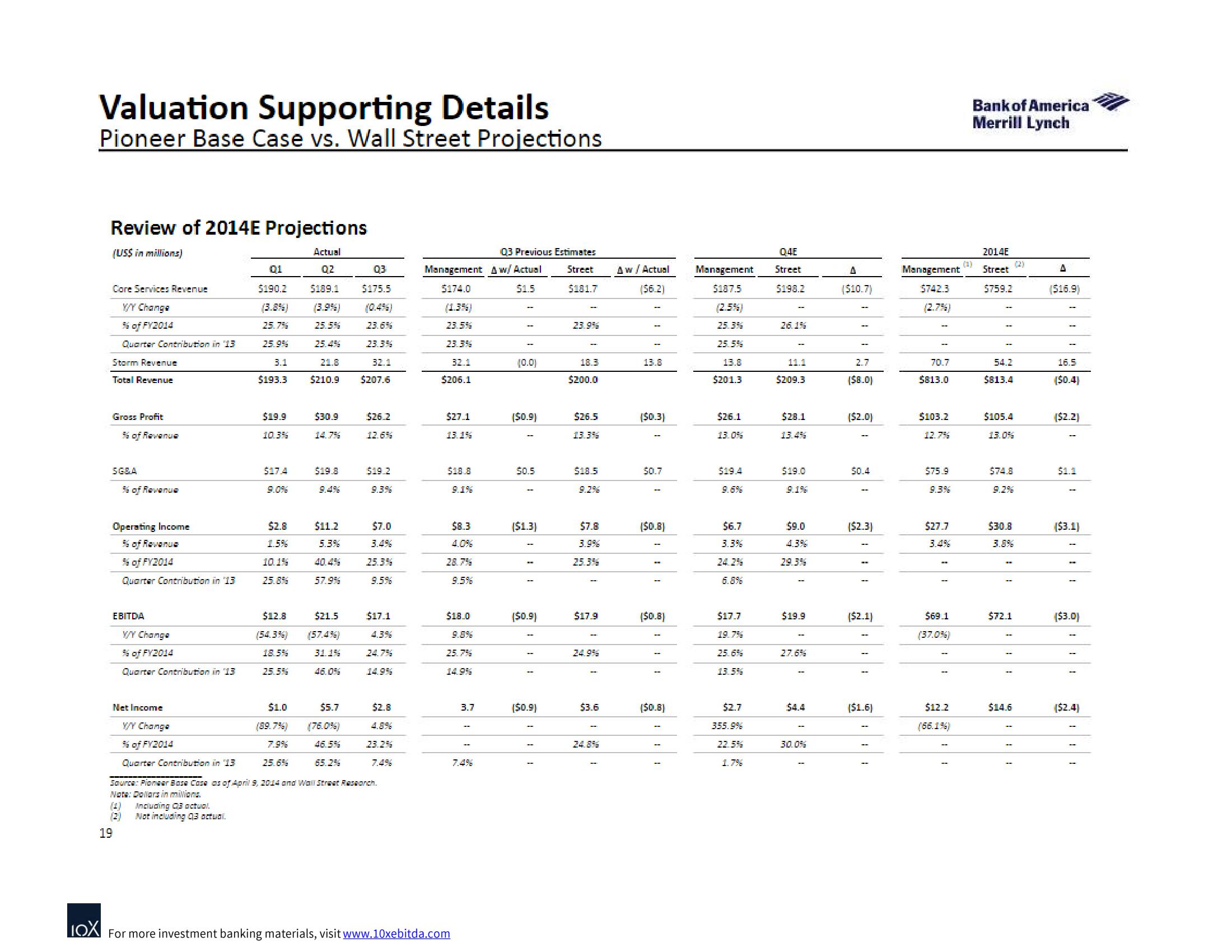

Valuation Supporting Details

Pioneer Base Case vs. Wall Street Projections

Review of 2014E Projections

(US$ in millions)

Actual

02

$189.1

Core Services Revenue

X/Y Change

% of FY2014

Quarter Contribution in 13

Storm Revenue

Total Revenue

Gross Profit

56 of Revenue

SG&A

19

% of Revenue

Operating Income

96 of Revenue

% of FY2014

Quarter Contribution in 13

EBITDA

X/Y Change

% of FY2014

Quarter Contribution in 13

Net Income

X/Y Change

% of FY2014

Quarter Contribution in 13

(1) Including 03 actual.

01

$190.2

(3.8%)

25.7%

25.9%

3.1

Not including 03 actual.

$193.3

$19.9

10.3%

$17.4

$2.8

1.5%

10.1%

25.8%

$1.0

(89.7%)

(3.9%)

25.5%

25.4%

25.6%

$30.9

14.7%

32.1

$210.9 $207.6

$19.8

$12.8

$21.5

(54.3%) (57.4%)

18.5%

31.1%

25.5%

$11.2

5.3%

40.4%

57.9%

03

$175.5

$5.7

23.6%

23.3%

$26.2

12.6%

$19.2

$7.0

25.3%

9.5%

$17.1

46.5%

65.2%

Source: Pioneer Boasa Cosa as of April 9, 2014 and Wall Street Research.

Note: Dollars in milions.

4.3%

$2.8

23.2%

Management Aw/ Actual

5174.0

$1.5

(1.3%)

23.5%

23.3%

32.1

$206.1

$27.1

13.1%

$18.8

9.1%

$8.3

28.7%

9.5%

$18.0

LOX For more investment banking materials, visit www.10xebitda.com

9.8%

25.7%

14.9%

03 Previous Estimates

Street

$181.7

3.7

[$0.9)

$0.5

1

($1.3)

m

[$0.9)

($0.9)

23.9%

18.3

$200.0

$26.5

13.3%

$18.5

9.2%

$7.8

3.9%

25.3%

$17.9

$3.6

Aw/Actual

($6.2)

13.8

($0.3]

$0.7

($0.8)

[$0.8)

[$0.8)

Management

$187.5

25.3%

25.5%

13.8

$201.3

$26.1

13.0%

$19.4

$6.7

$17.7

19.7%

25.6%

13.5%

$2.7

355.9%

22.5%

1.7%

Q4E

Street

$198.2

26.1%

11.1

$209.3

$28.1

13.4%

$19.0

9.1%

$9.0

4.3%

29.3%

$19.9

30.0%

A

($10.7)

2.7

($8.0)

[$2.0)

50.4

[$2.3)

($2.1)

($1.6)

Management

$742.3

-

70.7

5813.0

$103.2

12.7%

$75.9

$27.7

$69.1

(37.0%)

$12.2

(66.1%)

Bank of America

Merrill Lynch

2014E

Street

$759.2

54.2

$813.4

$105.4

13.0%

$74.8

$3.0.8

$72.1

$14.6

(2)

A

($16.9)

16.5

[$0.4)

[$2.2]

($3.1)

[$3.0)

($2.4)View entire presentation