Evercore Investment Banking Pitch Book

Valuation Perpectives

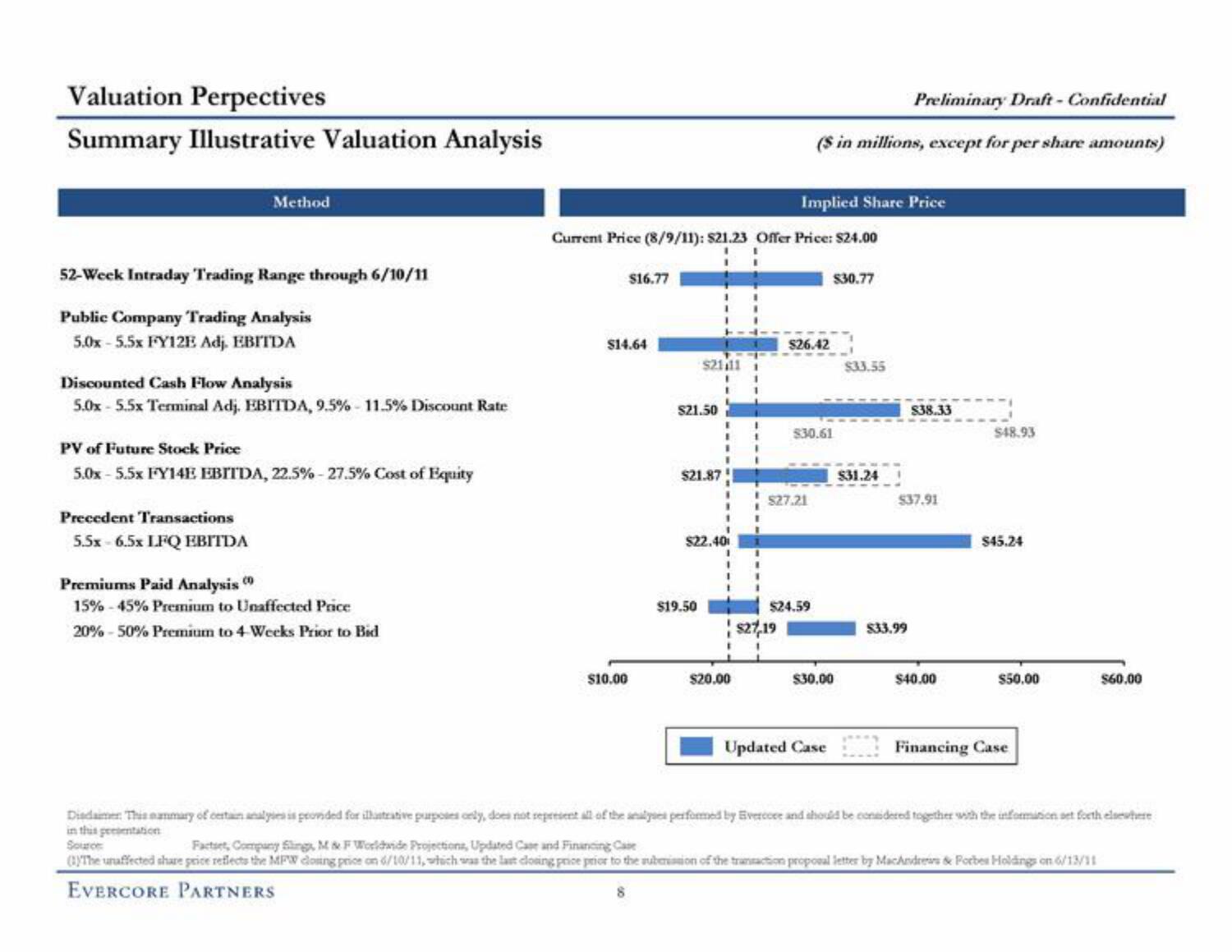

Summary Illustrative Valuation Analysis

Method

52-Week Intraday Trading Range through 6/10/11

Public Company Trading Analysis

5.0x - 5.5x FY12E Adj. EBITDA

Discounted Cash Flow Analysis

5.0x - 5.5x Terminal Adj. EBITDA, 9.5% -11.5% Discount Rate

PV of Future Stock Price

5.0x-5.5x FY14E EBITDA, 22.5% - 27.5% Cost of Equity

Precedent Transactions

5.5x 6.5x LFQ EBITDA

Premiums Paid Analysis

15% 45% Premium to Unaffected Price

20% -50% Premium to 4-Weeks Prior to Bid

Current Price (8/9/11): $21.23 Offer Price: $24.00

$16.77

$14.64

$10.00

$21111

$21.50

$21.87

$19.50

E I

1

I

I

1

1

$22.40

1

1

$20.00

Implied Share Price

Preliminary Draft - Confidential

($ in millions, except for per share amounts)

$26.42

$27.21

$30.61

$24.59

$30.77

$30.00

$33.55

$31.24

$38.33

$37.91

$33.99

$40.00

-1

$48.93

$45.24

$50.00

Updated Case Financing Case

$60.00

Diadaimer: This nummary of certain analyses is provided for illustrative purposes only, does not represent all of the analyses performed by Evercoce and should be considered together with the information set forth elsewhere

in this presentation

Source

Factset, Company Slings, M & F Worldwide Projections, Updated Case and Financing Case

(1)The unaffected share price reflects the MFW closing price on 6/10/11, which was the last closing price prior to the submission of the transaction proposal letter by MacAndrews & Forbes Holdings on 6/13/11

EVERCORE PARTNERS

8View entire presentation