Federal Signal Investor Presentation Deck

Strong Financial Position Supports Priority-Driven Long-Term

Capital Allocation

In October 2022, executed 5-year, $800 M revolving credit facility, with flexibility to increase further for acquisitions; At the end of Q2

2023, net debt leverage remained low, with ~$381 M of availability under credit facility

Reinvest in the

Business

Acquisitions

Dividend Policy

Share

Repurchases

●

●

●

●

●

●

●

●

●

●

●

Purchased Elgin, IL manufacturing facility in Q4 2021 (~$20 M) and University Park, IL

manufacturing facility in Q1 2022 (~$28 M)

Other cap ex of ~$25 M in 2022, including investments in machinery and equipment to support

automating and insourcing opportunities; expect cap ex of $27 M - $30 M in 2023

Innovation R&D efforts target new and updated products

Completed acquisition of TowHaul Corporation in October 2022 for initial payment of ~$43 M

Completed acquisition of Blasters, Inc. in January 2023 for initial payment of ~$13 M

Completed acquisition of Trackless in April 2023 for initial purchase price of ~$43 M

Focused primarily on acquisitions that fit closely within our existing products and services,

manufacturing competencies, channels and customers

Provide a competitive dividend yield while funding business growth

Paid increased dividend of $0.10 per share in Q2 2023, up from $0.09 in Q1 2023; recently

declared similar dividend for Q3 2023

Paid dividends of $6.1 M in Q2 2023 ($21.8 M in full-year 2022)

Opportunistic share buybacks as a return of cash to our shareholders

Share repurchases of $16.1M in 2022; ~$59 M of repurchase authorization remaining under

current programs (~2% of market cap)

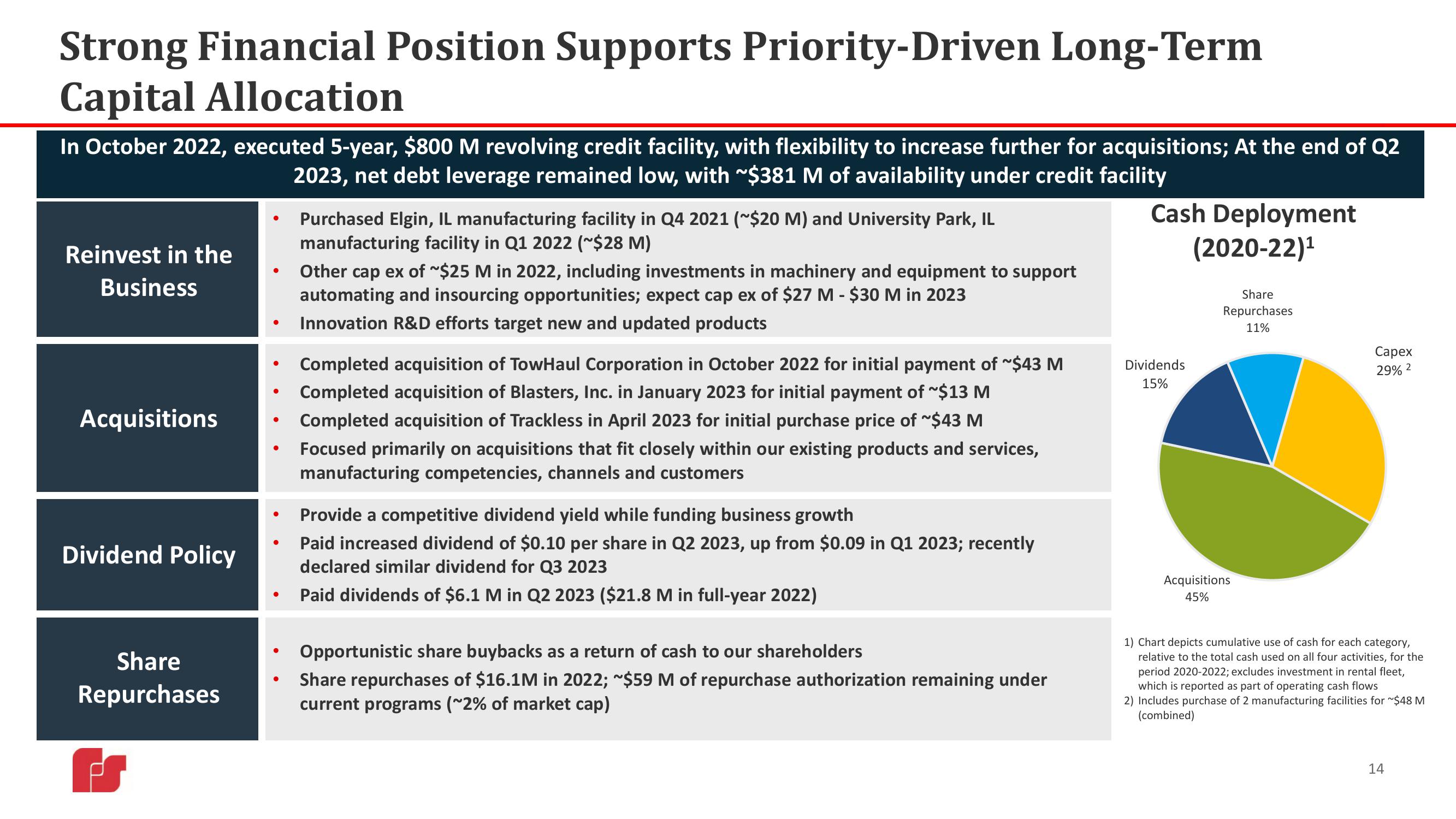

Cash Deployment

(2020-22)¹

Dividends

15%

Share

Repurchases

11%

Acquisitions

45%

Capex

29% 2

1) Chart depicts cumulative use of cash for each category,

relative to the total cash used on all four activities, for the

period 2020-2022; excludes investment in rental fleet,

which is reported as part of operating cash flows

2) Includes purchase of 2 manufacturing facilities for ~$48 M

(combined)

14View entire presentation