Avantor Results Presentation Deck

10

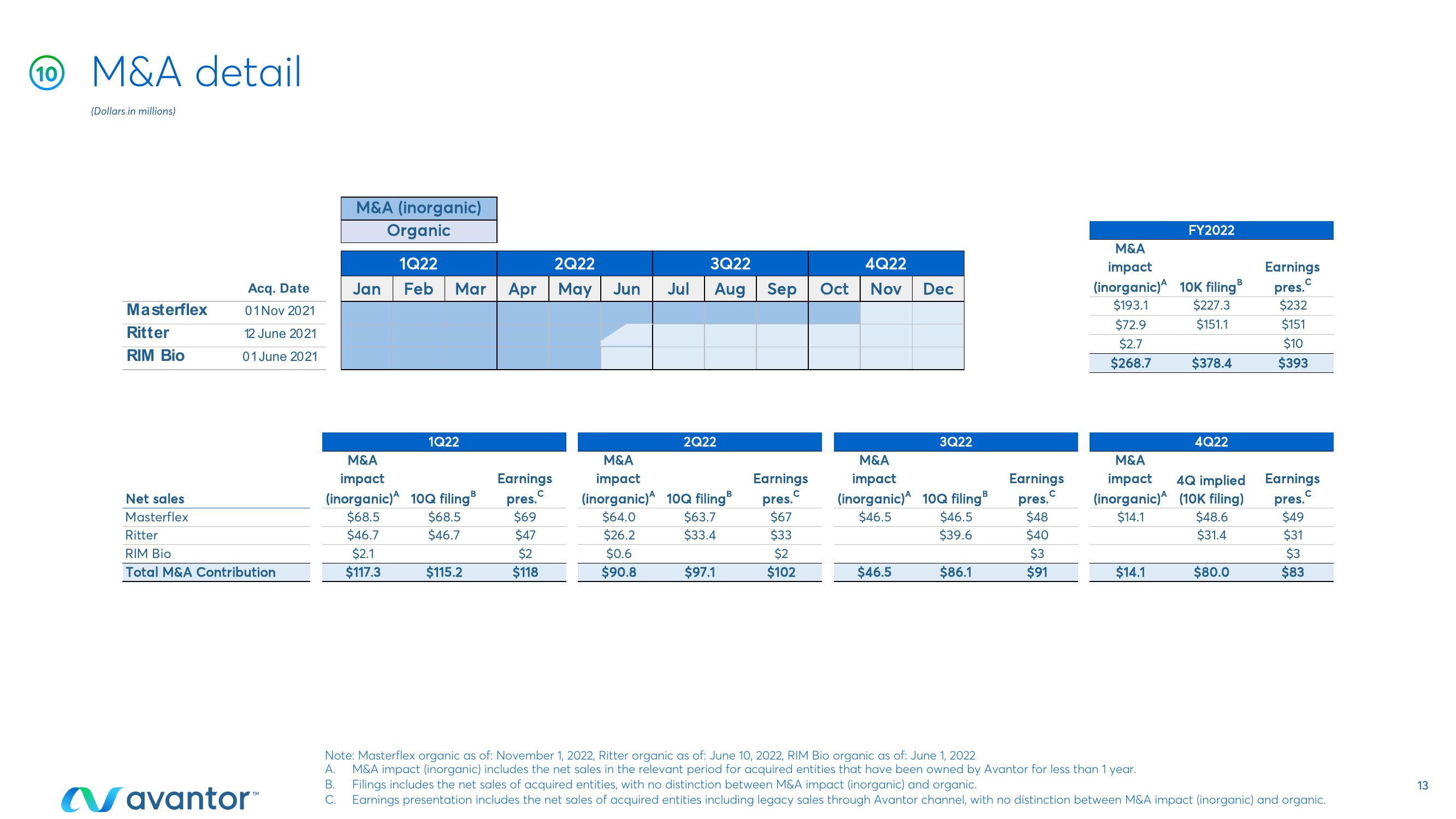

M&A detail

(Dollars in millions)

Masterflex

Ritter

RIM Bio

Net sales

Masterflex

Acq. Date

01 Nov 2021

12 June 2021

01 June 2021

Ritter

RIM Bio

Total M&A Contribution

Navantor™

M&A (inorganic)

Organic

1Q22

Jan Feb

M&A

impact

(inorganic)

$68.5

$46.7

$2.1

$117.3

Mar

1Q22

10Q filing³

$68.5

$46.7

$115.2

2Q22

3Q22

Apr May Jun Jul Aug Sep Oct

Earnings

pres.c

$69

$47

$2

$118

M&A

impact

(inorganic)

$64.0

$26.2

$0.6

$90.8

2Q22

В

10Q filing B

$63.7

$33.4

$97.1

Earnings

pres.c

$67

$33

$2

$102

4Q22

Nov

Dec

$46.5

3Q22

M&A

impact

(inorganic) 10Q filing B

$46.5

$46.5

$39.6

$86.1

Earnings

с

pres.

$48

$40

$3

$91

M&A

impact

(inorganic)

$193.1

$72.9

$2.7

$268.7

M&A

impact

(inorganic)

$14.1

$14.1

FY2022

10K filing B

$227.3

$151.1

$378.4

4Q22

4Q implied

(10K filing)

$48.6

$31.4

$80.0

Earnings

pres.

$232

$151

$10

$393

Earnings

pres.

$49

$31

$3

$83

Note: Masterflex organic as of: November 1, 2022, Ritter organic as of: June 10, 2022, RIM Bio organic as of: June 1, 2022

A.

M&A impact (inorganic) includes the net sales in the relevant period for acquired entities that have been owned by Avantor for less than 1 year.

Filings includes the net sales of acquired entities, with no distinction between M&A impact (inorganic) and organic.

B.

C. Earnings presentation includes the net sales of acquired entities including legacy sales through Avantor channel, with no distinction between M&A impact (inorganic) and organic.

13View entire presentation